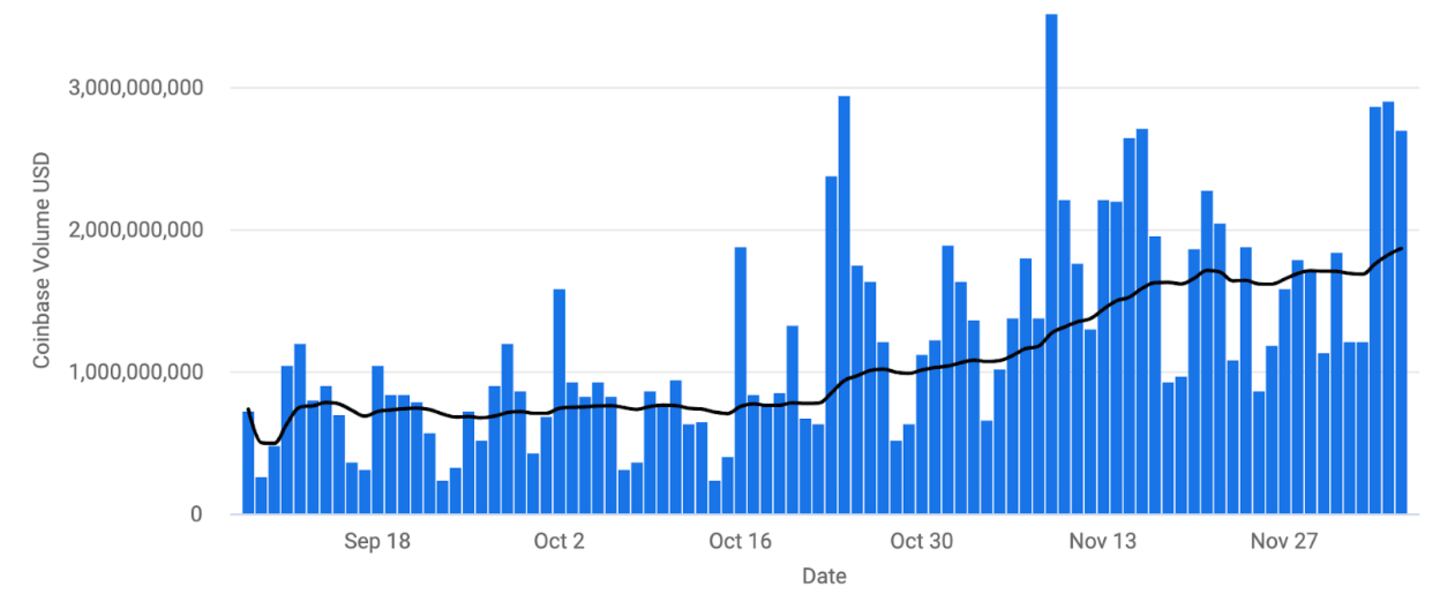

- The positive sentiment in crypto market has lifted trading volumes on exchanges.

- Daily exchange volumes have reached their highest level since March.

Trading volumes on crypto exchanges picked up in November, and could be on track to rise again. Coinbase said improving macroeconomic conditions and Bitcoin exchange-traded fund hype are key drivers for the move.

Let’s dig in!

Bullish volumes

Broader interest in crypto appears to be growing as volumes on Coinbase doubled in the past few weeks.

“The new money coming into the space seems to favour Bitcoin,” Coinbase Institutional said in a report on Friday.

The inflows are “helping to prolong its relative outperformance,” according to David Duong, head of institutional research at Coinbase.

Most of the crypto native investors and funds are focused on finding “high quality and higher beta names that could offer them an opportunity to outperform if the current uptrend continues.”

Higher beta means the asset is potentially more volatile than the broader market.

Flows show traders are positioning for the bullish mood to continue, Coinbase said.

Deribit data for Bitcoin contracts expiring on January 26 shows traders are betting on it trading above $50,000.

“Interestingly, a lot of the recent crypto appetite seems to be coming from institutional investors,” Coinbase said.

Bitcoin futures open interest on the CME reached a record high last week above $4.7 billion.

Daily exchange volume, using seven-day moving average across exchanges, is around $40 billion — its highest level since March, according to data from The Block Research.

Volumes on centralised crypto exchanges increased by 60% to $826 billion in November, and December volumes have reached $340 billion to date.

Crypto prices fell at the start of the week. Major macroeconomic events in the coming days could drive prices this week higher or lower.

Hotter than expected US jobs data on Friday dampened sentiment but rate cuts are still widely anticipated in 2024.

US Inflation data is set for release on Tuesday before the Federal Reserve announces its next interest rate decision on Wednesday.

The Fed is widely expected to keep the interest rate unchanged. On Monday, Goldman Sachs said it projects two cuts next year, beginning in the third quarter.

The CME’s FedWatch tool is pricing in a 36% probability of a cut at the Fed’s first quarter meeting on March 24.

Crypto market movers

- Bitcoin fell 3.6% to trade around $42,200.

- Ethereum traded down 4.6% to $2,240.

What we’re reading

- El Salvador offers citizenship to those with $1m Bitcoin or Tether as its own Bitcoin bet pays off — DL News

- From Al Capone to SBF: Searching for the obscure origins of ‘money laundering’ — DL News

- Jito airdrop FOMO sparks $200m Solana stampede — DL News

- Goldman Sachs projects two Fed rate cuts next year with first in Q3 — Reuters

- Senator Elizabeth Warren Calls Crypto A Threat — Milk Road

- SEC Gets Extension To Respond To DEBT Box False Statements — Milk Road

Adam Morgan McCarthy is DL News’ London-based Markets Correspondent. Got a tip? Reach out at adam@dlnews.com.