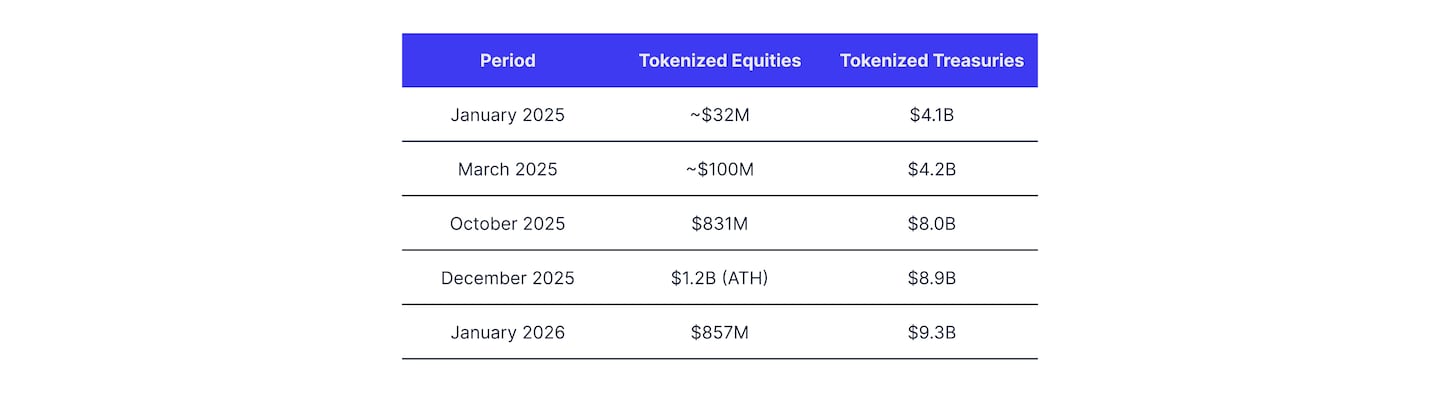

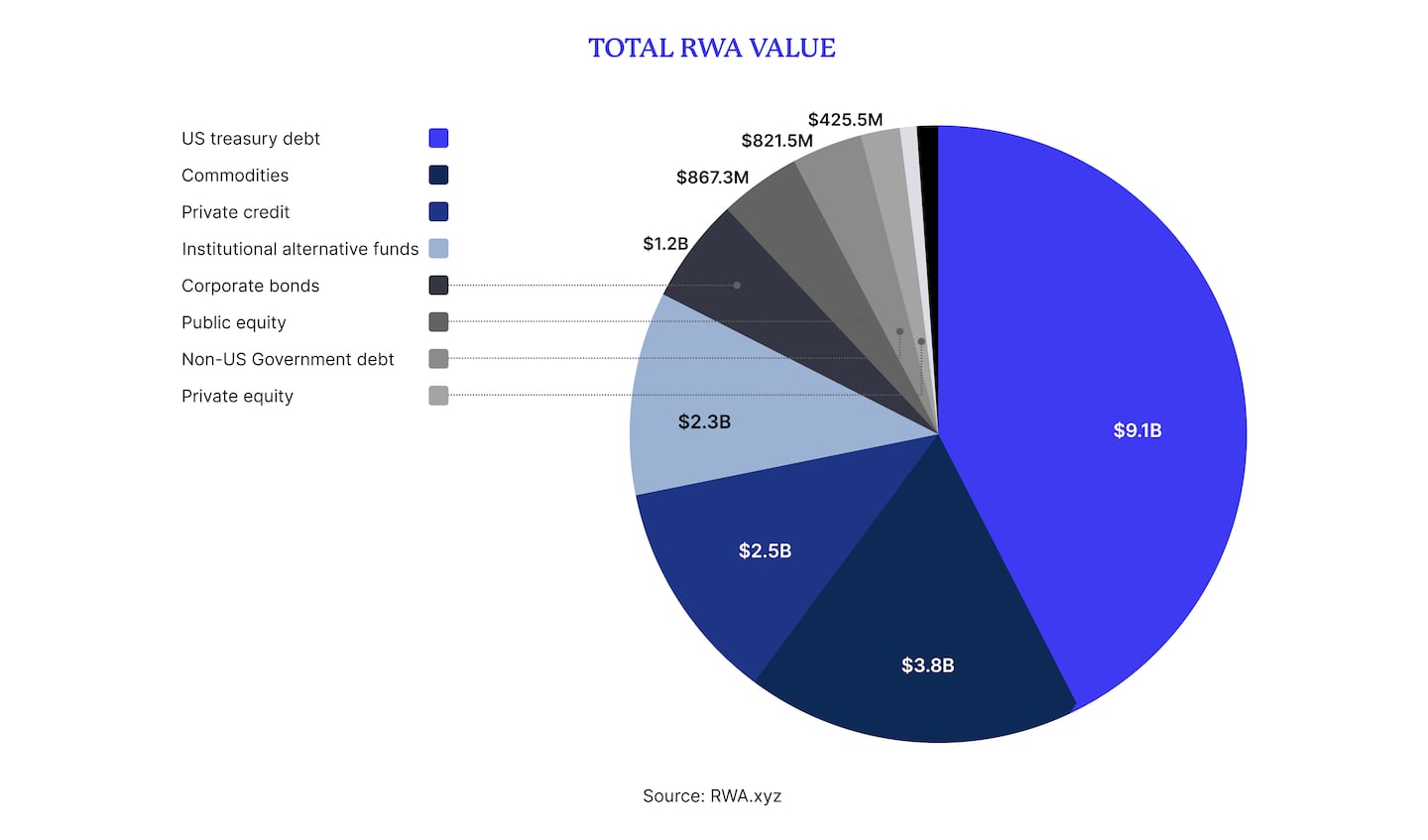

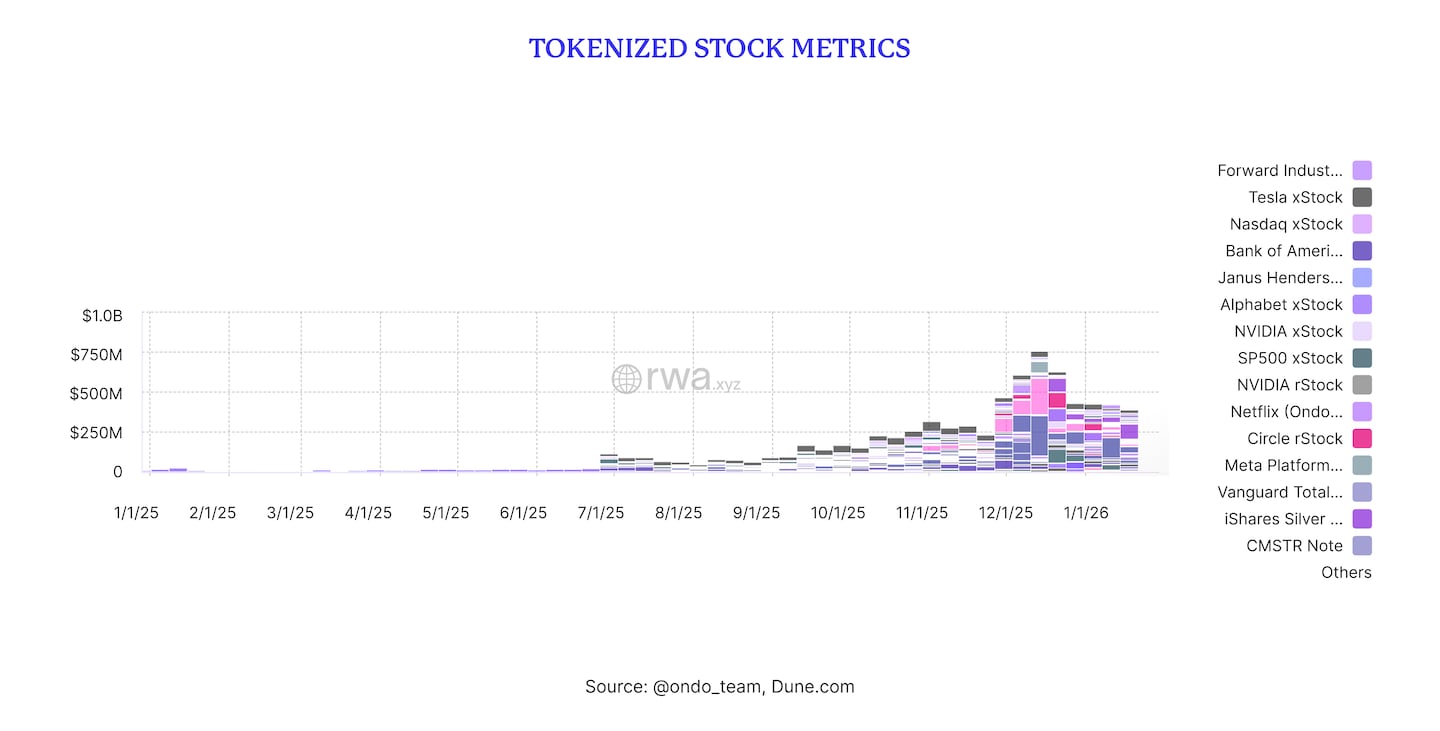

The tokenized equities market has crossed $963.04 million in value as of January 2026, representing a ~2,878% YoY increase from approximately $32 million in January 2025. While still dwarfed by the $9.3 billion tokenized treasury market, equities are growing nearly 30x faster, and December 2025’s regulatory breakthroughs suggest the infrastructure for institutional-scale adoption is finally materializing.

This report examines current market structure, protocol-level metrics, chain distribution, and the regulatory catalysts positioning tokenized equities as the next frontier for institutional DeFi allocation.

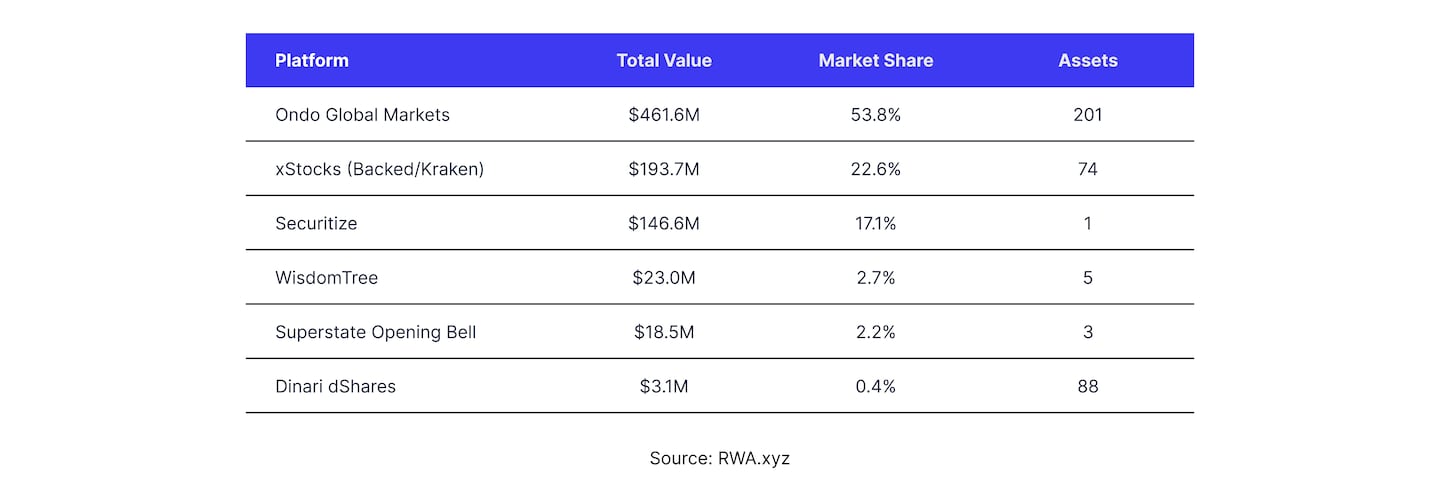

Market structure reveals a three-player monopoly

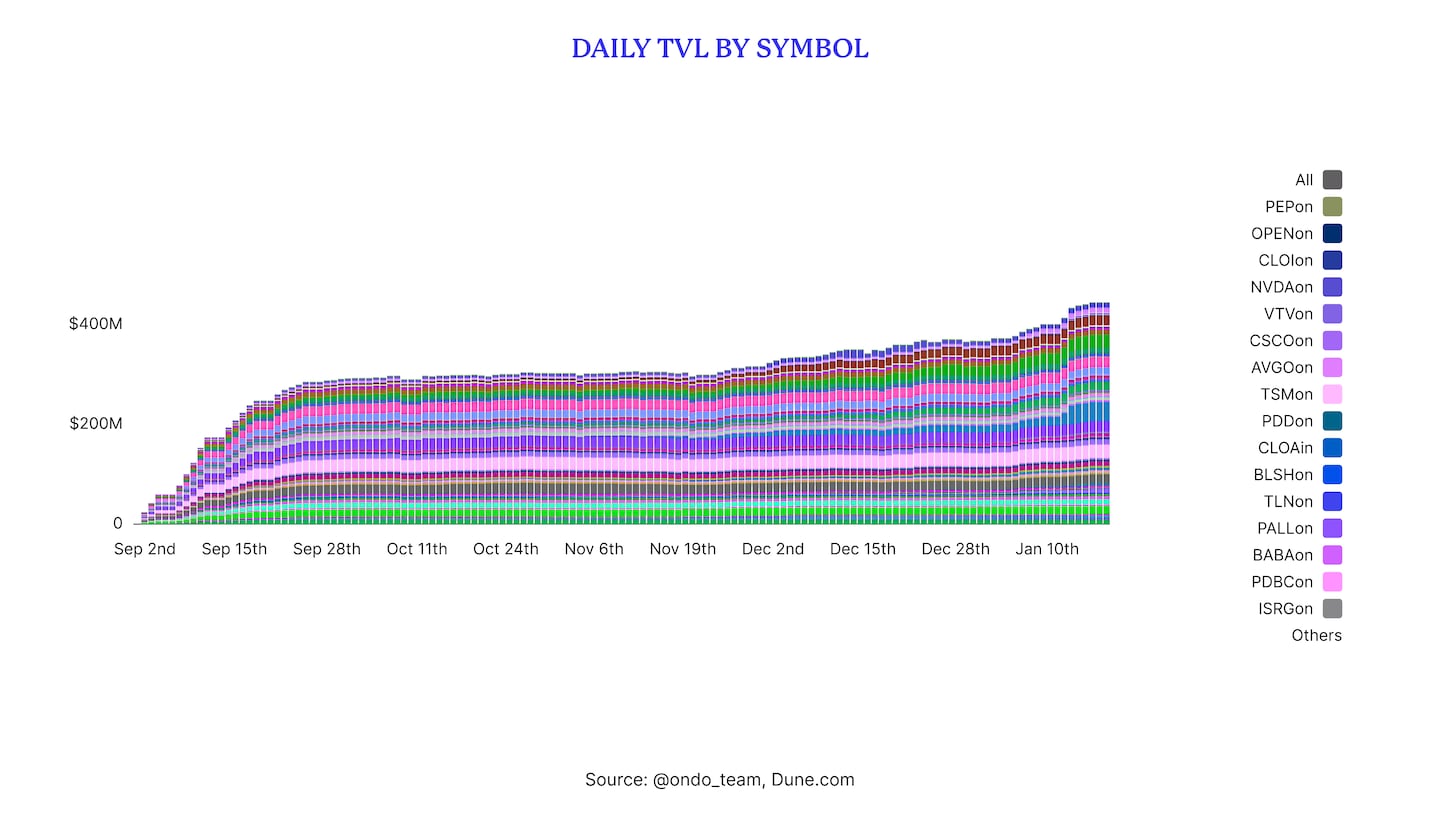

Ondo Global Markets launched September 3, 2025 and became the largest tokenized stock platform within 48 hours, an unprecedented velocity. TVL reached $100M in week one, $250M by week three, and exceeded $350M by late October alongside $669M in cumulative trading volume. The platform now offers 200+ tokenized U.S. equities and ETFs including Tesla, Apple, NVIDIA, and BlackRock/Fidelity ETFs, with plans to expand to 1,000+ assets.

xStocks, operated by Backed Finance (acquired by Kraken in December 2025), grew AUM 9x from launch to approximately $186M within five months. The platform processed over $10 billion in combined CEX/DEX transaction volume across 135 days, with nearly $2 billion on-chain. The Kraken acquisition, backed by its $800M November 2025 funding round from Citadel Securities, Jane Street, and DRW, signals major exchange commitment to vertically integrating tokenized equity infrastructure.

Securitize commands 17% of tokenized equities through a single asset: Exodus (EXOD), the first U.S.-registered company to tokenize common stock, valued at $146.6M. The platform’s broader AUM exceeds $4 billion across tokenized funds, including BlackRock’s BUIDL. Securitize announced plans for “Stocks on Securitize” launching Q1 2026, natively tokenized public stocks with SEC-registered shares rather than synthetic wrappers.

Growth trajectory outpaces tokenized treasuries by 30x

Tokenized equities are the fastest-growing segment within on-chain real-world assets, despite their smaller absolute size:

The 2,496% YTD growth for equities versus approximately 117% for treasuries reflects fundamentally different market dynamics. Treasury tokenization attracted institutional capital seeking yield-bearing stable value. Equity tokenization is capturing speculative and access-oriented flows, particularly from non-U.S. investors gaining 24/7 exposure to U.S. markets through blockchain rails.

Monthly transfer volume for tokenized equities reached $2.41 billion, with total unique holders at 159,000 (up 22.7%). The holder growth rate suggests retail and smaller institutional participants are driving incremental adoption, while the volume-to-AUM ratio of approximately 2.8x monthly indicates active trading rather than passive holding strategies.

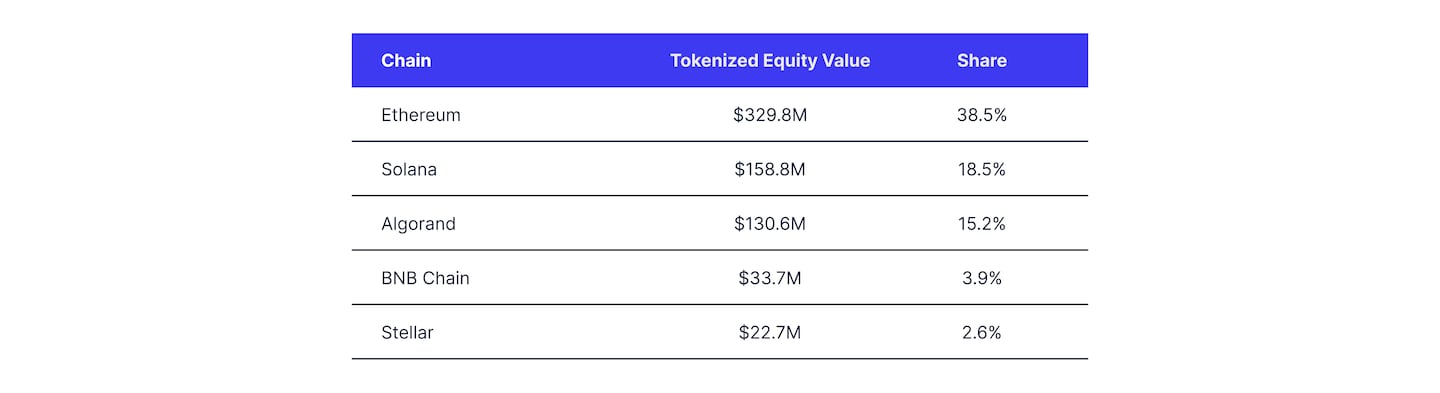

Chain distribution shows Ethereum dominance diminishing

Tokenized equities operate across a multi-chain landscape, with Ethereum’s historical dominance eroding as newer chains capture specific use cases:

Ethereum remains the settlement layer for institutional-grade products, hosting Ondo’s primary deployment. The chain’s $1.3 billion in total Ondo TVL (across equities, USDY, and OUSG) reflects deep integration with DeFi protocols including Morpho and Aave for collateralization.

Solana has emerged as the primary chain for xStocks, benefiting from sub-second finality and integration with major Solana DeFi protocols. Kamino Finance (Solana’s largest lending protocol with $2.6B TVL) integrated xStocks as collateral, enabling leverage strategies on tokenized equity positions.

Algorand’s $130.6M concentration stems entirely from Exodus (EXOD), which tokenized exclusively on Algorand, an architectural decision reflecting Algorand’s focus on compliant securities infrastructure rather than general-purpose DeFi.

Ondo’s October 2025 expansion to BNB Chain via PancakeSwap demonstrated multi-chain ambitions, with additional deployments planned for Solana (early 2026) and a proprietary Ondo Chain L1 under development. Cross-chain infrastructure via LayerZero’s Ondo Bridge connects assets across 2,600+ applications.

Regulatory catalysts accelerate institutional entry

December 2025 delivered transformational regulatory clarity for tokenized securities in the United States:

- DTCC No-Action Letter (December 11, 2025): The SEC’s Division of Trading and Markets authorized a three-year pilot enabling DTCC to tokenize Russell 1000 equities, U.S. Treasury securities, and major index ETFs (S&P 500, Nasdaq-100). This pilot, expected to launch H2 2026, represents the most significant U.S. regulatory approval for tokenized equities, creating a pathway for traditional market infrastructure to interoperate with blockchain settlement.

- Broker-Dealer Custody Guidance (December 17, 2025): SEC clarified that broker-dealers can maintain “physical possession” of tokenized equities under Rule 15c3-3 if they maintain exclusive private key control and implement appropriate security policies. This removes a critical barrier that previously forced custody through non-traditional pathways.

- Nasdaq Rule Change Proposal (September 2025): Nasdaq submitted a proposed rule change to trade and settle tokenized securities on its exchange while maintaining national market system oversight, signaling major exchange interest in blockchain integration.

Internationally, Ondo Finance received approval from Liechtenstein’s Financial Market Authority to offer tokenized U.S. stocks across all 30 EEA countries, accessing 500+ million potential investors. The SEC closed its investigation into Ondo without charges in November 2025, removing regulatory overhang.

Under EU frameworks, tokenized equities fall outside MiCA’s scope, remaining under MiFID II and existing securities laws, while the DLT Pilot Regime provides sandbox environments for compliant experimentation. Switzerland’s DLT Act continues to provide the most advanced framework for ledger-based securities recognition.

Institutional infrastructure reaches production scale

The institutional adoption pattern for tokenized equities mirrors the trajectory of tokenized treasuries, with a 12-18 month lag:

BlackRock’s BUIDL fund grew from $40M at March 2024 launch to $1.8-2.8 billion by end of 2025, demonstrating institutional appetite for on-chain exposure to traditional assets. While BUIDL holds treasuries rather than equities, its success provides a template for institutional-grade equity tokenization. BlackRock assets underpin Ondo’s OUSG product ($730M+ TVL), creating direct linkage between the world’s largest asset manager and DeFi infrastructure.

Goldman Sachs and BNY Mellon partnered in July 2025 to tokenize money market funds via LiquidityDirect, with BlackRock, Fidelity, Federated Hermes, and GSAM as participants, the first U.S. instance of fund managers enabling MMF subscriptions with mirrored tokenization. In December 2025, JPMorgan launched tokenized money market funds and announced institutional clients can use Bitcoin and Ether as collateral, infrastructure that naturally extends to tokenized equities.

Custody infrastructure has matured accordingly. Fireblocks, BitGo, and Anchorage Digital now provide institutional-grade custody for tokenized securities, while the December 2025 SEC guidance explicitly permits broker-dealer custody with proper key management.

Forward outlook: from pilot to production

The tokenized equities market sits at an inflection point. The DTCC pilot authorization, combined with Nasdaq’s rule change proposal, suggests regulated U.S. market infrastructure will begin interoperating with tokenized securities by late 2026. This creates a convergence pathway where traditional equity market structure, central clearing, regulated exchanges, broker-dealer intermediation, integrates with blockchain settlement.

Several catalysts merit monitoring:

- Securitize’s SPAC listing (ticker: SECZ) at a $1.25 billion pre-money valuation provides a public market proxy for tokenization infrastructure. The planned Q1 2026 launch of “Stocks on Securitize”, with natively tokenized rather than synthetic shares, could establish the compliance template for U.S. equity tokenization.

- Ondo Chain, the proprietary L1 under development, signals vertical integration ambitions. Combined with Ondo’s institutional partnerships (Mastercard MTN, State Street/Galaxy $200M seed capital for SWEEP fund, Chainlink oracle integration), the protocol is building the full stack for institutional-grade tokenized equity infrastructure.

- Kraken’s Backed acquisition positions a major regulated exchange to unify issuance, trading, and settlement for tokenized equities, a model that competing exchanges may replicate.

Market projections vary widely. BCG and Ripple forecast $18.9 trillion in tokenized assets by 2033; McKinsey projects $2-4 trillion by 2030; Galaxy Digital estimates $1.9-3.8 trillion. Applying these projections to equities’ current ~1% share of tokenized RWAs suggests a $20-190 billion addressable market by decade’s end, requiring sustained 50-100%+ annual growth rates.

Conclusion

Tokenized equities have transitioned from concept to functioning market infrastructure in under 12 months. The $857 million current market represents a rounding error against global equity market capitalization, but the 2,500% YTD growth, December 2025 regulatory breakthroughs, and institutional infrastructure buildout suggest the asset class is approaching the phase transition that tokenized treasuries experienced in 2024.

The rapid growth draws parallels with the growth of stablecoins, which crossed $1 billion in January 2020 to $306 billion by January 2026. Tokenized equities reaching a similar trajectory would imply a $150+ billion market by 2030, substantial, but still a fraction of the multi-trillion dollar projections that assume tokenization captures a meaningful share of global equity markets.

For institutional allocators, the key metrics to monitor are: monthly volume-to-AUM ratios (indicating market maturity), chain-level TVL shifts (signaling infrastructure preferences), and DTCC pilot implementation timeline (determining traditional market integration). The duopoly structure between Ondo and Backed/Kraken creates concentrated counterparty exposure, though Securitize’s Q1 2026 product launch and tZERO’s tokenized commercial real estate (CRE) planned $1B tokenized asset deployment may diversify the landscape.