- The CBECI has been retroactively revised. JPMorgan lowered its production cost outlook based on the changes.

- A JPMorgan analyst told DL News that this is a negative for the price of Bitcoin.

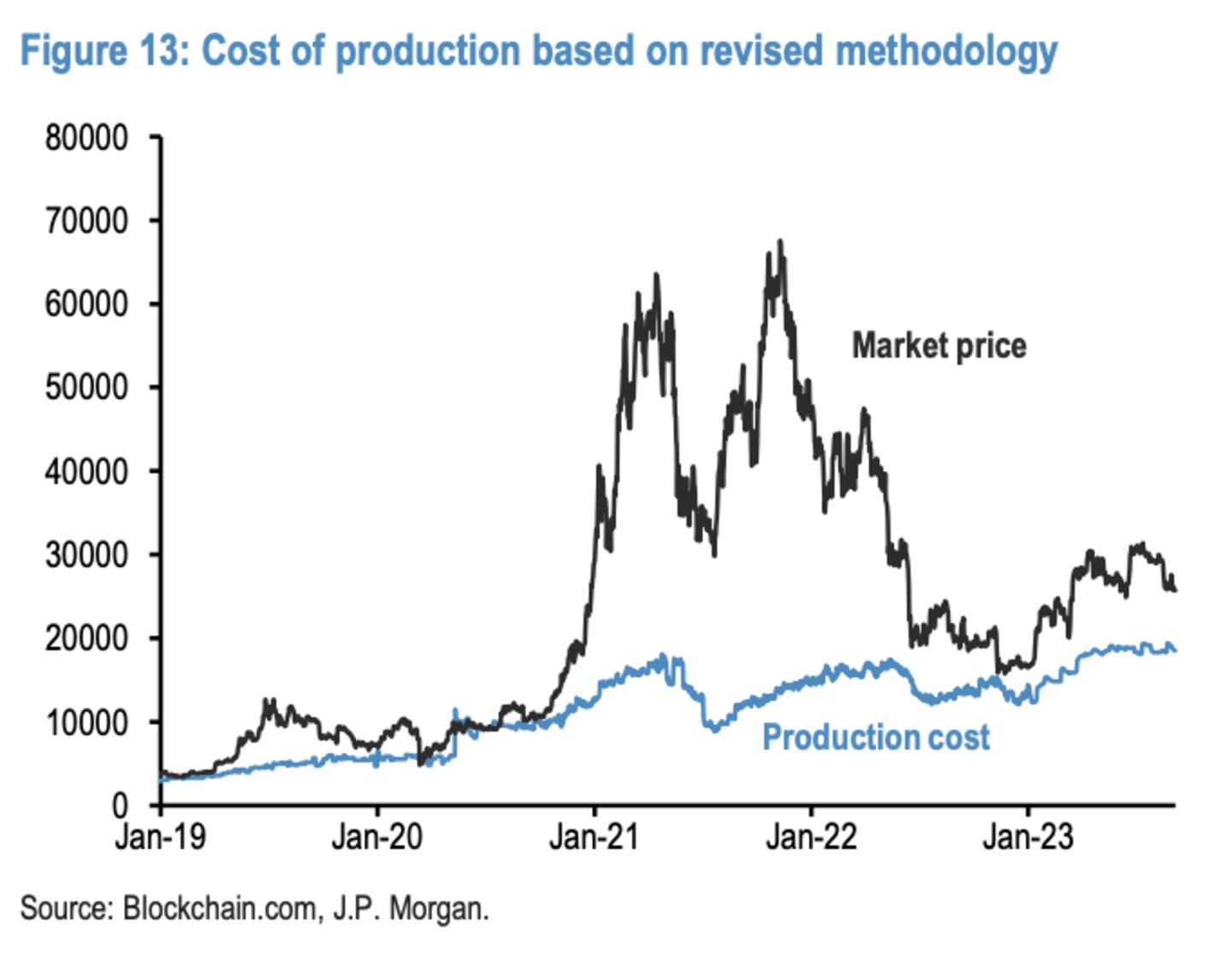

- The production cost typically acts as the lower boundary of Bitcoin’s price range.

Happy Friday!

Bitcoin’s production cost has been revised lower, and it’s not good for the price, a JPMorgan analyst told DL News. The investment bank views the cost as a sort of price floor for Bitcoin.

Let’s dig in, shall we?

Price floor

The production cost for Bitcoin miners has been retroactively revised by the Cambridge Centre for Alternative Finance after a methodology update.

The research institute prepares the Cambridge Bitcoin Electricity Consumption Index (CBECI), which provides a “top-down approach for estimating the electricity consumption for the Bitcoin network,” JPMorgan analysts led by Nikolaos Panigirtzoglou said in a note on Wednesday.

Bitcoin’s current production cost falls to about $18,000 with the institute’s new methodology, versus $21,000, the investment bank said.

“We believe the revision lower of the Bitcoin production cost is negative for Bitcoin,” Panigirtzoglou told DL News in an email.

The investment bank incorporates the CBECI into its model for calculating the Bitcoin production cost — which it says acts as the lower boundary of Bitcoin’s price range. Basically, a price floor, since miners will look to sell at or above this level.

The investment bank’s previous outlook for production cost following the halving is also affected by the revision.

JPMorgan said in June that the production cost would increase to $40,000 after the “halving” next year — when the reward for Bitcoin miners is cut in half. The reward for securing the network will fall to 3.125 Bitcoin from 6.25 Bitcoin.

“In theory, the production cost would double from $18,000 currently to $36,000,” Panigirtzoglou told DL News. The increase may even be significantly smaller, he noted, since the hash rate will likely decline with mining becoming less attractive after the halving.

The hashrate is the total computational power working to process transactions on the Bitcoin network. It may fall by as much as 30% next year as unprofitable miners turn off their mining rigs, according to some experts.

Crypto market movers

- Bitcoin gained 1.6% over the past day, to trade above $26,000 again.

- Ethereum added 0.8% as it traded around $1,650.

- Altcoins were broadly higher across the board. However, Polygon’s MATIC bucked the trend as it moved lower by 1.5%.

What we’re reading

- Can a Vitalik-backed privacy idea stop cyber criminals? One Tornado Cash dev says he’ll test it out — DL News

- It’s not just BlackRock — we ranked the finance world’s most exciting crypto projects — DL News

- Concave Finance $2m payout to investors marred by ‘horrible’ and ‘stupid’ smart contract flaw — DL News

Adam Morgan McCarthy is DL News’ London-based Markets Correspondent. Got a tip? Reach out at adam@dlnews.com.