Happy Saturday!

Coinbase will appeal a denial by the US Securities and Exchange Commission of its petition asking for new regulations for the digital-asset industry, a Hong Kong company launches an NFT marketplace, and Blockchain.com will increase its workforce amid expansion plans. Read on!

Coinbase to appeal SEC rules rejection

Coinbase said it will appeal the SEC’s denial of its petition seeking new rules designed specifically for the digital-assets industry.

The crypto exchange had argued in its petition that current regulations are unworkable for the crypto industry, but the commission disagreed by a 3-2 vote. “Existing laws and regulations apply to the crypto securities markets,” SEC Chair Gary Gensler said in a statement.

Paul Grewal, Coinbase chief legal officer, then said in a post on X: “We are now on file with Third Circuit to challenge the SEC’s arbitrary and capricious denial of our petition for crypto rulemaking.”

The SEC this year has filed a series of lawsuits against crypto exchanges, including Coinbase, all hinging on the assumption that tokens are securities, and therefore the agency has free rein to regulate the industry, DL News reported earlier.

Hong Kong company launches NFT marketplace

China Mobile Hong Kong is launching an NFT marketplace, LinkNFT, building on the metaverse digital space of its smart living mobile application, MyLink, which recently surpassed seven million users.

Users will have the opportunity to transform their Meta IDs into NFTs, creating unique identities enabling them to purchase, interact with friends, and even gift NFTs.

Ex-Credit Suisse exec launches crypto startup

Former Credit Suisse executive David Riegelnig has launched a crypto trading startup called Rulematch, aimed at servicing a clientele of banks and securities firms, Bloomberg reported. Riegelnig was head of operational risk in private banking for Credit Suisse when he left in 2015.

The Zurich-based firm is trading Bitcoin and Ether in most of the EU, the UK, and Singapore. Rulematch has raised $14 million from backers including ConsenSys Mesh, Flow Traders, and FiveT Fintech, the report said.

UK MPs said lacking crypto knowledge

Trade association CryptoUK said only about 5% of UK Parliament members have spoken publicly on crypto, suggesting a lack of knowledge, Cointelegraph reported.

“It’s important that MPs from all parties and from all corners of the UK get to know the crypto-asset industry better,” a CryptoUK spokesperson said. “Almost five million people ... in the UK have some sort of crypto-asset exposure, while tens of thousands of people work in the industry in the UK, supporting their local economies and helping the British economy grow.”

Blockchain.com to increase workforce, expand

Blockchain.com plans to increase its employee headcount by 25% in Q1 2024 as it expands into markets including Nigeria and Turkey, Bloomberg reported.

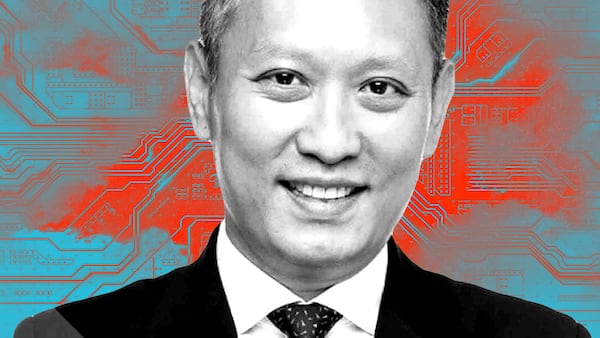

The crypto exchange also hired Curtis Ting, former head of global operations at Kraken, to establish a hub in Paris and local EU branches that will be needed under new regulations, the report said.

What we’re reading around the web

How El Salvador’s Bitcoin bet is paying off — DL News

Gemini Earn creditors face potential 70% cut in crypto payouts — Crypto.Com

‘The SEC is busier than Santa’s elves’ as BlackRock, Fidelity meetings fuel Bitcoin ETF hype — DL News