- Bitcoin’s hashrate is so high, it’s preventing miners from turning in a profit.

- The halving is likely to prove fatal to a number of independent mining outfits.

- While pressure on mining revenue is unlikely to impact Bitcoin on the day-to-day, it may lead to the liquidation of large holdings.

Bitcoin mining operations are in for a tough year, says a Coinbase analyst.

The problem is that Bitcoin’s so-called hashrate — the amount of computing power used per second — has risen at the same time as the cryptocurrency’s price.

That means that miner revenues have barely moved even as ETF euphoria has sent Bitcoin soaring.

And the looming “halving” this year will only make things worse.

Soaring hashrate

A Coinbase report this week warned of a scenario where Bitcoin miners could find themselves forced to sell their current, sizable Bitcoin reserves to finance their operations — as Core Scientific did throughout 2022 before declaring bankruptcy.

The problem is multi-faceted.

Not only will the upcoming “halving” slash Bitcoin mining revenue in half, but miners barely benefited from Bitcoin’s 181% surge in 2023.

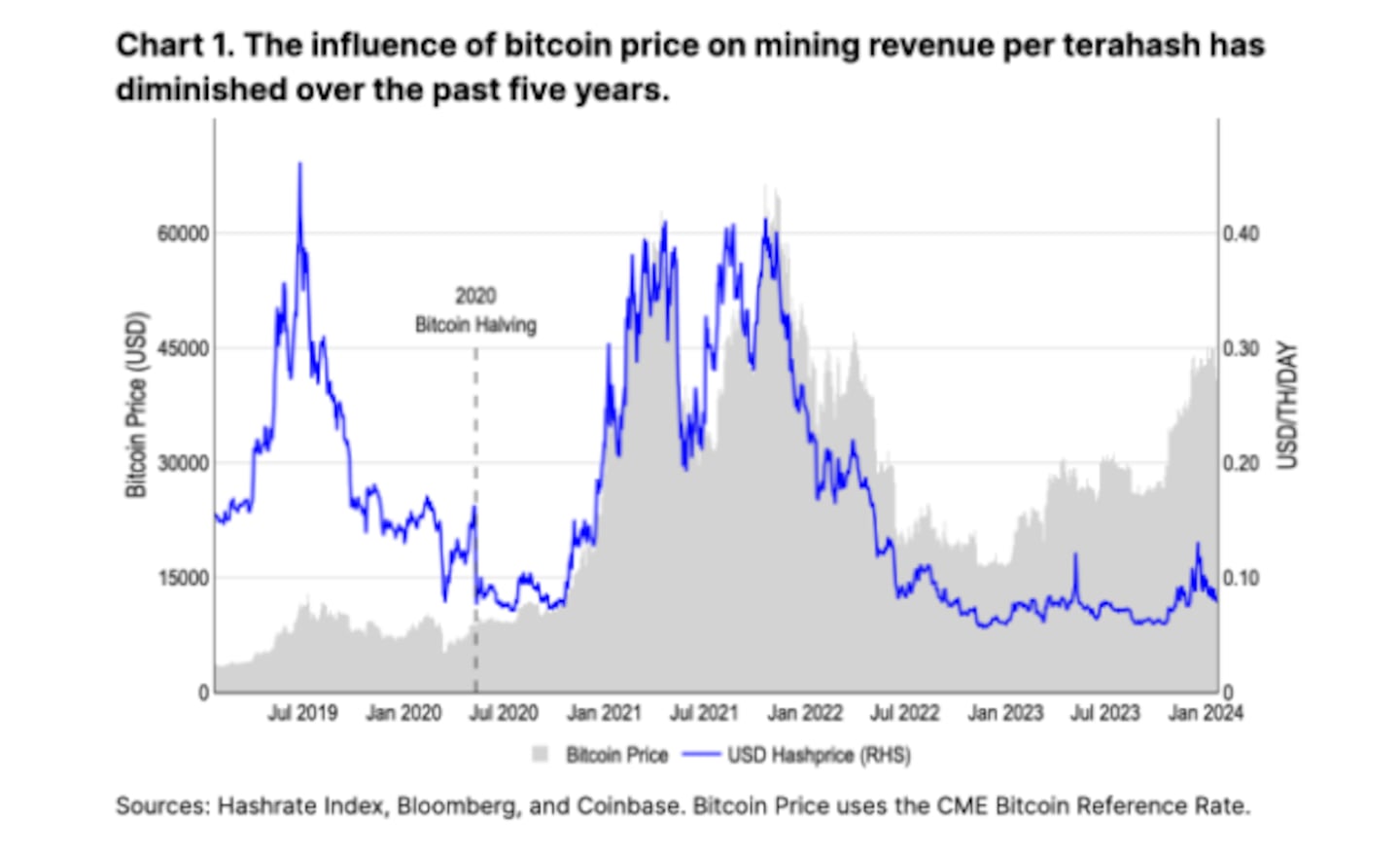

While miners received increasingly valuable Bitcoin rewards, they also faced rising operational costs due to the network’s soaring hashrate — which reached a record 563 exahashes per second on January 28.

“The increasing hashrate has likely absorbed most of the upside from higher Bitcoin prices,” Coinbase analyst David Han said.

“Most increases in individual miner revenues have been driven primarily via the acquisition of more mining rigs.”

Bitcoin miners are rewarded with Bitcoins and transaction fees every time they add a new block to Bitcoin’s blockchain.

It isn’t easy — they need to spend enormous amounts of computational power to solve the puzzle that unlocks the next block.

That computational power is called hashrate. Miners compete to increase their hashrate in order to have higher chances of creating new blocks and boost revenue.

Miner revenue has historically swelled during Bitcoin rallies, as mining operations earn higher rewards against lagging computational costs.

However, since early 2023 the network’s hashrate has kept pace with Bitcoin’s price.

Coinbase warned that computational costs following Bitcoin’s price so closely only left a little room for continued hashrate growth, especially after the halving.

This could eventually pose security concerns to Bitcoin.

Halving

The Bitcoin halving, expected in April, will slash Bitcoin mining rewards by half — potentially depriving miners of as much as 50% of their total revenue.

The event will likely prove fatal to some mining outfits, Coinbase warned.

“Without significant bitcoin price appreciation, the revenue per unit of hash power could drop to all time lows following the halving in April 2024,” the report said.

As miner profits narrow, they will need to sell a higher percentage of their Bitcoin rewards in order to keep afloat.

This will likely not have an impact on the market, said Coinbase, since the Bitcoin rewards will be slashed by half, cancelling the sell pressure.

However, distressed companies may have to liquidate their sizable Bitcoin reserves in an attempt to finance future operations.

Core Scientific, once the biggest publicly-traded Bitcoin mining company, suffered that fate in 2022, when it sold almost 8,500 Bitcoins over the course of the year before declaring bankruptcy.

“The next halving will weaken the viability of independent, non-institutional miners from retaining profitability, which could further contribute to consolidation both at the miner and the mining pool levels,” Coinbase said.

“Institutional miners likely are better positioned to acquire distressed mining assets at a discount, have improved operational efficiency due to economies of scale, and have access to cheaper energy sources,” the report added.

Crypto market movers

- Bitcoin fell 0.6% over the last 24 hours, falling to $42,744.

- Ethereum is down 0.4% in the same period, at $2,298.

What we’re reading

- Solana stablecoin volume just hit a record $144bn. Or did it? — DL News

- Vitalik Buterin Reflects On Evolution Of Crypto And His Changing Role — Milk Road

- Coinbase and Its CEO Prep ‘War Chest’ for Pro-Crypto Politicians — Bloomberg

- A16z Crypto’s Chris Dixon on How Blockchains Can Save the Internet — Unchained

- FTX Expects Full Repayment To Customers, Scraps Relaunch Plans — Milk Road

- Bettors put millions on Michelle Obama winning presidential election — DL News

Tom Carreras is a markets correspondent at DL News. Got a tip? Reach out at tcarreras@dlnews.com