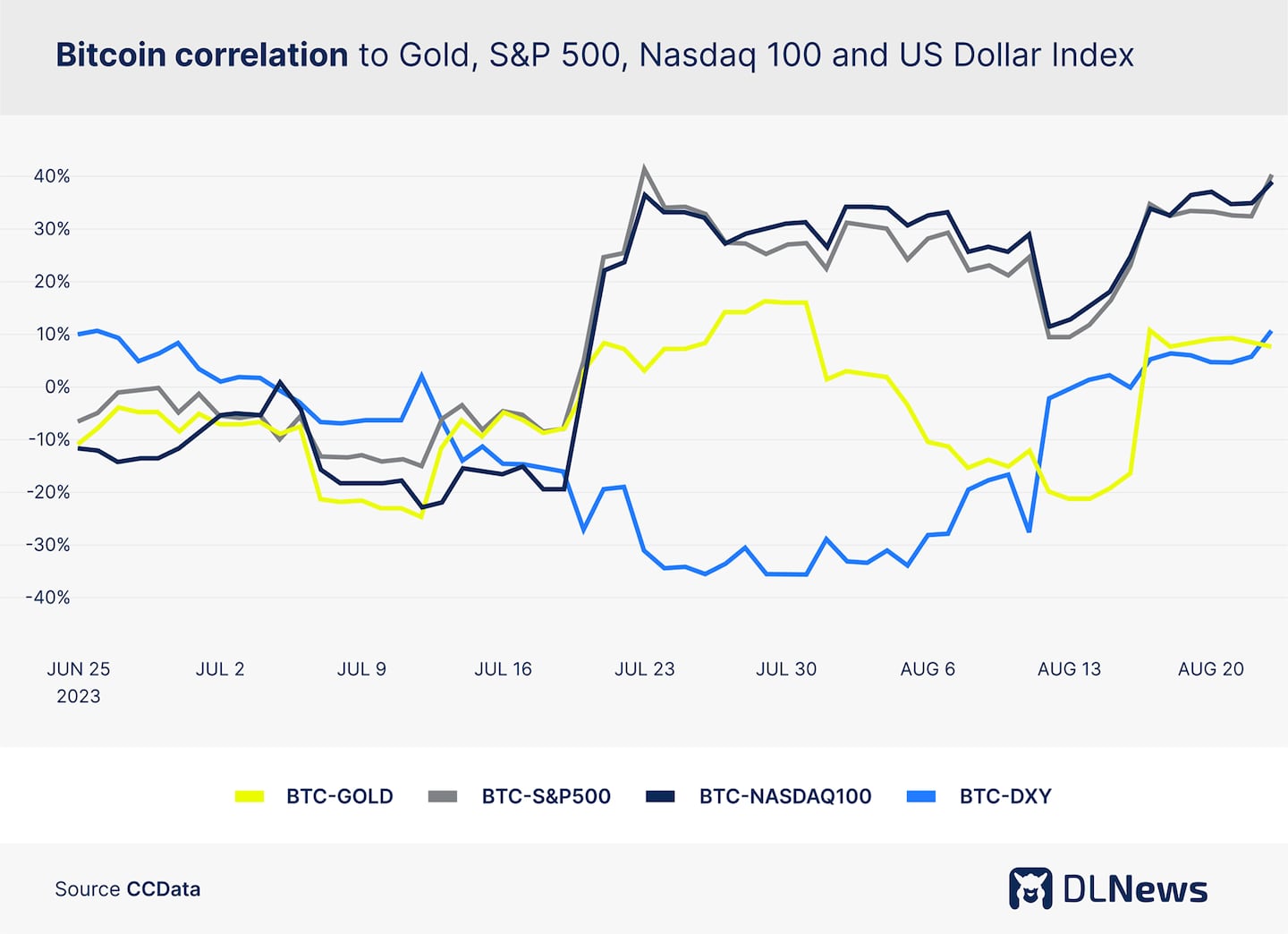

- After falling earlier in the summer, Bitcoin’s correlation to the S&P 500 intensified in August.

- Digital assets moved lower in line with equities over the past few days as market participants reassessed interest rate outlooks.

Happy Wednesday!

Bitcoin continues to trade either side of $26,000, Ethereum dipped lower overnight while some altcoins experienced a modest recovery. Digital asset’s correlation to equity indexes has jumped throughout August, according to CCData.

Let’s get into it.

Crypto correlations

Bitcoin’s correlation to stock indexes is on the rise again.

Correlation is simply a measure of the degree to which two variables move in relation to each other. In this case, we’re looking at Bitcoin, the S&P 500, and the Nasdaq’s daily price moves. A correlation of 1, or 100%, implies a perfect positive relationship. In other words, when one asset moves higher or lower so does the second.

Bitcoin’s correlation to the S&P 500 is 40% at present, up from a negative correlation in July. The increased correlation comes as interest rate expectations are being reassessed and economic conditions worsen in China.

“Over the past few weeks, there has been a noticeable increase in correlation between traditional financial assets and digital assets, marking a shift from a period of decoupling,” CCData’s Hosam Mahmoud told DL News.

The trend suggests that both markets are now exhibiting more similar performance behaviours, especially in the aftermath of the recent setbacks that the digital asset industry has faced, Mahmoud concluded.

Crypto market movers

- Bitcoin was below $26,000 shortly after mid-day London time on Wednesday. Down 0.4% over the past 24 hours.

- Ethereum slid 1.3% to $1,640 in the same period of time.

- Some altcoins bucked the downward trend in the two leading assets by market capitalisation. Binance-affiliated BNB was up 2.6%. Polygon’s MATIC added 2.1% and Tron’s TRX was up 2%.

What we’re reading

- Why Croatia is the latest European Union state to craft crypto rules ahead of landmark MiCA law – DL News.

- Meta adds crypto scams to the list of reasons people are threatening it with legal action – DL News

Adam Morgan McCarthy is a London-based markets correspondent for DL News. To contact him with story tips, reach out at adam@dlnews.com.