- Macroeconomic headwinds loom for Bitcoin ahead of the Federal Reserve’s next policy decision on Wednesday.

- The prospect of higher-for-longer interest rates could lead to more volatility.

- Bitcoin ETF inflows have fallen in recent days and could be put to the test in the coming weeks.

Traders will be fixed on the US Federal Reserve’s policy announcement later today as policymakers get ready to give their outlook on interest rates.

The potential for fewer interest rate cuts in 2024 than many have expected has weighed on crypto prices. Volatility is likely here to stay as the US economy threads the needle between growth and lowering inflation.

Dot plot

Members of the central bank’s policy-setting group will update their projections on interest rates Wednesday evening, in what is known as the “dot plot.”

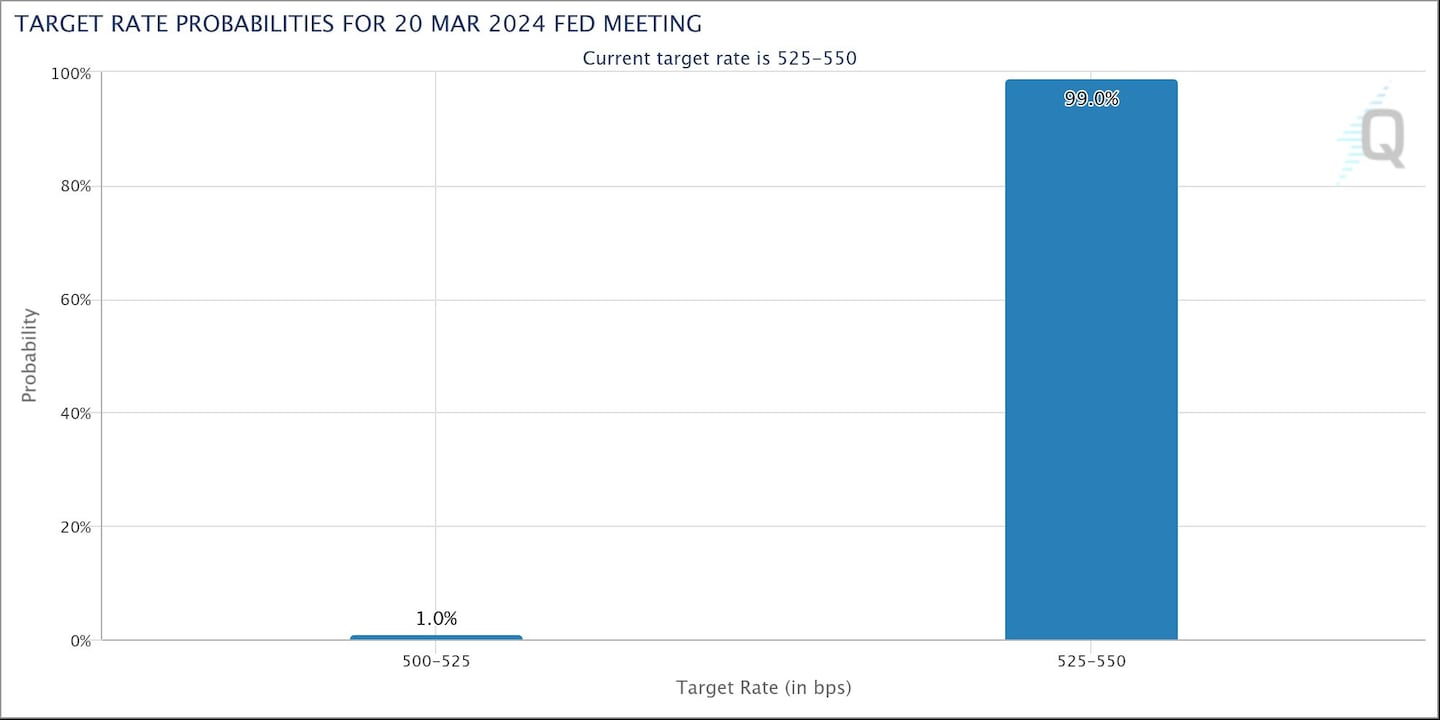

The Federal Open Market Committee, which sets the fed-funds rate, is widely expected to keep the interest rate unchanged in the 5.25% to 5.5% range.

Lower interest rates are typically favourable for risky assets like Bitcoin

The potential for rates to stay higher for longer is “one of the things weighing on crypto assets,” Noelle Acheson, author of the “Crypto is Macro Now” newsletter, said on Monday.

The dot plot tracks each FOMC member’s projections for interest rates and is updated quarterly. In December, the most popular forecasts showed three cuts in 2024.

Now members are expected to project that interest rates will stay higher for longer.

That’s bad news for Bitcoin.

The biggest factor affecting price movement is the macroeconomic environment, Kelly Ye, head of research at investment firm Decentral Park Capital, said in a report on Monday.

Ye expects more “volatility in the broad risk market as the economy is dancing the delicate balance between growth vs. inflation.”

Whether spot exchange-traded fund inflows can meet heightened expectations as the price of Bitcoin falls will also affect markets in the coming weeks, according to Ye.

Spot Bitcoin ETFs had consecutive net outflows on Monday and Tuesday.

Grayscale Investments’ increased outflows and “lower demand for the new ETFs in the US,” contributed to the two days of outflows, James Butterfill, head of research at digital asset manager CoinShares, said on LinkedIn.

Just over $1 billion has exited Grayscale’s GBTC so far this week as investors weigh the fund’s relatively higher fees compared with peers. CEO Michael Sonnenshein said the asset manager will consider lowering fees as the market matures.

Crypto market movers

- Bitcoin fell to $63,500, down 0.7% over the past 24 hours.

- Ethereum declined 0.1% since Tuesday to around $3,300.

What we’re reading

- Why some in crypto don’t want Ethereum ETFs to win approval – yet — DL News

- Do Kwon to be extradited to South Korea for $60bn Terra Luna collapse after Montenegro court rejects appeal — DL News

- SBF’s Lawyers Respond to ‘Disturbing’ 50-Year Sentencing Recommendation That Cast Him As ‘Depraved Super-Villain’ — Unchained

- Robinhood Wallet Expands To Android Users Globally — Milk Road

- Ethereum Foundation Faces Investigation From State Authority — Milk Road

Adam Morgan McCarthy is a market correspondent at DL News. Got a tip? Email him at adam@dlnews.com.