Ahead of Consensus Toronto kicking off in just a few days, DL Research sat down with Addressable to answer a simple question: What should growth and marketing teams watch for in Canada’s web3 scene this year? The numbers reveal a market that is expanding quickly, experimenting on mobile, and hungry for brands that know how to speak its language.

Key takeaways for growth leaders

- Prioritise mobile and Metamask: With nearly eight out of ten interactions on phones and a seventy-plus percent wallet share for Metamask, optimise every click for small screens and one-tap signatures.

- Design for the long tail: Most Canadians hold less than USD 1,000 in crypto, yet they transact often. Micro-rewards and low-commitment experiences may scale faster than high-ticket NFT drops.

- Join the conversation in real time: The same users who ape into memecoins are also hungry for clear guidance on infrastructure upgrades. Marry entertainment with education to stay top of feed and top of mind.

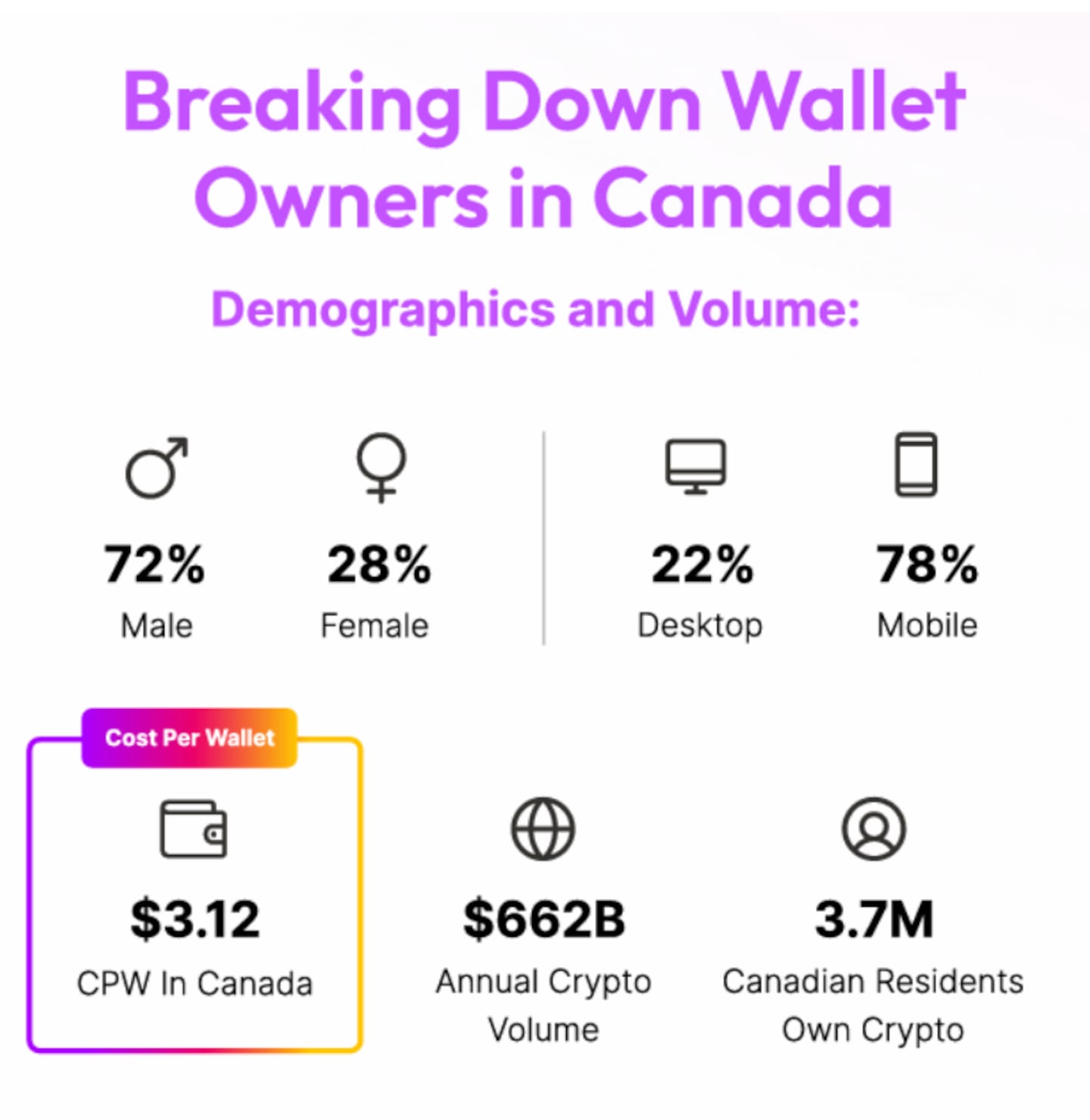

Who owns crypto in Canada

An estimated 3.7 million Canadians now hold digital assets, and they collectively generate about USD 662 billion in onchain volume each year. For brands used to measuring reach in ad impressions, that figure signals an audience that spends, trades, and experiments in real time.

Better still, Addressable data shows that the average cost to reach a Canadian wallet is only USD 3.12, a fraction of what many brands pay for a single click on legacy platforms.

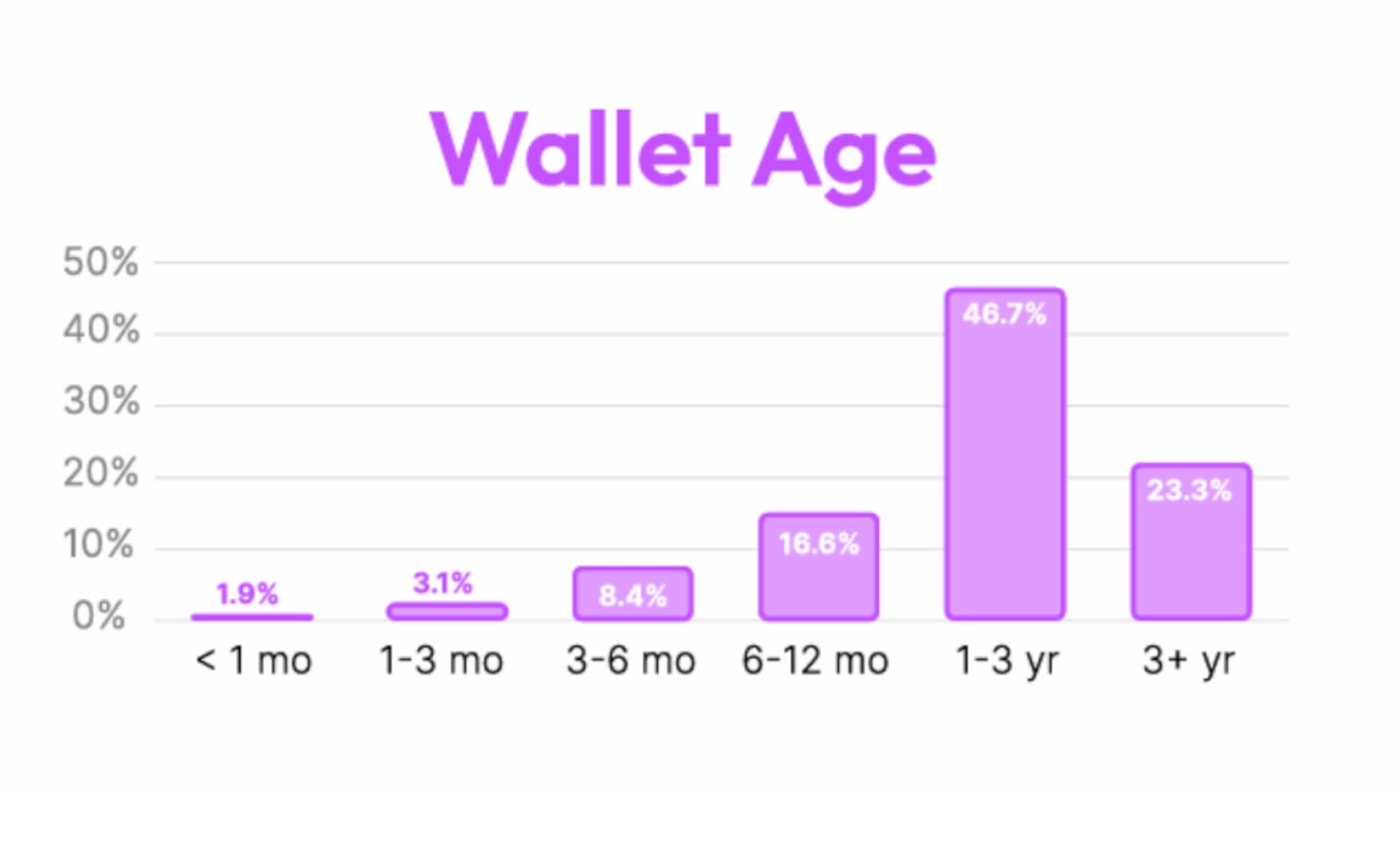

Crypto adoption in Canada still skews male (72 percent), but the 28 percent share of female holders is larger than in many peer markets, hinting at a widening mainstream appeal. Age distribution tells a second story: nearly half of all wallets (~47 percent) are less than three months old.

The freshness of these wallets implies a constant inflow of newcomers, many of whom are testing their first trades on smaller budgets. Brands that provide early, low-risk experiences like token rewards for sign-ups or gated content can become trusted companions on the user’s learning curve.

How Canadians connect

Mobile rules the northern market: 78 percent of holders engage primarily on phones, while just 22 percent lean on desktops. That ratio demands mobile-first creative and snackable content, but it also expands the canvas for real-world activations.

Geo-fenced wallet drops at events, QR-code treasure hunts, and near-field communication campaigns can meet users where they already transact.

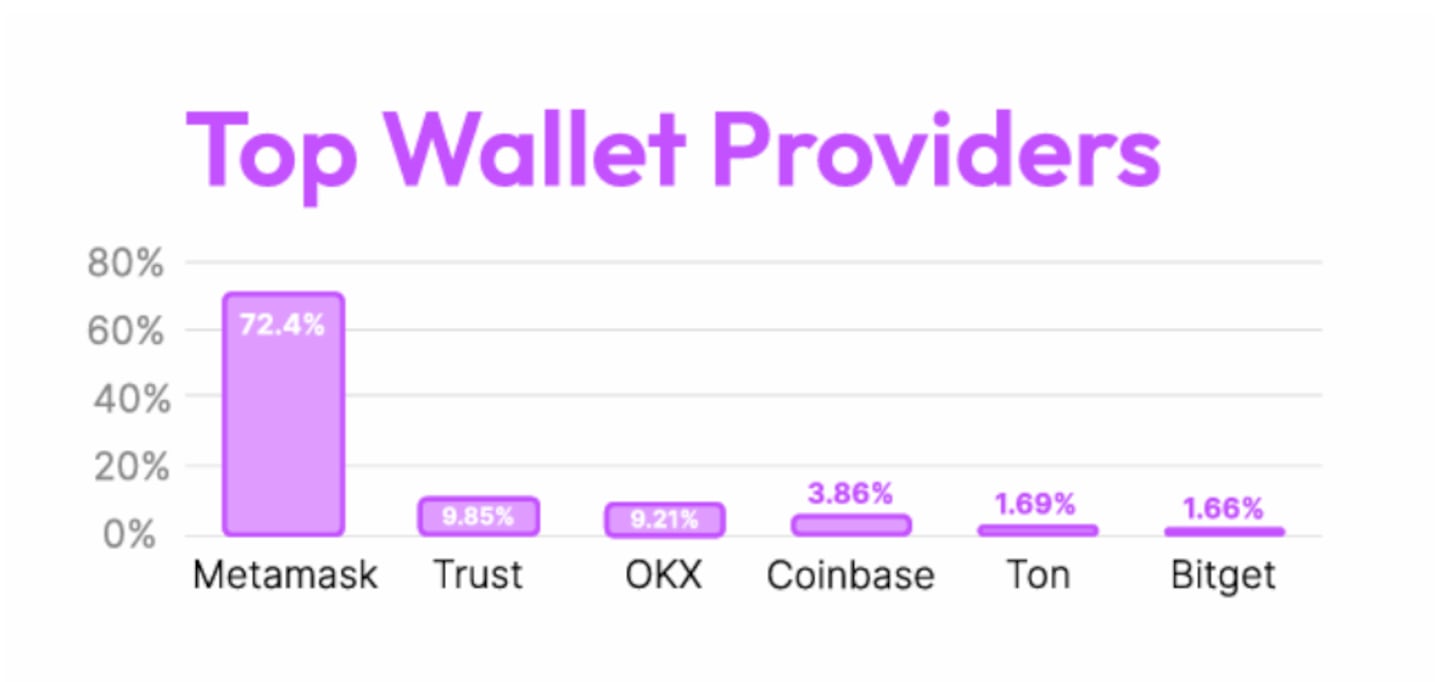

Metamask dominates with a near 73 percent share, towering over Trust (~10 percent) and OKX (9 percent). Coinbase and Bitget round out the top five, while Ton sneaks in at around 1.7 percent. For marketers, this mix simplifies campaign design: optimise token contracts and sign-in flows for Metamask first, then localise messaging for Trust and OKX power users. Integrations with Coinbase’s browser wallet can serve as a bridge to fiat-native audiences who are dipping a toe into self-custody.

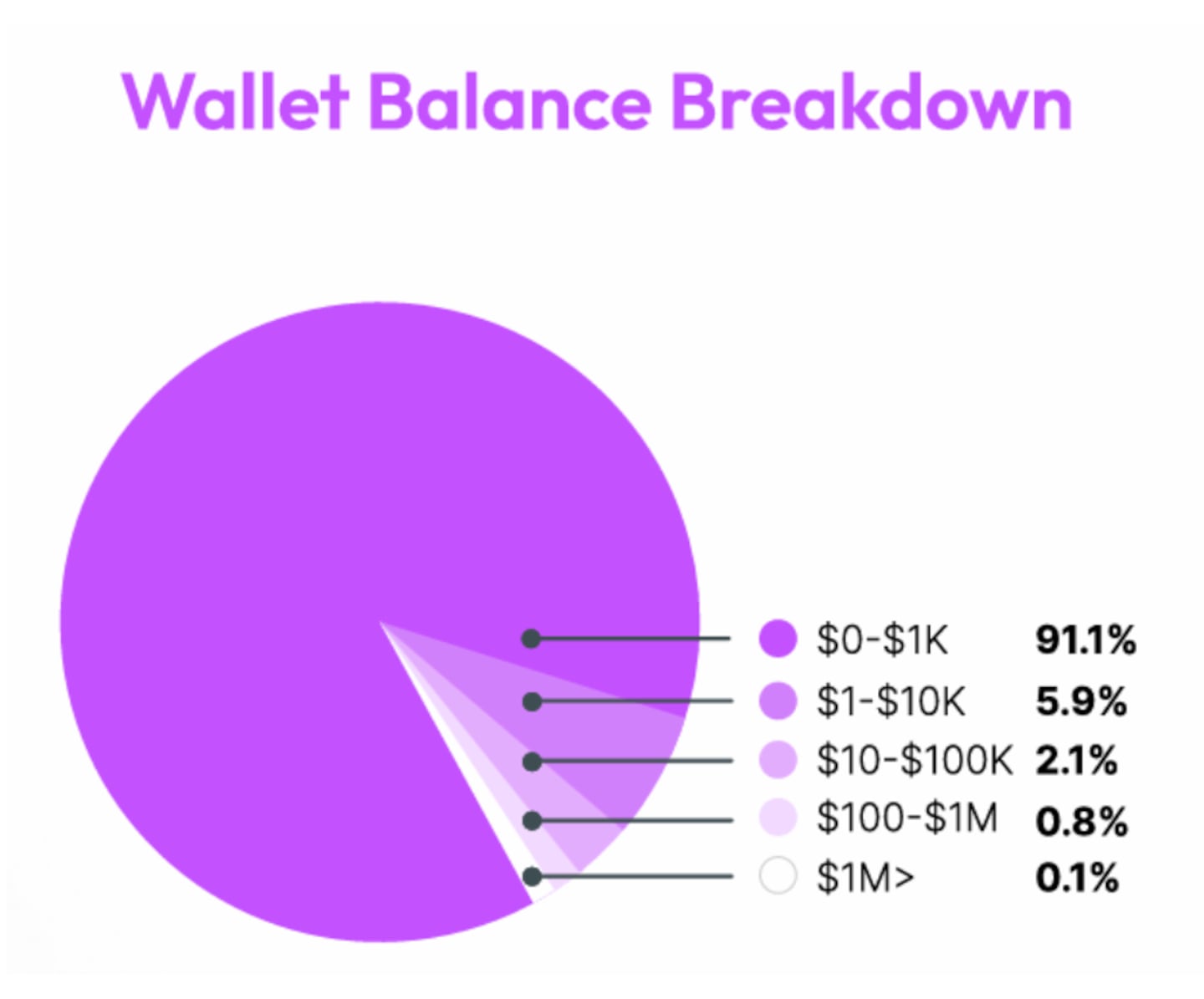

Onchain wealth distribution

Canada’s crypto economy is broad rather than deep. A striking 91 percent of wallets hold under USD 1,000, and another 6 percent sit between USD 1,000 and 10,000. Only three percent of wallets exceed USD 10,000.

This long-tail balance profile challenges the stereotype of whales driving all activity. Micro-incentive programs like loyalty NFTs, discount codes, and tiered staking rewards may speak directly to the majority who treat crypto as a modest but active part of their financial lives.

With almost half of wallets younger than a quarter, retention is the battlefield. Only 3 percent of Canadian wallets survive past three years. The attrition underscores how quickly casual users drift away if their first experiences feel clunky or risky.

Brands that offer clear onboarding, transparent fees, and quick paths to using tokens for real utility can break that churn cycle. In practice, this means streamlined gasless drops, customer support on social channels, and user education that demystifies private-key management.

Where the conversations happen

Twitter, now rebranded as X, remains the loudest megaphone. Canadians follow the same global heavyweights — @binance, @Opensea, @Coinbase, @Coinmarketcap, and @BoredApeYC — while home-grown influencers ride the same waves.

Key opinion leaders such as @cz_binance, @VitalikButerin, @garyvee, @saylor, and @Alexbecker_yt set the tone of debate and discovery.

The most-tweeted tokens ($STEVE, $BTC, $NAKA, $SUI, $BOOPA) and hashtags (#STEVE, #CRYPTO, #LOADEDLIONS, #BITCOIN, #GALXEID) highlight a blend of blue-chip topics and fast-moving memecoin chatter.

Brands that show up early in these threads through sponsored spaces, influencer partnerships, or timely airdrops gain cultural relevance at the speed of the timeline.

Mentions of @BoredApeYC, @SuiNetwork, and @garyvee also reveal that Canadians are not just trading, they are building identity and community. Campaigns that let users signal membership like exclusive profile-picture frames, limited badges, or IRL meet-ups tied to token ownership tap into this desire to belong.

Content that converts

When Addressable analysed engagement, three themes towered above the rest. Memecoin performance posts pulled 277,000 views, Ethereum and layer 2 updates drew nearly 220,000 views, and web3 marketing thought-leadership captured 153,000 views.

The lesson is clear: Canadians crave both speculation and education. A balanced content calendar that mixes hot-take commentary on volatile assets with practical guides to scaling solutions keeps feeds sticky and brand trust high.

For example, a consumer brand launching a loyalty token might publish a primer on how its rewards migrate to a layer 2 network, then follow up with weekly “meme market minutes” that playfully track niche coins. The educational piece positions the brand as a builder, while the meme commentary keeps the tone playful and shareable.

Canada’s web3 landscape is dynamic, accessible, and increasingly competitive, yet the door is still wide open for brands that act with speed and purpose. The data show where audiences trade, talk, and transact, but the opportunity lies in meeting them with mobile‑first experiences, micro‑rewards, and real‑time storytelling.

Ready to turn insight into measurable growth? Reach out to Addressable and start connecting with Canada’s most active web3 users today.