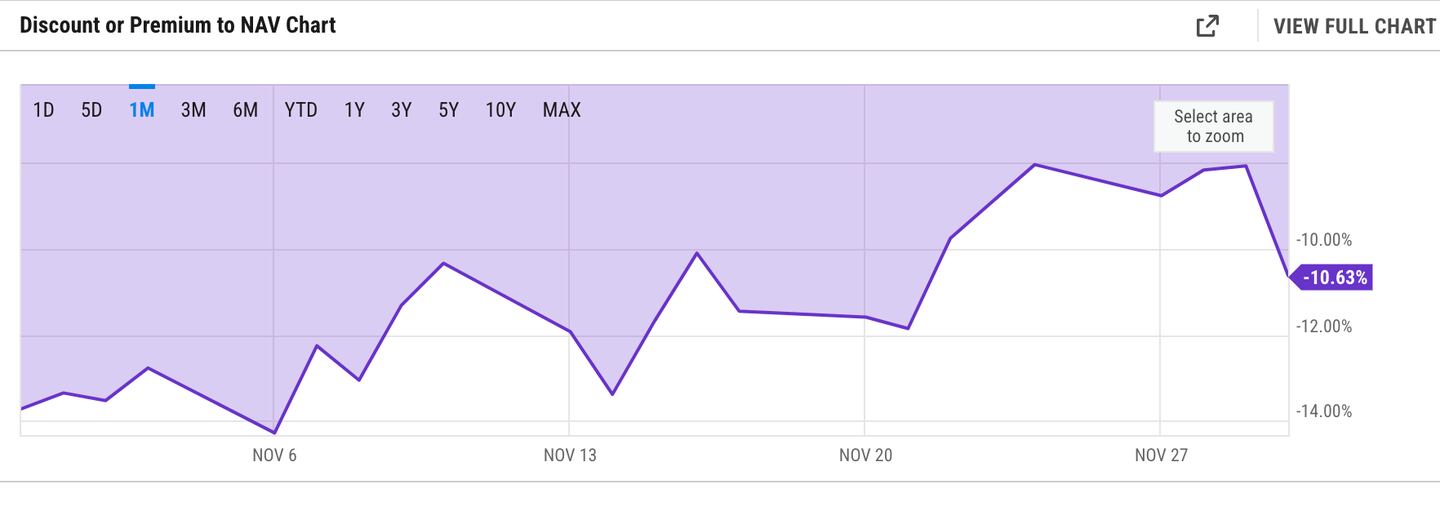

- Grayscale’s GBTC is trading at a discount of almost 11% after it shortened to 8%.

- The move comes after collapsed crypto exchange FTX was approved to sell more than $870 million GBTC shares.

The Grayscale Bitcoin Trust saw its discount to net asset value widen at the end of November after reaching its lowest point in two years.

Here’s what that means.

Discount bets

Expectations of a spot Bitcoin exchange-traded fund have driven traders to make speculative bets on GBTC throughout 2023, which has caused the trust’s discount to narrow from about 45% to 8% this week.

Grayscale’s flagship product tracks the price of the Bitcoin it holds, but doesn’t currently offer users the option to redeem shares. As a result, there is a disparity — or a discount — between its share price and the spot price of Bitcoin.

The discount has narrowed throughout the year as spot Bitcoin ETF approval became more likely. It can be seen as an indicator of how probable it is that a spot Bitcoin ETF will be approved, Coinbase’s head of institutional research, David Duong, said in September.

Based on this, the market is pricing in a 90% probability of approval, in line with the views of Bloomberg Intelligence analysts Eric Balchunas and James Seyffart.

Last Friday, the estate of collapsed crypto exchange FTX was approved to begin selling its $870 million-plus worth of GBTC shares.

The dislocation between its share price and the value of the share holdings can be seen as a supply and demand issue — there is an oversupply of shares because investors cannot redeem, or destroy, old shares directly for the equivalent value of the Bitcoin the shares represent.

So, the trust’s discount won’t narrow to zero until there is sufficient demand or a redemption mechanism. If the trust is approved to convert to a spot Bitcoin ETF it will be open for redemptions and in theory the discount will narrow to zero.

JPMorgan analysts estimated that GBTC could see as much as $3 billion in outflows on the approval of a spot Bitcoin ETF. That could put “severe downward pressure on Bitcoin prices,” they said.

Crypto market movers

- Bitcoin traded above $38,000, at its highest point of the year, up 2% over the past day.

- Ethereum added 2% to trade around $2,100.

What we’re reading

- Philippines to block Binance for failing to get licenced and rein in ‘influencers and enablers’ — DL News

- Blast’s biggest investor says new layer 2 ‘sets a bad precedent’ — DL News

- Crypto Hacks Soar In November, Resulting In $343,000,000 Stolen — Milk Road

- Miami Crew Leader Receives 63-Month Prison Sentence For $4M Crypto Fraud — Milk Road

Adam Morgan McCarthy is DL News’ London-based Markets Correspondent. Got a tip? Reach out at adam@dlnews.com.