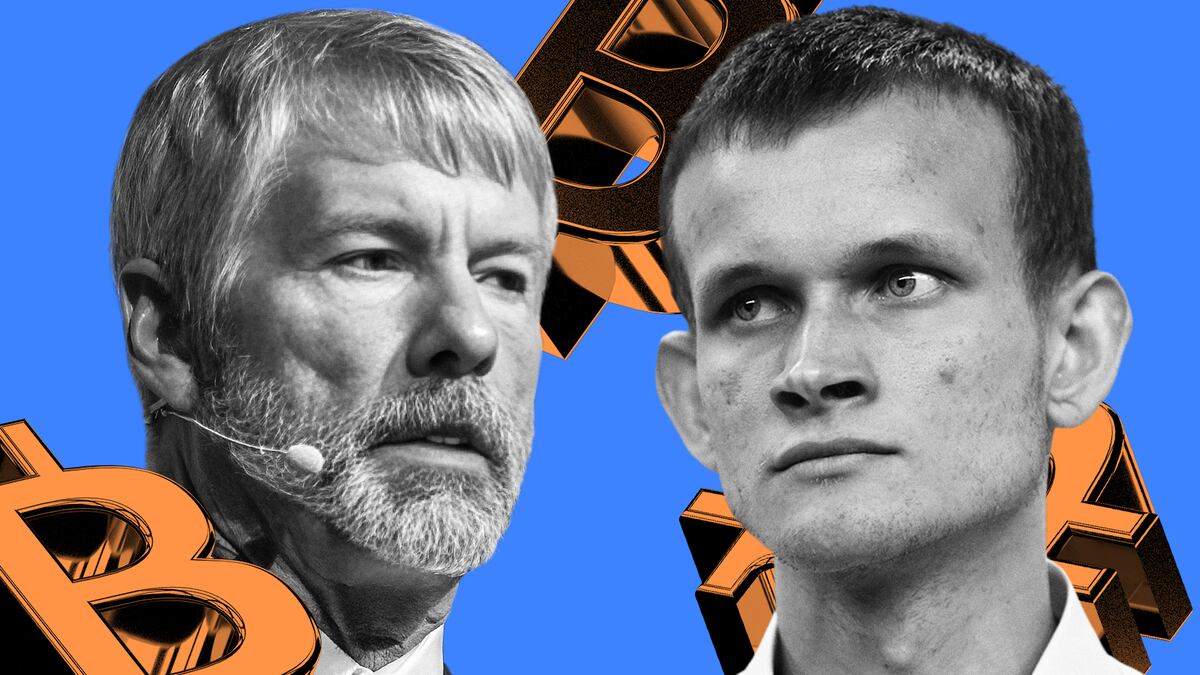

- Vitalik Buterin joins those criticising Michael Saylor's pro-institution comments.

- The Ethereum co-founder was an early proponent of Bitcoin.

Bitcoin billionaire Michael Saylor shocked crypto believers after saying the top crypto is more secure in the hands of financial institutions like BlackRock, Fidelity, and JPMorgan than private holders.

Vitalik Buterin was among those slamming the MicroStrategy founder after he told an interviewer that Bitcoin is at greater risk from authorities when it is held by non-regulated “crypto anarchists” who don’t acknowledge the government, taxes, or reporting requirements.

In the interview, journalist Madison Reidy asked Saylor if fewer larger institutions holding Bitcoin increased its risk of government seizure.

“I think it’s the opposite,” Saylor said.

“Saylor’s comments are batshit insane,” Ethereum co-founder Buterin said in an X post, echoing others who said such arguments oversimplify what Bitcoin accomplishes.

“He seems to be explicitly arguing for a regulatory capture approach to protecting crypto,” Buterin added. “There’s plenty of precedent for how this strategy can fail, and for me it’s not what crypto is about.”

While most famous for his work on Ethereum, Buterin was an early proponent of Bitcoin, co-founding Bitcoin Magazine in 2011 and helping create a Bitcoin wallet in 2013.

Buterin has also written extensively on how crypto can create a fairer and more resilient financial landscape, and how its decentralisation means it can work outside of existing systems.

Institutions and Bitcoin

The adoption of crypto among institutions has been supercharged by the launch of exchange-traded funds.

In January, the Securities and Exchange Commission approved spot Bitcoin ETFs, then greenlighted spot Ethereum ETFs in July.

Saylor has praised the adoption of Bitcoin ETFs. Last month, he said the recent approval of options for BlackRock’s Bitcoin ETF will accelerate institutional adoption.

Buterin’s stance on the ETFs is less clear. Comments from 2022 give a rare glimpse into his thinking.

“I’m actually kinda happy a lot of the exchange-traded funds are getting delayed,” Buterin said on X. “The ecosystem needs time to mature before we get even more attention.”

‘Just like Satoshi’

It’s not just ETF issuers who are scooping up Bitcoin.

MicroStrategy is the largest single corporate holder of Bitcoin, with 252,220 coins worth almost $17 billion.

Saylor said in the interview with Reidy that he privately holds at least $1.1 billion worth of Bitcoin.

He also revealed what he plans to do with his Bitcoin stash when he dies.

“Just like Satoshi left a million Bitcoins to the universe, I will leave everything I have to civilisation,” he said, referring to pseudonymous Bitcoin creator Satoshi Nakamoto, who according to lore, deliberately gave up access to the 1.1 million Bitcoin held in his wallets.

What MicroStrategy will eventually do with its Bitcoin, though, is anyone’s guess. Saylor says the plan is for the firm to never sell its Bitcoin and continue issuing bonds to buy even more.

Crypto market movers

- Bitcoin is down 1.4% today and is trading at $66,510.

- Ether fell 2% in the last 24 hours and is at $2,585.

What we are reading

- Ethereum’s Goal for The Verge: Consensus and Execution on a Smart Watch — Unchained

- Nigeria withdraws money laundering charges against jailed Binance exec — DL News

- Who’s Afraid of Gary Gensler? Not Don Wilson, the Trader Who Beat the Regulator Once Before — CoinDesk

- Primary Bridge for Coinbase’s L2 Base Reaches Record Level of ETH Held — Unchained

- These $BTC vs. Gold ETF charts are wrong — Milk Road

- How bizarre AI cults are creating a new billion-dollar crypto memecoin bubble — DL News

Tim Craig is DL News’ Edinburgh-based DeFi Correspondent. Reach out with tips at tim@dlnews.com.