After more than four years of continuous development, the Octra ICO marks the public distribution phase of a network built to support protocol-level encrypted computation. Since 2021, Octra has focused on developing a general-purpose encrypted compute network utilizing a proprietary fully homomorphic encryption (FHE) scheme, which enables network nodes to perform computations on encrypted data without accessing the plaintext. Octra describes its approach as integrating encrypted state and execution directly into its core architecture.

Octra is preparing to conduct a public token sale from December 19 to December 25, 2025. The sale will be hosted on Sonar, a token issuance platform operated by Echo.

The public sale will offer 10% of the total OCT token supply at a fixed price of $0.20 per token, implying a fully diluted valuation (FDV) of $200 million if fully subscribed, with a total fundraising cap of $20 million.

All tokens purchased in the ICO are expected to be fully unlocked at distribution, a design choice that contrasts with more recent token sales that commonly include vesting schedules or lockups. While this structure enhances liquidity and transparency, it may also introduce short-term market dynamics that participants should evaluate accordingly.

What Octra Is Focusing On

Octra positions itself as a general-purpose, privacy-centric Layer-1 blockchain designed to support computation on encrypted data. At the core of the protocol is fully homomorphic encryption, a cryptographic technique that allows mathematical operations to be performed directly on encrypted inputs without first decrypting them. In theory, this enables applications to process sensitive data such as financial information, proprietary logic, or user activity, without exposing that data to validators, nodes, or the broader public ledger.

Octra’s design embeds confidentiality at the base layer. The stated objective is to allow developers to build privacy-preserving smart contracts and workflows without relying on external privacy layers or complex cryptographic abstractions.

Octra’s differentiation hinges on its attempt to make encrypted computation a first-class primitive, rather than an optional add-on.

Fundraising History

Octra has raised approximately $8 million across early funding rounds since 2024, including a $4 million pre-seed round led by Finality Capital Partners.

These earlier rounds funded initial protocol development, internal testing, and ecosystem preparation. Unlike private placements that typically limit participation to institutional or accredited investors, the upcoming ICO is structured to broaden access and distribute ownership across a wider set of participants.

Token Distribution and Ownership Profile

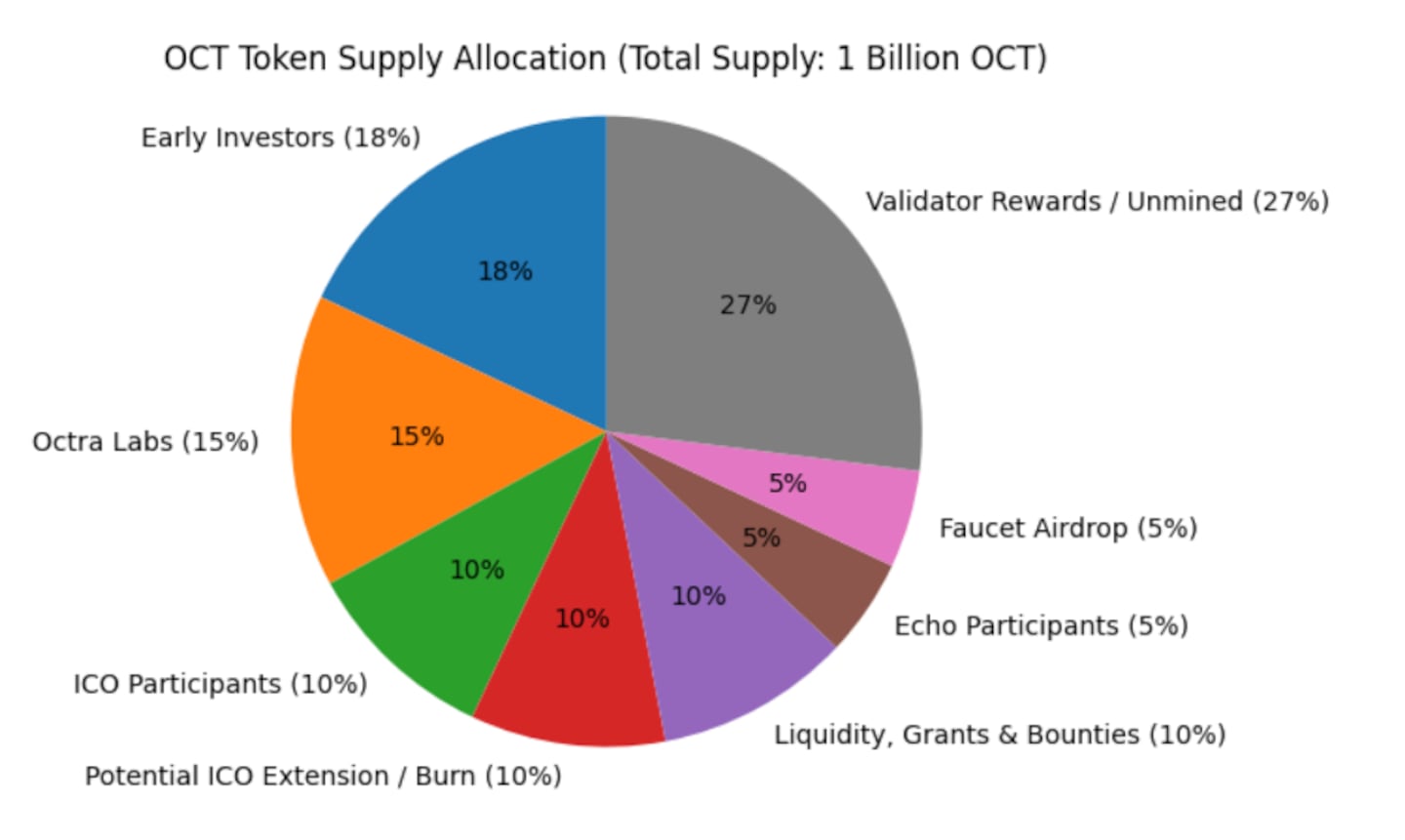

Based on publicly available information, Octra’s token allocation is structured as follows:

Octra has stated that no single investor controls more than 3% of the total token supply, a distribution profile intended to limit concentration risk and promote decentralized ownership.

Participation Requirements, Compliance, and Risks

Participation in the ICO requires registration through Octra’s official sale portal and the creation of a verified Sonar account. Prospective participants must complete standard KYC and eligibility checks, including residence verification and sanctions screening. Registration alone does not guarantee participation, as final eligibility remains subject to compliance requirements.

As with any early-stage public token sale, participation in the Octra ICO carries material risk. Fully homomorphic encryption, while academically mature, remains computationally intensive and largely unproven at scale in production blockchain environments. Execution risk, developer adoption, and competitive differentiation will be critical to long-term outcomes.

Additional considerations include regulatory uncertainty surrounding token sales, evolving global compliance frameworks, and the historically volatile trading behavior associated with immediately unlocked tokens. Market participants should evaluate the ICO within the broader context of their risk tolerance and investment objectives.