- Digital asset investment products experienced net outflows last week for the first time since October.

- The $16 million in net outflows was likely due to profit-taking, CoinShares said.

Digital asset fund flows posted $16 million in outflows last week, breaking a streak of 11 weeks of inflows.

Trading volume soars

Outflows from digital asset investment funds were driven by profit-taking, rather than a “turn in sentiment,” CoinShares head of research James Butterfill said in a report on Monday.

Trading activity remained elevated, with over $3.5 billion for the week — well above the year-to-date average of $1.6 billion.

Crypto prices climbed higher at the beginning of December, buoyed by hopes that spot Bitcoin exchange-traded funds will win approval in the US.

The majority of outflows came from Bitcoin funds, where $33 million exited funds.

Outflows were offset by altcoins, with products tracking the likes of Solana’s SOL and Cardano’s ADA experiencing large inflows. Solana products saw $10.6 million in inflows last week, while Cardano-linked funds had $3 million in inflows.

Inflows into funds in Canada and Switzerland also helped to offset outflows from US-based funds.

The world’s largest spot Bitcoin ETF, the Purpose Bitcoin ETF, saw its assets under management jump 60% this year. The fund had nearly $1.5 billion in AUM as of Friday, according to CoinGlass data.

The explosion in Canadian ETFs can be used as a proxy for what will follow in the “massive” US market, Eric Balchunas, an ETF analyst at Bloomberg Intelligence, told DL News earlier this month.

Crypto market movers

- Bitcoin fell 1.4% since Sunday to trade around $41,000.

- Ethereum followed Bitcoin lower, dropping 1.8% to below $2,200 down 1.8%.

What we’re reading

- Arbitrum blames hour-long outage on ‘surge in network traffic’ — DL News

- ‘The SEC is busier than Santa’s elves’ as BlackRock, Fidelity meetings fuel Bitcoin ETF hype — DL News

- Bitcoin Fees Surge to Highest Level Since April 2021 — Unchained

- Arbitrum Is Now Up And Running After Partial Outage — Milk Road

- Coinbase To Challenge SEC’s Denial Of Crypto Rules Petition — Milk Road

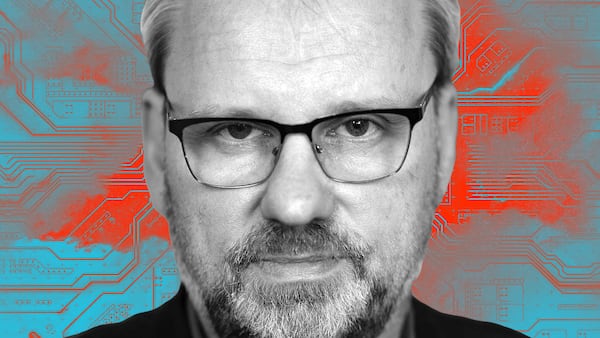

Adam Morgan McCarthy is DL News’ London-based Markets Correspondent. Got a tip? Reach out at adam@dlnews.com.