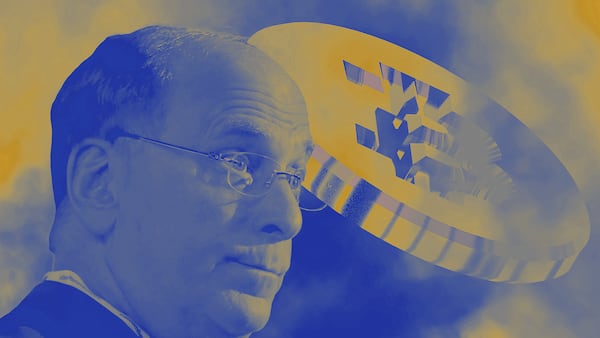

- Jamie Dimon just bashed Bitcoin, again, saying that Congress should ban it.

- But JPMorgan's digital assets unit has quietly tripled its headcount in the last three years.

- The firm also handles $1 billion a day in blockchain transactions.

Jamie Dimon just said he’d love to ban Bitcoin, again: “If I was the government, I’d shut it down,” he told Congress last week.

The JPMorgan boss has a long history of Bitcoin bashing. But behind the scenes, JPMorgan’s blockchain unit, Onyx, now counts 300 employees from only 100 or so three years ago.

An insider, who confirmed the hires, also said the firm handles some $1 billion in daily blockchain transactions.

Dimon is at least consistent.

“He hates Bitcoin. But he loves enterprise blockchain. He’s even intrigued by DeFi,” crypto and macroeconomics expert Noelle Acheson told DL News.

The billionaire called Bitcoin a terrible store of value in 2014, and said in 2017 that he’d immediately fire any JPMorgan trader caught trading Bitcoin.

“It’s difficult for many people with a certain mindset who run the financial system to understand that while Bitcoin is an asset, it’s also a technology,” Acheson said.

The size of JPMorgan’s blockchain unit puts the firm in the same ballpark as that of financial giants that have openly embraced crypto, like Fidelity or BNY Mellon.

However, all of JPMorgan’s transactions involve JPM Coin — the company’s own stablecoin, which it offers to institutional clients.

JPM Coin is different from other cryptocurrencies in that it runs on a private blockchain and is subject to standard industry controls and compliance measures.

The company does not trade crypto, and does not provide crypto custody services. It does, however, provide client clearing for Bitcoin and Ethereum futures and options listed on the CME.

It also holds an investment in Consensys, the company behind Ethereum’s MetaMask wallet.

Blockchain not Bitcoin

“Reasonable people could disagree on what the value of Bitcoin could be,” Umar Farooq, the head of Onyx, told Financial News in 2022. “That doesn’t mean that we fundamentally either discount the underlying tech.”

“Jamie has made that point. He has been a big believer that things like blockchain technology can be big disruptors. We can’t afford not to be at the forefront of that revolution.”

Acheson pointed out that JPMorgan doesn’t have any Bitcoin projects in the works — only enterprise, or private, blockchain projects.

Enterprise blockchains generally aim to streamline business transactions between companies.

Dimon has often said in public that he’s very excited about them, Acheson noted.

Private equity firm Apollo revealed in November that it plans, in conjunction with JPMorgan, to launch the mainnet of an enterprise blockchain which will offer tokenised treasuries, stablecoins, and eventually tokenised money-market funds.

“Crypto and blockchain are very, very intertwined in our minds,” said Acheson. “But operationally, they’re very different. Saying ‘I don’t like crypto assets’ is like saying, ‘I don’t like books.’ There’s such a wide variety.”

Crypto market movers

- Bitcoin fell 1.5% in the past 24 hours to trade around $41,120. The crypto market contracted ahead of the Fed’s last meeting of the year later on Wednesday.

- Ethereum dropped below $2,200 as it lost 2.3% since Tuesday.

What we’re reading

- Charlie Munger’s disgust for crypto was political. But I’m keeping an open mind — DL News

- SBF’s Lawyer Says Client Was ‘Worst’ Witness He Has Ever Seen — Bloomberg

- KuCoin Settles With New York, Agrees To Pay $22 Million And Exit — Milk Road

- El Salvador’s $1bn volcano-powered Bitcoin bonds greenlit for launch in early 2024 — DL News

- To See Where Web3 Gaming Is Headed, Look to the Philippines — Unchained

- Best NFT Tax Loss Harvesting Tools 2023 — Milk Road

Got a tip about Jamie Dimon, JPMorgan, or enterprise blockchains? Contact Joanna Wright and Tom Carreras at joanna@dlnews.com and tcarreras@dlnews.com