- The SEC approved spot Ethereum ETFs in all-but-official terms on Thursday.

- But Ether’s price is struggling to rise.

- That may be due to inflation fears.

Even with the approval of spot Ethereum ETFs in the US last week, Ether is struggling to make new highs.

The second-largest cryptocurrency was recently trading at $3,840, roughly the same price as on Thursday, when the Securities and Exchange Commission approved Ethereum spot exchange-traded funds.

How come? According to Noelle Acheson, former head of market insights for Genesis Global Trading, Ether’s price is being bogged down by persistent inflation fears.

Manufacturing pushing inflation up

Just like Bitcoin, Ethereum is sensitive to global macro forces, Acheson wrote in her newsletter, “Crypto is Macro Now.”

On Thursday, while the crypto industry was celebrating the SEC’s approval of Ethereum ETFs, the release of the S&P Global’s purchasing managers’ index — or PMI, an indicator that provides insight into manufacturing and services — showed “quite stunning” numbers.

“It looks like the US economy is in full expansion, with the manufacturing sector joining services in keeping inflation high,” Acheson said.

That’s a problem for Bitcoin and Ethereum. The Federal Reserve has kept interest rates relatively high in order to fight inflation.

High rates deter investors from piling into risk-on investments, like crypto and tech stocks, because they can earn high yields from risk-free Treasuries.

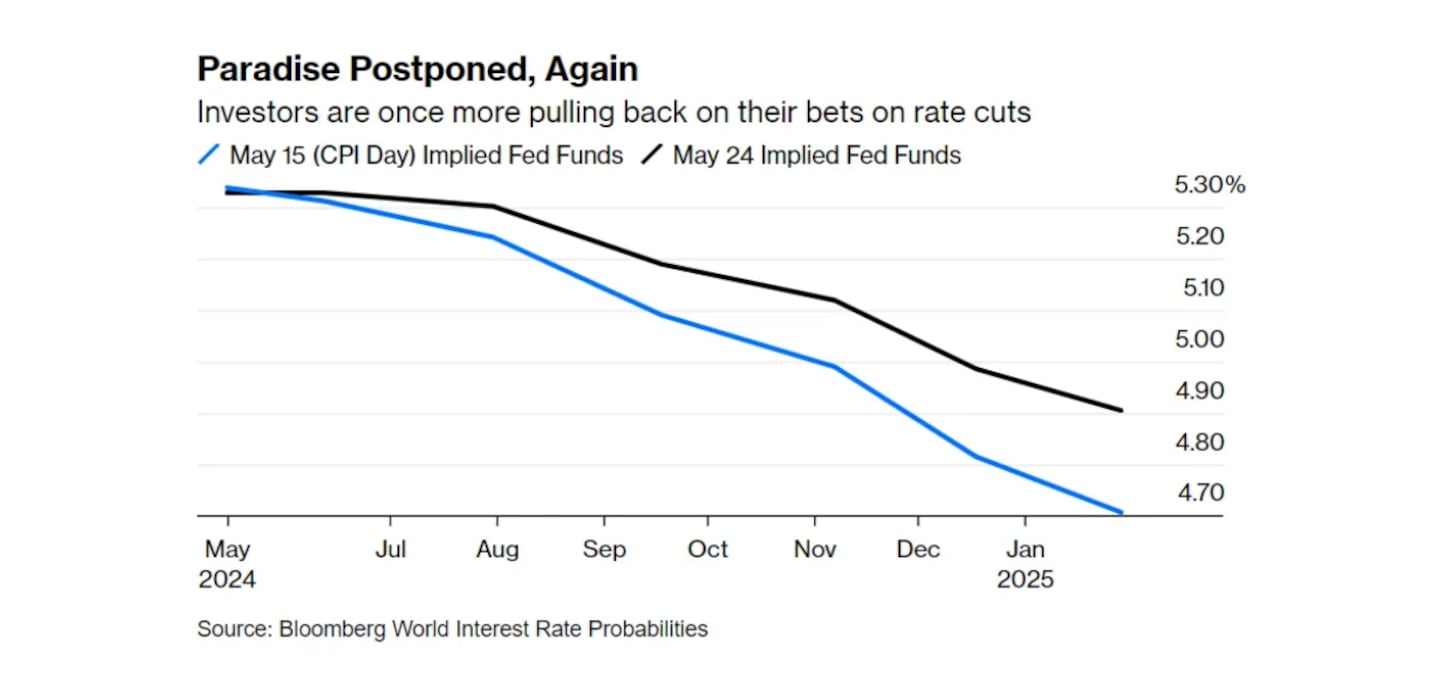

“It looks like rates are going to be truly ‘higher for longer,’” Acheson wrote, pointing out that expectations of lower rates have moved even further back from two weeks ago.

Quinn Thompson, founder of crypto hedge fund Lekker Capital, also said that crypto mania wouldn’t happen until the US dollar weakened — which will likely occur when the Fed cuts rates.

Crypto market movers

- Bitcoin is down 2.9% in the last 24 hours, trading at $68,000.

- Ethereum slumped 2.3% in the same period, to $3,840.

What we’re reading

- Disgraced project ZKasino says it will return deposits — but investors only have 72 hours — DL News.

- Semler Scientific Adopts Bitcoin As Primary Reserve, Buys $40M In BTC — Milk Road.

- Senator Cynthia Lummis on Why Crypto Now Has Bipartisan Support in Congress — Unchained.

- Mt. Gox Transfers 140,000 BTC, Triggering Bitcoin Price Drop — Milk Road.

- Jailed Binance exec in Nigeria is struck by malaria amid anguished pleas from his lawyers and family — DL News.

Tom Carreras is a markets correspondent at DL News. Got a tip about Bitcoin ETFs? Reach out at tcarreras@dlnews.com