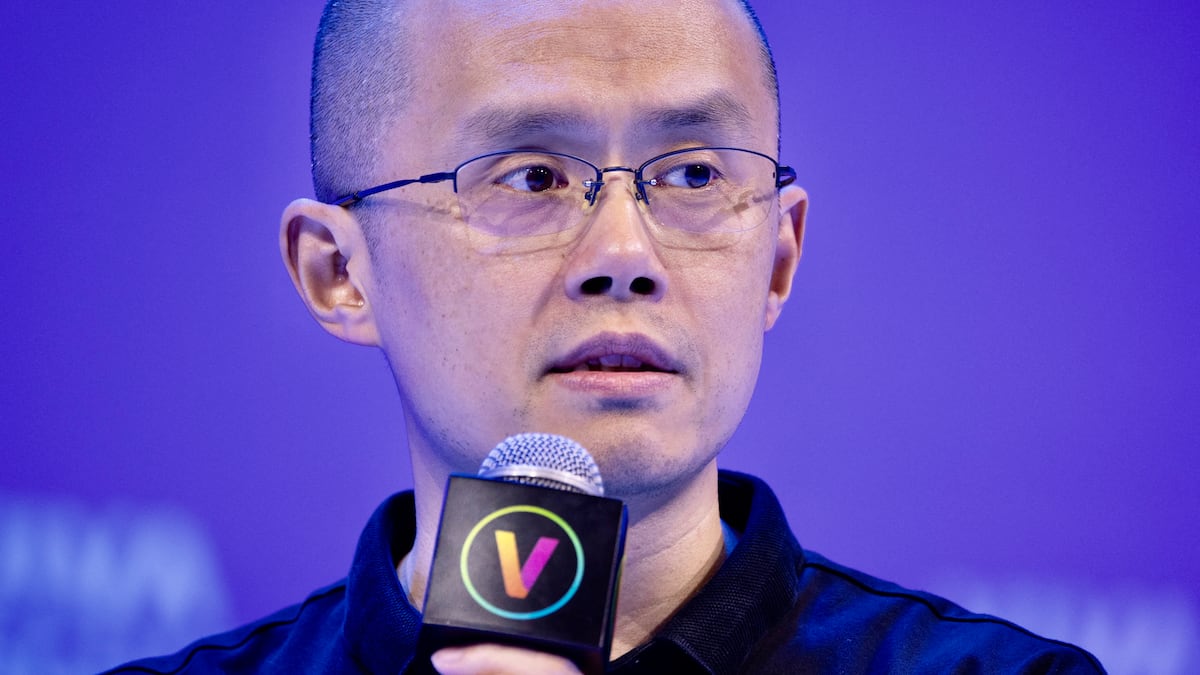

- Changpeng Zhao has agreed to step down as CEO of Binance after the exchange agreed to pay $4.3 billion to US authorities.

- JPMorgan says Binance’s settlement may see traditional finance firms accelerate their crypto land grab.

Happy Wednesday!

Binance was losing ground even before it agreed to pay $4.3 billion to US authorities over violating anti-money laundering and sanction evasions laws.

As the world’s biggest cryptocurrency exchange reels from the regulatory reprimand, JPMorgan tells DL News that traditional finance players will continue to grab market share from crypto native firms.

Let’s dive into it.

TradFi land grab

On Tuesday, Binance agreed to pay US authorities $4.3 billion in fines and restitution for violating anti-money laundering laws and facilitating trading for criminals and terrorist organisations, including Hamas-linked groups and Isis.

For Nikolaos Panigirtzoglou, managing director of global market strategy at JPMorgan, the case will accelerate the traditional finance land grab that has seen titans like BlackRock and Fidelity making moves into the sector.

Binance and other crypto native firms stand to lose market share.

“This has been happening already this year with exchanges or platforms not complying with US regulations and/or becoming the target of US authorities losing market share,” he told DL News.

The comment comes after CME overtook Binance as the largest exchange for Bitcoin futures contracts earlier in November.

Giovanni Vicioso, head of crypto at the derivatives exchange, told DL News the record number of futures contracts was partially due to the constant barrage of scandals hammering the crypto industry, which have made regulated exchanges more appealing.

“There has been this crypto flight to regulated futures contracts,” Vicioso said.

Duncan Trenholme agrees. The CME Group leapfrogging Binance “points to more traditional financial firms, more institutional firms, wholesale firms coming into crypto,” Trenholme, global co-head of digital assets at TP Icap, told DL News.

A “general shift in volume moving off unregulated offshore platforms onto regulated entities in major financial jurisdictions,” has been underway since FTX collapsed, Trenholme said. “It hasn’t been a surge, it’s been a kind of steady trend for the last 18 months.”

US authorities seem to share that sentiment.

Treasury Secretary Janet Yellen warned on Tuesday — as the Treasury, the Department of Justice, and the Commodity Futures Trading Commission slapped Binance with the massive sanction — that the days of crypto companies playing fast and loose with law are over.

“Any institution, wherever located, that wants to reap the benefits of the US financial system must also play by the rules that keep us all safe from terrorists, foreign adversaries, and crime, or face the consequences,” Yellen said.

So long, CZ

The crypto community itself is divided on what to think of Binance’s guilty plea — not to mention its co-founder Chanpeng Zhao agreeing to quit as CEO.

Some said the news came as relief and will allow the industry to mature. Others noted that it was just more of the same old crypto Wild West.

Bernstein analysts welcomed resolution of the DOJ investigation, saying that “with limited Binance business disruption, the crypto industry can move on from this.”

Coinbase CEO Brian Armstrong echoed Binance’s statement, telling Bloomberg that it is time for the industry to “turn the page as an industry.”

Armstrong’s bullish sentiment wasn’t shared by everyone.

“I thought we turned the page after: FTX, BlockFi, Terra, Celsius Network, Voyager Digital, Three Arrows Capital, Gemini Trust, Hodlnaut,” regulation expert Sean Tuffy responded.

Others focused specifically on Zhao stepping down from his executive role.

“I’m gutted about CZ,” Pulsr founder Maxine Ryan posted on X. “When I resigned from my first startup CZ was one of the only people who told me that I would get back on my feet. Not only did CZ take the risks when no one else would, he is also humble and believes in our collective freedom. Sad day.”

Justin Sun, the founder of the TRON blockchain network and who has appeared on Chinese TV alongside Binance co-founder Yi He, also praised Zhao.

“You’ve consistently played a leadership role for the community, the industry, and for me,” Sun said to Zhao on X. “Without you, the cryptocurrency industry wouldn’t have reached the heights it has today.”

Stefan Rust, CEO of independent economic data provider Truflation, told DL News: “It’s sad to lose such a strong individual who spoke the truth, played fair, and tried to hold together a business growing at a breakneck pace.”

Crypto market movers

- Bitcoin fell around 1.6% to $36,517 over the past day.

- Ethereum rose by 0.5% in the same period, trading for $2,019.

- BNB is down 9.9%.

What we’re reading

- Binance ‘accommodated criminals’ across the world, says DOJ, as CZ pleads guilty in US court — DL News

- New Binance CEO Teng’s First Job Is to Avert Customer Exodus — Bloomberg

- Crypto Fear & Greed Index 2023: Live Crypto Sentiment — Milk Road

- Why Financial Advisors Are So Excited About a Spot Bitcoin ETF — Unchained

- 11 Best Crypto Discord Servers 2023: Groups For Traders & Investors — Milk Road

Got a tip about Binance? Reach out at tcarreras@dlnews.com or adam@dlnews.com