The Ethereum ecosystem has undergone significant changes since the Dencun upgrade (EIP-4844) went live in March 2024. This upgrade, introducing “blobs” to more efficiently handle Layer 2 (L2) data requirements, was a critical step forward in Ethereum’s scaling journey. However, the impact of Dencun has been multifaceted, triggering shifts in the network’s economic dynamics, including a notable decline in both the amount of Ether burned and the annual percentage yield (APY) for staked Ether.

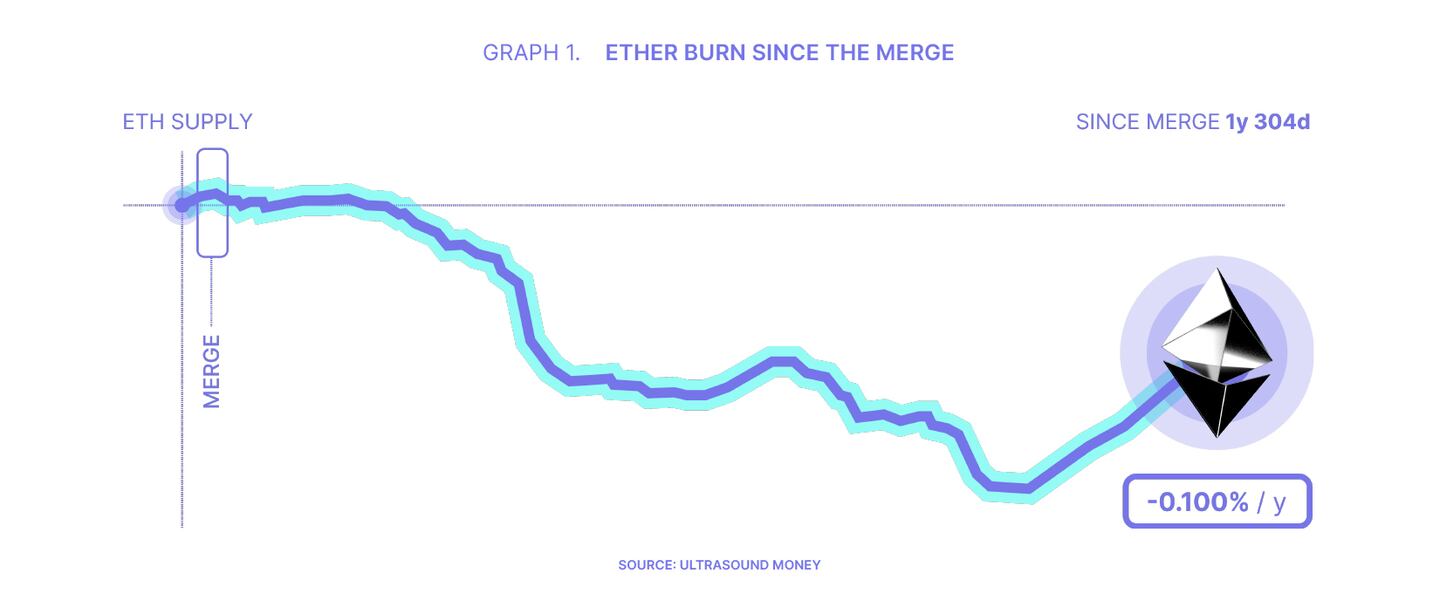

These developments have sparked debates within the community, with some voicing concerns that Ethereum’s Layer 1 (L1) is being overshadowed by its L2 counterparts, or that the prioritisation of L2 scaling has inadvertently weakened the network’s financial foundation. As Ethereum’s supply growth rate moves away from deflationary territory, and as staking yields trend downward, questions arise about the long-term sustainability of the network’s revenue model and staking incentives.

In this report, we examine the evolving transaction dynamics and economic incentives in a post-Dencun Ethereum. We explore the mechanisms driving these changes, including the impact on Ether burn rates and staking APY, and assess the potential for their recovery. Additionally, we analyse various strategies for balancing L1 and L2 interactions, highlight the role of new innovations, and consider the broader implications for Ethereum’s network robustness, and long-term sustainability.

Ethereum Transactions 101

Ethereum transactions can simply be thought of as a message with a set of instructions. Transactions include details like the sender, recipient, and amount, and can even attach additional data or instructions, similar to how a PDF might be attached to an email, using “Calldata”.

When a user wants to interact with a smart contract, or application, calldata is used to provide specific instructions on what the user wants to do. On the other hand, Layer 2 networks will use calldata to post transaction data from their blockchain and synchronise their state. Basically, L2s leave a message with Ethereum every so often letting it know what transactions happened recently and that everything is running smoothly.

The cost of these transactions is determined by their complexity, the amount of data they include, and the current demand for processing transactions on the network. Before EIP-1559, which went live in August 2021, users paid a single gas price, leading to a competitive bidding process where miners prioritised higher-priced transactions. With the introduction of EIP-1559, the gas fee structure was updated to include both base and priority fees.

The base fee is set by the market’s current demand for transacting, while the priority fee, set by the user as a “tip,” incentivises miners to process those transactions faster. The base fee is burned, meaning it is permanently removed from circulation, and the priority fee is given to validators.

L2 Fees Post-Dencun

Dencun lets L2s do the same tasks they once relied on calldata for, but with far greater efficiency using “blobs”. The simplest way to think of it is as a highway where drivers on the regular lanes are users transacting on mainnet, while drivers in the private, or HOV lane, are L2s bundling information in blobs to send to mainnet. Traffic in one lane doesn’t directly affect the other, though both lanes can still experience congestion.

By introducing this new lane for L2s, the Dencun upgrade has significantly reduced gas fees for users on both mainnet and its various L2s. On mainnet, fees have fallen from an average of $23.3 per transaction in the week before Dencun to just $1.18 on average over the last seven days. Meanwhile, on L2s, transaction fees have decreased by as much as 98% in some cases, with sub-cent fees becoming the norm.

However, these reduced gas fees came at the expense of reduced Ether burn and Ether staking APY. Many analysts anticipated fees would drop, but it is unclear whether fees were expected to drop dramatically as they did. It’s possible demand was expected to increase at the same pace to counteract decreasing fees. Either way, the situation is at an interesting crossroads.

In blob gas pricing, there is a target of three blobs per block with an upper limit of six blobs per block. When there are less than three blobs in a block, the base fee decreases, and when there are more than three blobs the base fee increases. However, with current levels of L2 activity, there simply isn’t enough demand to consistently fill these blobs. Since Dencun, the average blob count per block has always remained below the target of three blobs.

Each blob holds the same amount of data (128 KB), and generally, when an L2 reaches this amount, it will post its blob to mainnet for settlement. There are again priority fees, similar to regular transactions on mainnet, where L2s can pay more to get included faster. The idea is that more activity on an L2 results in more data, which results in the L2 needing to post blobs quicker.

In reality, that hasn’t been the case.

Sure, there were some instances – between March 25-31, for example – where blob base fees increased dramatically, but this was due to inscriptions. Generally, inscription traders are insensitive to price demands.

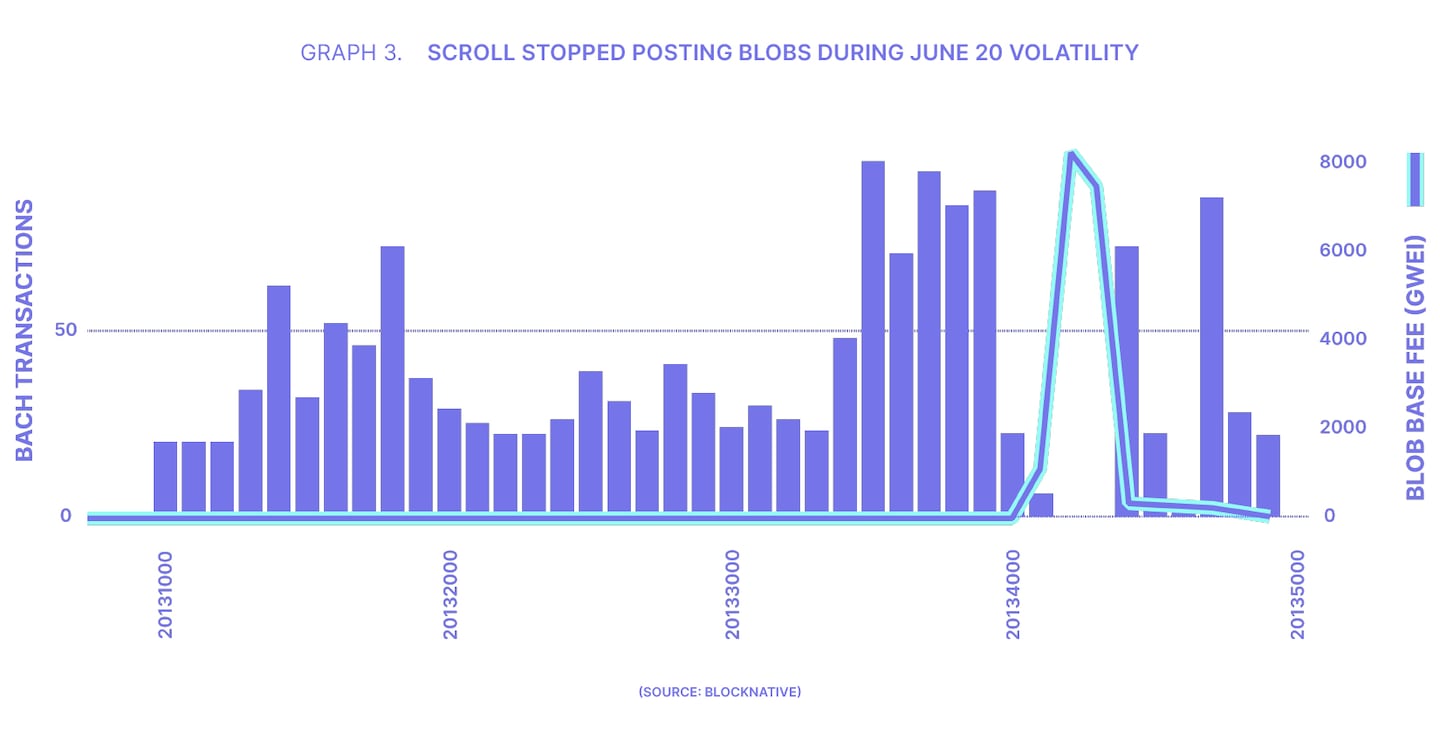

Around June 20 we saw another spike in blob fees, but this time some interesting details emerged, as first noticed by Blair Marshal from Blocknative. He observed that most of these L2s will play timing games to post blobs when it is most cost effective for them.

Since transactions on the L2 will settle whether a blob is posted to mainnet or not, the UX for the end user on an L2 isn’t really impacted if the L2 waits a bit longer to post a blob. Some L2s, like Scroll, stopped posting blobs altogether at one point during the spike. Other L2s including Arbitrum and Optimism even switched back to consistently posting their states through calldata, as this proved to be cheaper than using blobs.

Still, we shouldn’t ignore that in terms of scaling, Dencun was incredibly successful.

According to data from Grow The Pie, the aggregated daily transaction count across all layer 2s hit an all-time high of 15.2m on August 18. For reference, the day before the Dencun upgrade went live, the total aggregated daily transaction count across L2s was just 4.7m.

Similarly, daily transactions on Ethereum mainnet are still at strong levels, exceeding 1m on August 18 with an average gas price of 3.1 gwei, compared to 1.2M on March 12 with an average gas price of 64.3 gwei.

Potential Solutions

With a general understanding of the impacts of Dencun, we can take a look at some potential solutions.

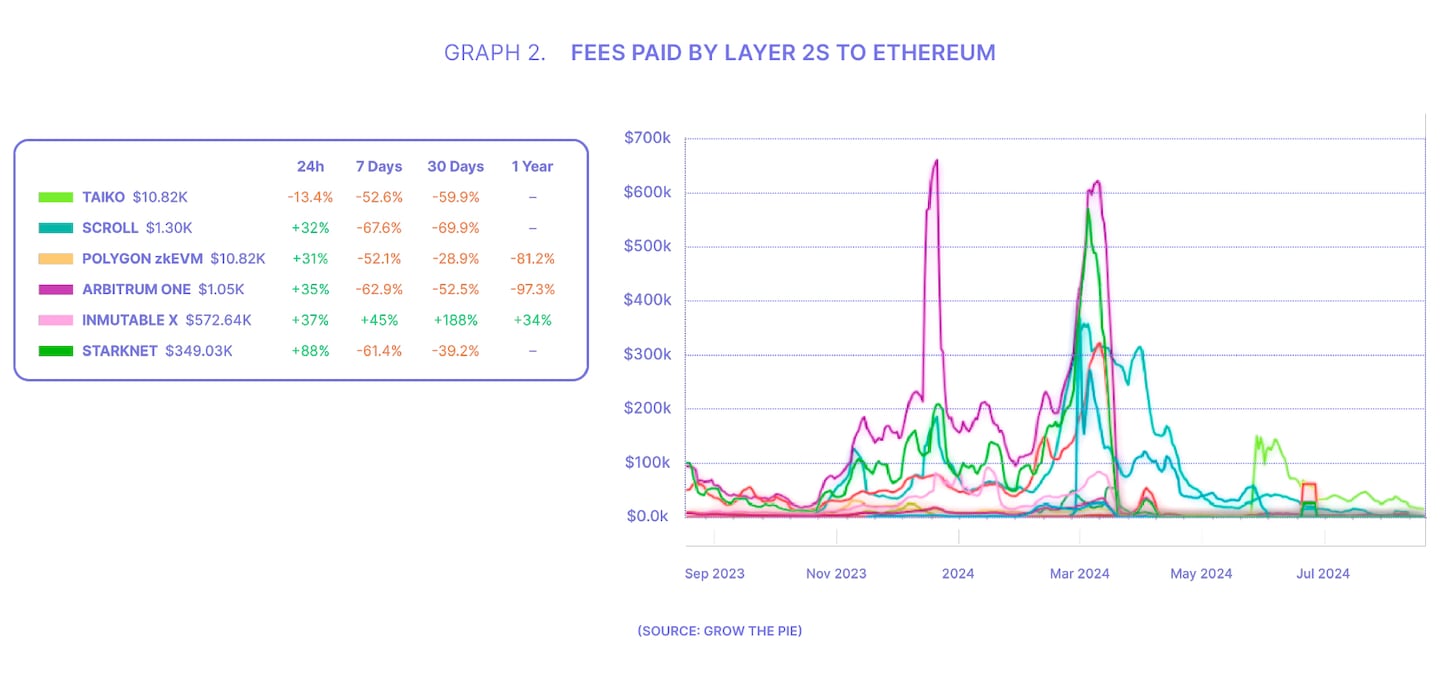

While it appears unlikely that L2s will contribute significantly to L1 revenues in the near term, “based” rollups like Taiko offer some promise. Based rollups are tightly integrated with Ethereum’s Layer 1 sequencing, meaning their transactions are ordered through Ethereum block proposers.This design choice requires frequent updates to the L1, leading to higher operating costs.

These costs arise from the need to process transactions and generate proofs for submission to L1. Taiko, for example, incurs significant expenses due to these frequent postings, which, in turn, boost Ethereum’s L1 revenues. On the other hand, most other L2s manage transaction ordering differently, often delaying L1 submissions to reduce costs.

However, Taiko’s planned integration of transaction preconfirmations could significantly reduce these costs, potentially by up to 32x, as it would allow transactions to be confirmed off-chain before being posted to L1.

The trend of continued cost optimization is not isolated to L2s; the Ethereum base layer itself is being further optimised for L2 efficiency with upcoming upgrades like Pectra, which aims to further reduce transaction fees by expanding blob capacity.

This focus on efficiency is something Coinbase’s David Han has also observed. Han suggests that as Ethereum scaling progresses, average transaction fees will trend toward zero, regardless of the scaling architecture used.

While this might initially seem detrimental to L1 revenue, Han believes it will drive greater adoption by making on-chain activity more accessible, arguing that this shift will make application-based utility the primary driver of demand for Ether, as new types of applications become feasible on L2s.

This shift could fundamentally alter the landscape, making application-based utility the most critical factor for Ether price performance in the long term. Han points out that billions in USD have already been bridged to L2s, and the industry has recorded substantial growth in staked Ether and DeFi inflows. These trends, according to Han, are early indicators of a transition where the demand for Ether is driven by innovative applications that leverage the low fees and high throughput offered by L2s.

As the ecosystem evolves, the value proposition of Ether may increasingly hinge on its utility within these new applications - rather than purely on transaction fees - leading to a broader and more diverse set of use cases for Ethereum.

The rise of L2s, therefore, not only supports Ethereum’s scalability but also enhances the overall utility and adoption of the network.

With these ongoing optimizations and the competition among L2 solutions, perhaps now is the time to shift some focus back to L1 execution. Despite the rapid growth of L2s, Ethereum mainnet continues to be highly valued for its censorship resistance, network effects, and decentralisation, as evinced by its dominance, holding 57.5% of the total value locked across all blockchains.

For users with significant holdings, higher gas fees can be viewed as a “security fee,” offering peace of mind when transacting on a trusted network like Ethereum. With gas fees currently at their lowest in years, emphasising L1 execution could provide the bump in L1 revenues that so many are looking for.

Finally, a newer innovation that could provide added economic rewards to Ethereum stakers is the introduction of restaking with projects like EigenLayer or Symbiotic. Restaking allows users to lock up their already staked Ether as collateral for another Proof-of-Stake protocol. By doing so, these restakers can earn additional rewards, as these other PoS protocols are expected to share a portion of their service fees with them.

However, it should be noted this approach also introduces additional risks, such as potential slashing or losses due to failures in the secondary protocol. Furthermore, the complexity of managing multiple staking positions could increase the exposure to technical vulnerabilities and operational risks. This approach not only enhances the economic incentives for staking but also strengthens the security and resilience of multiple networks, creating a mutually beneficial ecosystem

Final Thoughts

Ethereum is actively executing on its scaling strategy, implementing crucial upgrades to optimise L2 performance. However, in the near term, expecting L2 activity to generate significant L1 revenue is unrealistic. It would require the emergence of multiple “killer apps” (apps with millions of real users) to drive the necessary demand, which, while possible, doesn’t seem likely at this stage.

This doesn’t diminish the critical role of Ether’s utility. As transaction fees across all blockchains trend toward zero, Ether’s use in DeFi, as money, and in other applications will become the cornerstone of its value. Ethereum continues to stand out among Proof-of-Stake chains, offering stakers around a 3% APY with a modest inflation rate of approximately 0.6% in the last 30 days.

Looking ahead, a blended approach involving the development of more rollups — 81 are currently in progress, according to L2Beat — and specifically, more based rollups like Taiko, combined with a renewed focus on L1 execution, is likely to have the most substantial impact on L1 revenues. Taiko’s planned transaction preconfirmations, which could reduce costs significantly, along with Ethereum’s ongoing optimizations through upgrades like Pectra, exemplify the continuous effort to enhance both L2 efficiency and L1 performance.

In addition to these efforts, the introduction of restaking presents another promising opportunity for Ethereum stakers. With 16 projects currently building on EigenLayer, this could provide new revenue sources, enhancing the economic incentives for restakers.

Moreover, it’s crucial to recognize that the blob fee market is still in its infancy, having been live for just over five months. As the market evolves, further updates could enhance its effectiveness; even now, there are conversations about improving upon EIP-1559, which launched three years ago. In the medium term, while L2s are vital for scaling, a strong focus on L1 execution could play an essential role in maintaining Ethereum’s dominance and its value proposition as the most secure and decentralised blockchain network.