Over the past year, the DeFi sector has shifted away from speculative yield farming toward products focused on more sustainable revenue and greater automation.

That includes AI-powered trading assistants, points-based incentive models, and multichain deployments.

Amped Finance is one of several protocols building around that model. Its focus is a mix of trading tools, yield strategies, and AI integrations, all tied to a multichain rollout and a soon-to-launch token.

Features like chat-based trading and a points program are already live, aimed at attracting users ahead of its token generation event.

Early traction

Amped Finance is already deployed on a handful of networks, including Sonic, Berachain and Base, with additional integrations on testnets like Monad. This multichain approach helps diversify liquidity and ensures early access across several Layer 1 and Layer 2 ecosystems.

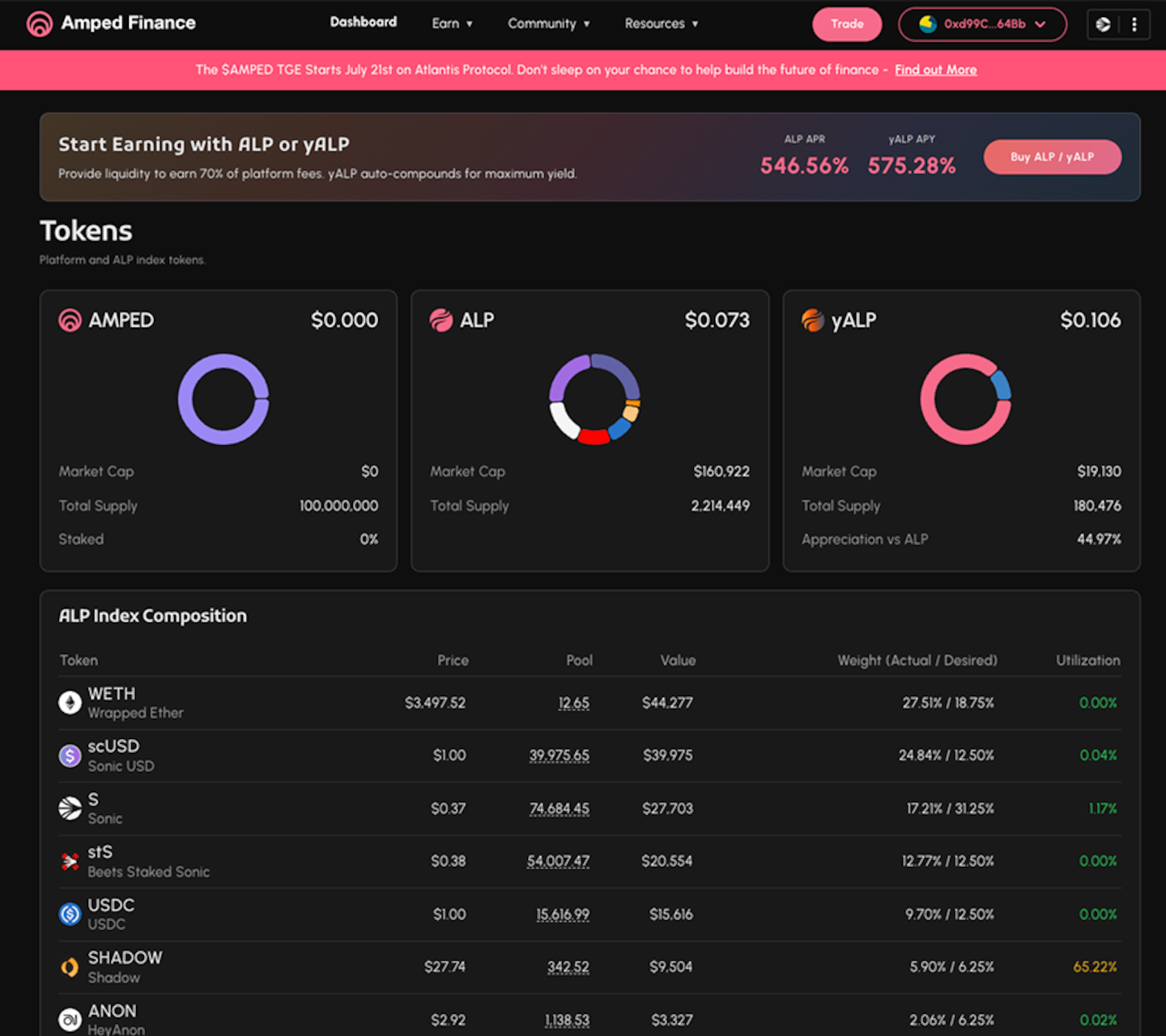

According to its public dashboard, the protocol has processed over $300 million in cumulative trading volume and generated close to $900,000 in fees. That performance positions Amped among the top performers by fee generation relative to TVL within the Sonic ecosystem.

That activity comes primarily from its spot and perpetual trading products, paired with liquidity pools and vaults.

AI integrations and automation tools

One of Amped’s more experimental angles is its use of agentic AI, which are tools that aim to simplify trading or liquidity provision through natural-language commands. This aligns with a broader push toward simplifying DeFi interactions for a wider audience, particularly those newer to transacting onchain.

Its first integration, HeyAnon, is already live and allows users to open positions or manage trades using a chat-style interface.

While still limited in functionality, the idea is to reduce reliance on traditional dashboards and let users delegate more complex tasks over time. HeyAnon represents a first step toward a more intuitive layer of DeFi access, lowering the barrier for non-technical users.

The team has signalled a broader roadmap around these features, including infrastructure for developers to build their own AI agents on top of the protocol.

It’s part of a wider trend among newer DeFi projects exploring automation as a way to improve usability, particularly for retail users who may not be comfortable managing positions manually. As more projects experiment with smart agents and AI tooling, Amped is positioning itself as an early mover in this emerging space.

The impact of these tools is unclear for now, though they point to a growing focus on usability and on making DeFi more approachable.

Points, airdrops, and token launch mechanics

Like many protocols in the sector, Amped has layered on a points program to encourage user activity ahead of its token generation event. These systems have become a staple in DeFi go-to-market playbooks, blending product incentives with token distribution.

Users who interact with its ALP and yALP liquidity tokens accumulate points toward a share of AMPED tokens, with 3% of the total supply set aside for distribution 30 days after launch. The mechanism aims to reward early engagement while aligning users with long-term protocol growth.

The yALP token is designed to appeal to airdrop-focused users. It tracks a weighted index of assets in the Sonic ecosystem and earns points toward both the AMPED and Sonic “Season 2” airdrops. That dual exposure makes yALP a rare intersection of passive yield and dual airdrop eligibility.

That dual exposure, combined with auto-compounding yields, positions yALP as a kind of passive rewards vehicle, though the long-term utility of the asset will depend on broader ecosystem adoption.

Amped’s upcoming initial DEX offering will follow a farming overflow model via the Atlantis launchpad. This model has been used in several recent IDOs to balance demand with fairer distribution, especially during early-stage fundraising.

Participants deposit tokens into a shared pool, earning escrowed AMPED (esAMP) during the process. Any oversubscribed funds are refunded. Escrowed AMPED can be staked like regular AMPED to earn a share of protocol fees, a system designed to activate from day one.

This means contributors don’t just wait for launch, they begin earning real yield the moment they join the sale. The allocation of 500,000 esAMP to the farming bonus pool ensures that early participants are directly rewarded for their risk and commitment.

The token will launch with an initial market cap of $778,000 and a fully diluted valuation of $4 million. That’s relatively low compared to many recent DeFi launches, but it’s reflective of a conservative float and tight early supply.