- Bitcoin spot ETFs are creating new market inefficiencies.

- Crypto native traders can therefore take advantage of new arbitrage opportunities.

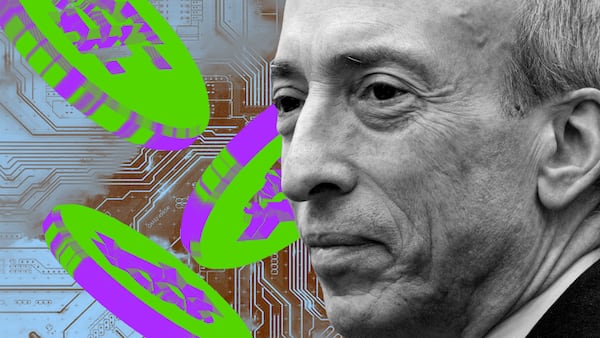

- BitMEX co-founder Arthur Hayes explained a few of them in his latest blog post.

The launch of Bitcoin exchange-traded funds in the US is giving professional traders new arbitrage opportunities, according to BitMEX co-founder Arthur Hayes.

No Binance? No problem

BlackRock’s Bitcoin ETF is good news for sophisticated traders, Hayes wrote in a recent blog.

“For the first time in a long time, the Bitcoin markets will have a predictable and long-lasting arbitrage opportunity,” he said.

Hayes pointed out that the ETF’s net asset value — or NAV — is determined each day by a CF Benchmarks index price of Bitcoin at 4pm Eastern US time.

The index receives prices from six approved exchanges: Coinbase, Kraken, Gemini, iBit, LMAX Digital, and Bitstamp.

ETF managers in the US will only be able to trade Bitcoin on these exchanges, Hayes said.

But Binance, with its roughly $4 billion in daily Bitcoin spot trading volume, remains the most liquid crypto exchange and a primary driver of price discovery.

Yet, Binance is excluded from the index.

In other words, fund managers won’t be able to trade Bitcoin at the best available price — only the price quoted on those six exchanges.

“This unnatural state of play only serves to create more market inefficiencies from which we, as arbitrageurs, can profit,” said Hayes.

Arbitrage galore

Hayes offered a simple arbitrage scenario.

Traders can bet whether fund managers will seek to create or redeem new ETF shares based on whether the ETF trades higher or lower than its intraday net asset value, Hayes said.

If it trades higher, they’ll need to create more shares, adding supply to the market and lowering the price. If it trades lower, then managers will redeem shares, lifting shares from the market and reducing supply.

And because of the regulatory limitations imposed on them, ETF managers are forced to use CF Benchmark exchanges, pushing prices up or down on these venues depending on whether they’re buying or selling Bitcoin.

The trade: Traders can simply choose the least liquid exchange on the CF Benchmarks index and compare the price of Bitcoin on the platform against the price of Bitcoin on Binance.

Then, they can buy Bitcoin on the cheapest exchange of the two and sell it on the more expensive one.

Put another way, traders can now frontrun the funds creating or redeeming ETF shares by keeping track of Bitcoin prices on CF Benchmark exchanges.

“Hopefully, billions of dollars of flow will be concentrated in an hour-long period on exchanges that are less-liquid and price followers of their larger Eastern competitors,” Hayes said.

Hayes also predicted that listed options will soon appear on US options exchanges, using ETF shares as the underlying asset.

Not only will options give traders a liquid way to place leveraged bets on Bitcoin, they will also open up new ETF-specific strategies, such as forward arbitrage — arbitrage between Bitcoin perpetuals on centralised exchanges and options on US options exchanges.

The New York Stock Exchange filed on Tuesday to list options on spot Bitcoin ETFs.

“Options will likely be a big hit on these given the volatility,” according to Bloomberg Intelligence ETF analyst Eric Balchunas.

“For these trading opportunities to last a long time and allow arbitrageurs to execute them in sufficient size, the Bitcoin spot ETF complex must trade billions of dollars-worth of shares each day,” warned Hayes.

Crypto market movers

- Bitcoin is down 0.79% on the day, trading at just above $42,780.

- Ethereum fell 1.49% on the day, trading at just over $2,540.

What we’re reading

- Europe’s more than 200% gain in crypto trade volumes shows MiCA laws are luring investors — DL News

- Tether Pushes Back On UN Crypto Crime Report, Calls For Blockchain Education — Milk Road

- Coinbase at the Center of Bitcoin ETF Draws Envy and Risks — Bloomberg

- How Small Bitcoin ETF Issuers Will Compete With the Likes of BlackRock — Unchained

- Cantor Fitzgerald CEO lauds Tether after UN spotlights stablecoin use in crypto crime — DL News

- OKX Subsidiary Secures VASP License In Dubai — Milk Road

- How Gold Mining Stocks Changed Post-Gold ETF W/ Amanda Fabiano — The Mining Pod

- Coinbase lashes out against regulator’s bid to ‘grab jurisdiction’ over crypto — and it’s not the SEC — DL News

Update: This story was corrected to reflect that CF Benchmarks is the name of the indices provider, not the index itself.

Tom Carreras is a markets correspondent at DL News. Got a tip about Bitcoin ETFs or trading strategies? Reach out at tcarreras@dlnews.com.