- Bitcoin’s price has risen in the past five days after an earlier January slump.

- Grayscale outflows are showing signs of slowing down, predicted by some analysts to lessen the pressure from Bitcoin selling.

Bitcoin is bouncing back from a price slump this month, as the biggest driving force behind the cryptocurrency’s price decline — outflows from Grayscale’s Bitcoin Trust — is decelerating.

Bitcoin recovers

After falling about 20% from its $49,000 high earlier in January, Bitcoin has climbed 10% over the past five days.

Since January 25, the world’s leading cryptocurrency has increased from $39,900 to about $43,400.

The recent slump has been linked to shifting market dynamics following the approval of 11 US spot Bitcoin exchange-traded funds.

Grayscale’s GBTC is the largest of the approved offerings, with $20.8 billion in assets under management.

Analysts say factors including forced selling linked to the FTX estate and profitable investor strategies linked to GBTC’s discount over the past two years have been big drivers of outflows.

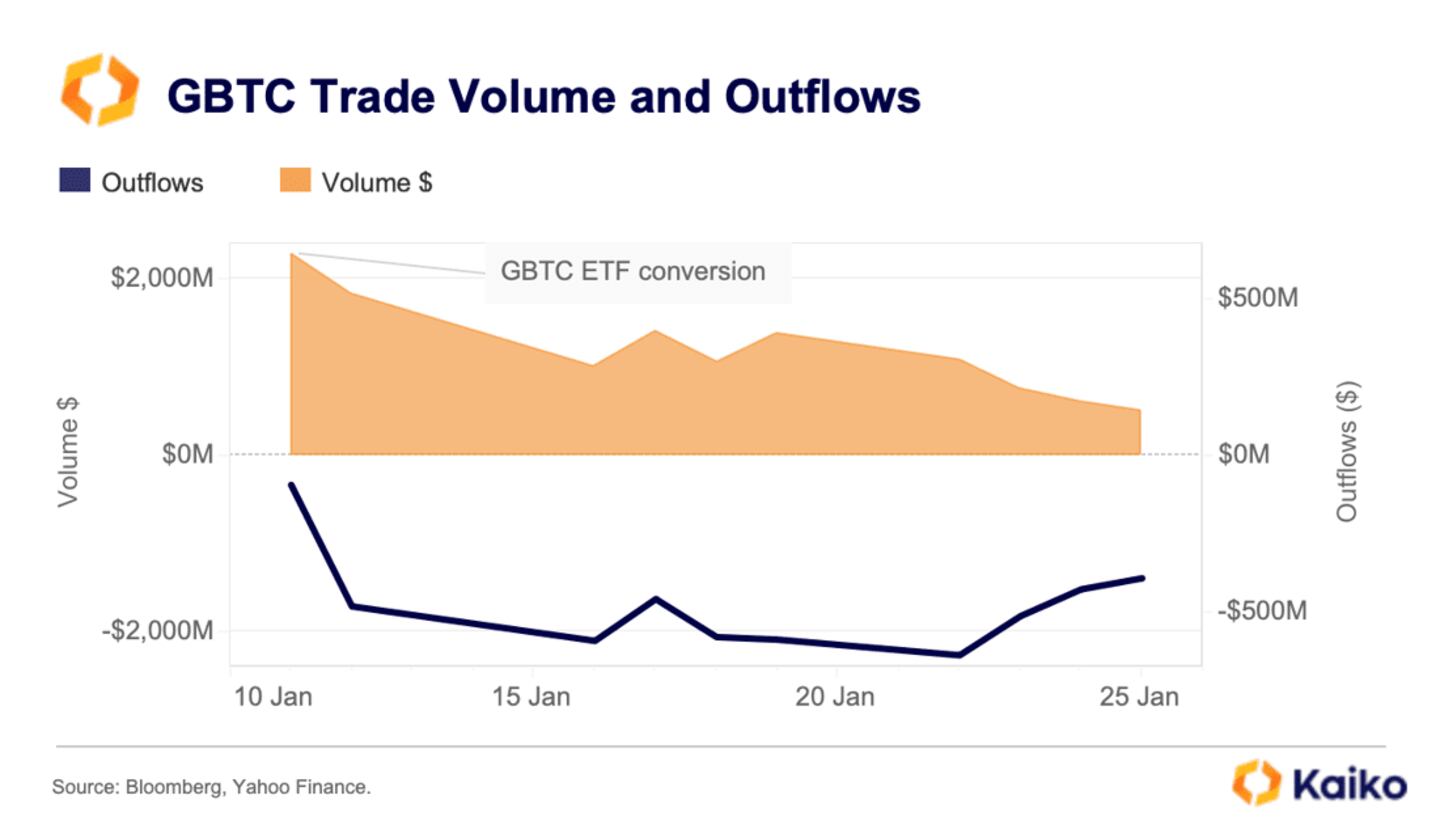

Those outflows — combined with overall bearish macroeconomic outlooks — have hit Bitcoin’s price. Grayscale’s ETF has seen about $5 billion in outflows since its launch on January 11.

On January 23, they peaked at $640 million a day.

Now, Grayscale is averaging nearly $500 million daily, according to crypto analytics firm Kaiko. That’s a 22% drop.

“The good news is that trade volumes and outflows have showed signs of slowing, providing much-needed support” for Bitcoin, Kaiko analysts wrote. “While GBTC outflows have been expected and are partly compensated by inflows into the other newly launched spot ETFs, the impact on sentiment has been significant.”

However, Bloomberg analyst James Seyffart noted that daily GBTC outflows had dropped to $191.7 million on Monday.

GBTC outflows have been partially offset by inflows into newly launched spot ETFs.

Total inflows to the newly issued US Bitcoin ETFs, meanwhile, swelled to $1.8 billion, according to data from digital asset manager CoinSshares.

Downward pressure

A lessening of GBTC’s outflows would ease the “downward pressure” on Bitcoin’s price, JPMorgan said last week.

Although Seyffart had a more nuanced take.

“ETFs aren’t THE market themselves,” Seyffart tweeted. “Yes they’re now a big slice of the pie but there’s a lot more to the pie. Bitcoin ETF inflows can coincide with falling Bitcoin prices. Outflows can coincide with rising prices.”

The rotation of funds from GBTC to newly issued ETFs raises questions about the nature of these inflows, whether they represent fresh capital entering the market or merely a shift between investment products, Kaiko said.

A clearer picture is expected to form in the coming months as the funds mature, and as market makers show signs of entering.

Crypto market movers

- Bitcoin is up 3.09% in the last 24 hours, trading at $43,503.

- Ethereum is up 2% in the same period, at $2,311.

- Avalanche and Solana are down 6.1% and 8.8%, respectively.

What we’re reading

- Ether ETFs, more regulation, and privacy battles — Here’s what’s coming in crypto — DL News

- Crypto Funds Record $500 Million In Net Outflows Last Week — Milk Road

- $674 Million of Stolen Crypto Recovered in 2023: PeckShield — Unchained

- HyperFund Founders Charged With $1.89B Crypto Scam And Ponzi Scheme — Milk Road

- Sei bets on ‘EVM parallelisation’ to lure Ethereum developers — but it’s not alone — DL News

Sebastian Sinclair is a markets correspondent for DL News. Have a tip? Contact Seb at sebastian@dlnews.com.

This story has been updated to reflect that the average daily pace of GBTC outflows was $500 million, according to Kaiko’s estimates and to show that it has now dropped below $200 million, per Seyffart’s numbers.