With Securities and Exchange Commission (SEC) enforcement actions dominating crypto news over the past few days, here’s a timeline of enforcement events to recap what brought us here and where things may be headed.

SEC enforcement background

Early 2023 saw the crypto space claw back from the collapse of once-venerated major crypto entities Terra/Luna, FTX and Three Arrows Capital whose falls shattered the confidence of institutional and retail investors alike. Despite these events providing possible justification for regulatory bodies to swoop in and play hero, the battle for regulatory supremacy – particularly in the US – goes back much further than May 2022.

Timeline of major SEC actions

December 22, 2020 - SEC sues Ripple (XRP), accusing it of conducting an unregistered $1.3 billion securities offering. This action marks the start of the SEC taking the gloves off when it comes to cryptocurrencies.

August 9, 2021 - The SEC charges crypto exchange Poloniex for operating an unregistered digital exchange. Without admitting or denying the charges, the exchange agrees to pay $10 million to settle the case.

September 1, 2021 - The regulator charges the people behind crypto lender Bitconnect for allegedly defrauding retail investors out of $2 billion through a high-yield investment programme, a type of Ponzi scheme.

February 14, 2022 - BlockFi agrees to pay $100 million for offering an unregistered lending product. The exchange later files for bankruptcy in November after having been swept up in the FTX collapse.

March 8, 2022 - The SEC slams siblings John and JonAtina Barksdale with charges, accusing them of “defrauding thousands of retail investors” of more than $124 million via Ormeus Coin.

July 21, 2022 - The SEC charges former Coinbase manager Isahn Wahi and two others in $1.1 million insider trading ring. He later pleads guilty in February, 2023.

August 1, 2022 - The markets watchdog charges 11 individuals linked to smart contract company Forsage of running a $300 million Ponzi scheme and slams them with with cease-and-desist actions leading back to 2020.

September 30, 2022 - The SEC accuses Bermuda-based Arbitrade and Canada-based Cryptobontix, as well as their principals, of creating and running an alleged gold-backed pump-and-dump scheme called “Dignity,” netting $36.8 million.

October 3, 2022 - SEC hits celebrity Kim Kardashian with $1.26 million in penalties for promoting securities without disclosing personal holdings.

“This case is a reminder that, when celebrities or influencers endorse investment opportunities, including crypto asset securities, it doesn’t mean that those investment products are right for all investors,” said SEC Chair Gary Gensler.

December 13, 2022 - Weeks after the implosion of FTX, the SEC charges the disgraced founder Sam Bankman-Fried with “orchestrating a scheme to defraud equity investors” through the collapsed crypto exchange. The market watchdogs also announces that it is investigating if he has also violated other securities laws.

“We allege that Sam Bankman-Fried built a house of cards on a foundation of deception while telling investors that it was one of the safest buildings in crypto,” said Gensler.

December 21, 2022 – The SEC charges former Alameda Research CEO Caroline Ellison and former FTX CTO Zixiao Wang for their alleged role in defrauding the exchange’s investors.

January 4, 2023 – The SEC charges the founder of CoinDeal and seven others linked to the crypto scheme for allegedly defrauding over 10,000 people of over $45 million. The US Department of Justice had levied similar charges against people involved in CoinDeal in June 2022.

January 12, 2023 - The securities watchdog slams crypto lender Genesis and exchange Gemini with charges alleging that they offered and sold unregistered securities to retail investors through the Gemini Earn crypto asset lending programme. Genesis files for Chapter 11 bankruptcy days later.

January 19, 2023 - Crypto lender Nexo agrees to pay $45 million and cease operations in the US of its earn interest product after the SEC accused it of offering an unregistered crypto lending product.

February 9, 2023 - The SEC ordered Kraken to discontinue its US-based staking service. The service enabled investors to transfer crypto assets to Kraken for staking in exchange for advertised annual investment returns of as much as 21%. The crypto exchange settled the charges by ceasing operations of the US-based service and paying $30 million in disgorgement, prejudgment interest and civil penalties.

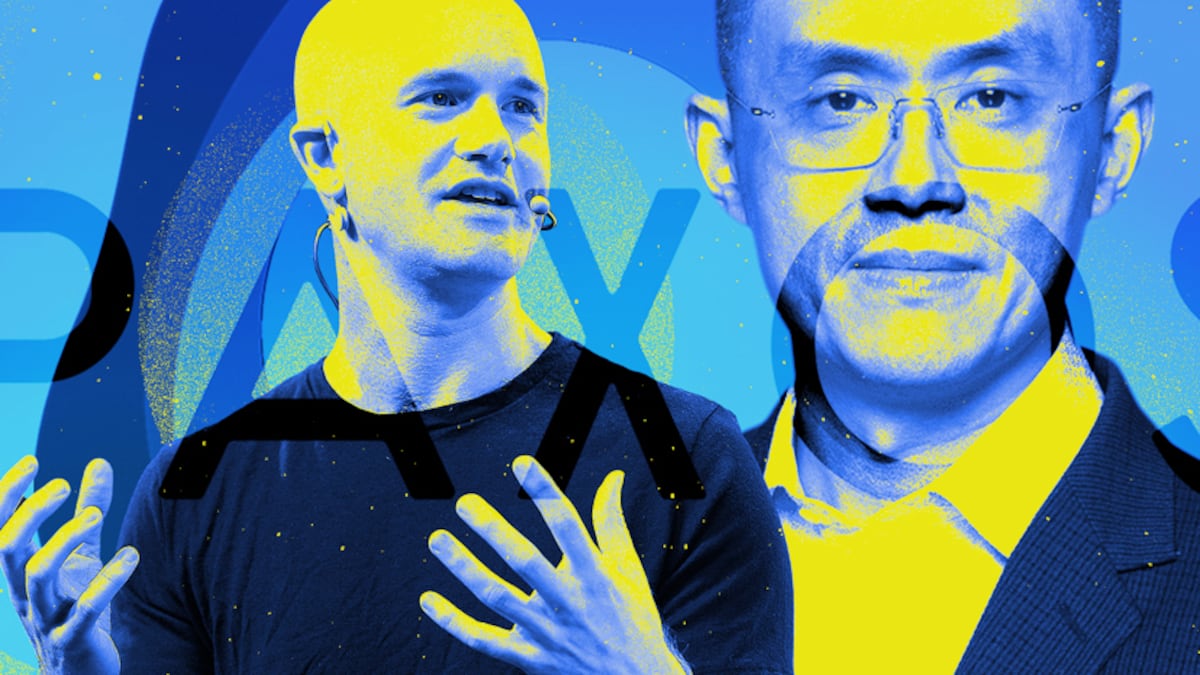

February 13, 2023 - Stablecoin issuer Praxos discloses receiving an SEC notice alleging that the stablecoin Binance USD, or BUSD, is a security. The regulator ordered Paxos to stop minting the token. Paxos has responded by saying that it will end its relationship with the major exchange Binance and stop minting the BUSD stablecoin. In an effort to calm investors, Binance CEO Changpeng “CZ” Zhao later took to Twitter to say that “funds are safe.”

#BUSD. A thread. 1/8

— CZ 🔶 BNB (@cz_binance) February 13, 2023

In summary, BUSD is issued and redeemed by Paxos. And funds are #SAFU!

Looking forward

Many industry voices – including SEC targets Coinbase CEO Brian Armstrong, Kraken CEO Jesse Powell and even SEC chairperson Hester Pierce – have expressed dissent in the face of Gensler’s efforts to put crypto providers “on notice.” The SEC’s main targets at press time consist of stablecoin issuer Paxos, staking platform and exchange Kraken, and protocol Nexo, which was recently subject to a multi-agency raid at one of its offices in Bulgaria.

Other stuff in Web3:

LACMA Art Museum Acquires NFT Collection With CryptoPunk, Art Blocks

How Crypto Keeps Feeding Russia’s War Despite Sanctions

Draft EU Rules Will Force Banks to Give Cryptocurrencies Highest Risk Rating

CFTC, SEC cases against Bankman-Fried to be pushed back until criminal case ends