- Bitcoin ETF trading volume hit $4.6 billion on its first day.

- Wall Street heavyweights are going toe-to-toe to attract investors' capital.

- Next up? An Ethereum ETF, which BlackRock’s Fink says could be a value-add for the Wall Street giant.

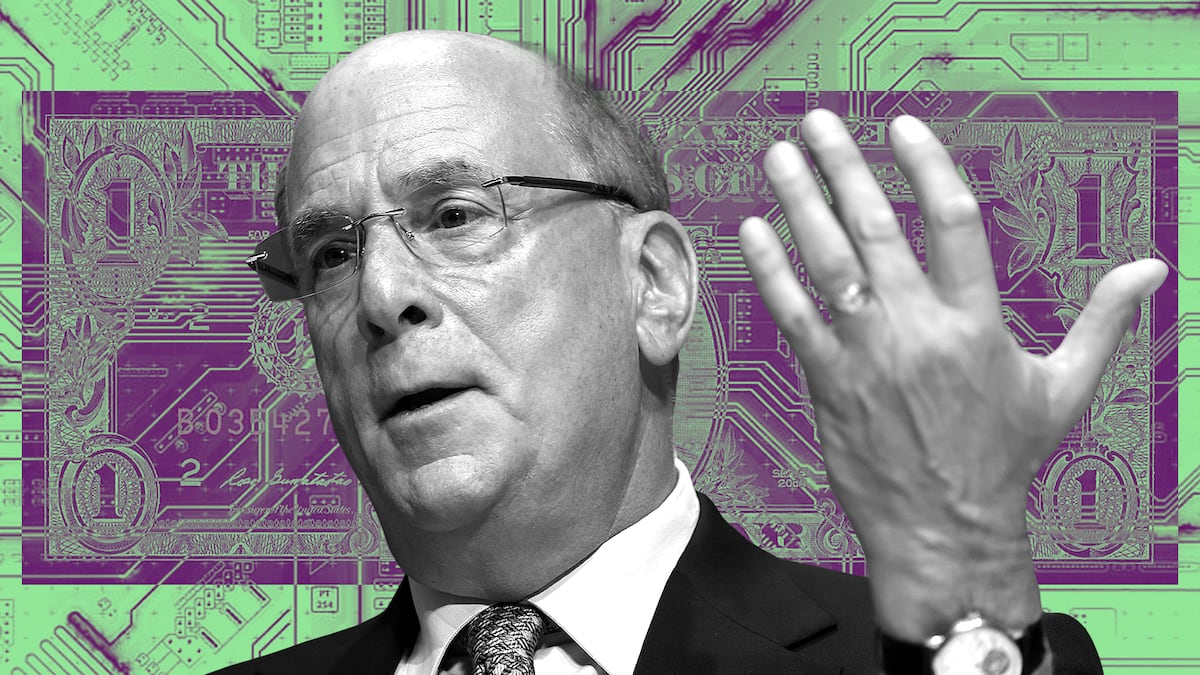

The day after Bitcoin ETFs hit the market, BlackRock CEO Larry Fink says get ready — more is to come, including tokenisation.

The Wall Street giant was one of 11 firms, including Fidelity and Ark Invest, that kicked off a new era for digital assets with the advent of the spot price Bitcoin exchange-traded fund.

Total flows in the Bitcoin ETF — meaning funds entering the market, leaving, or switching products — hit an eye-watering $4.6 billion on day one, according to Bloomberg News.

Many are now casting an eye on the potential advent of Ether ETFs, as market watchers say the rollout of crypto ETFs ploughs the ground for tokenising traditional assets such as stocks and bonds.

“I see value in having an Ethereum ETF,” said during a CNBC interview today. “These are just stepping stones towards tokenisation. I really do believe that this is where we’re going, we have the technology to tokenise today.”

Analysts are hinting that the new offerings may be launched before the end of the second quarter.

Mass influx

The details of those billions of dollars in flows remain fuzzy.

Still, the influx probably stems from investors eager to access Bitcoin as it rallies on the back of a fading bear market and a favourable interest rate environment.

With inflation largely tamed, investors are rotating out of fixed-income instruments such as government bonds and back into stocks, which are poised to benefit from lower interest rates. Bitcoin, as it happens, has also rallied at such moments because it’s become a “risk on” asset.

Then there’s the issue of costs. ETFs have revolutionised investing thanks to their super-cheap fees. By charging investors only 0.12% in fees, iShares’ IBIT was one of the least expensive ETFs on the market.

Tokenise all things

Fink’s been a fan of tokenisation, the process of adding financial assets to a blockchain, for some time.

“The next generation for markets, the next generation for securities, will be the tokenisation of securities,” he said during a DealBook event in 2022.

He joins a gaggle of Wall Street’s finest, too, with Citigroup and HSBC launching tokenised bonds and other pro-blockchain products.

According to MarketsandMarkets research, the niche is expected to balloon to as large as $5.6 billion by 2026.

Analysts point to lower costs and faster settlement times via tokenisation, and Fink went as far as saying today that the technology “eliminates all corruption by having a tokenised system.”

“Just yesterday, the iShares Bitcoin ETF began trading in another landmark moment that advances ETF innovation and expands access to Bitcoin for investors,” Fink said Friday during a fourth-quarter earnings call for BlackRock, which manages more than $10 trillion in assets.

Crypto market movers

- Bitcoin erased almost all of its weekly gains, dropping 6%.

- Ethereum is up in the last 24 hours, trading at just over $2,600 as investors bet on the next ETF play.

- Solana posted today’s biggest losses. It has slipped 6% in the last 24 hours.

What we’re reading

- Sorry, haters. Bitcoin ETFs are Gary Gensler’s legacy now — DL News

- The rise and fall of SocialFi: What Friend.tech’s 90% plunge in revenue shows about a fading model — DL News

- The Cointucky Derby — Milk Road

- BlackRock CEO backs Ethereum ETF day after Bitcoin ETF debut — Milk Road

- Spot Bitcoin ETFs record $4.6 billion first day trading volume — Unchained

Liam Kelly is a Berlin-based DeFi Correspondent. Contact him at liam@dlnews.com or on Telegram at @Liam_Gallas.