- Ark Invest, once one of the most notable investors in Grayscale’s Bitcoin Trust, has closed its position in the trust.

- The move comes as it looks to launch its own spot Bitcoin ETF.

- Ark invested around $100 million of its proceeds into ProShares Bitcoin futures ETF.

Investment management firm Ark Invest sold its remaining Grayscale Bitcoin Trust holdings this week.

It had been the largest holding in the asset manager’s Next Generation Internet exchange-traded fund just a month ago, according to Bloomberg Intelligence data.

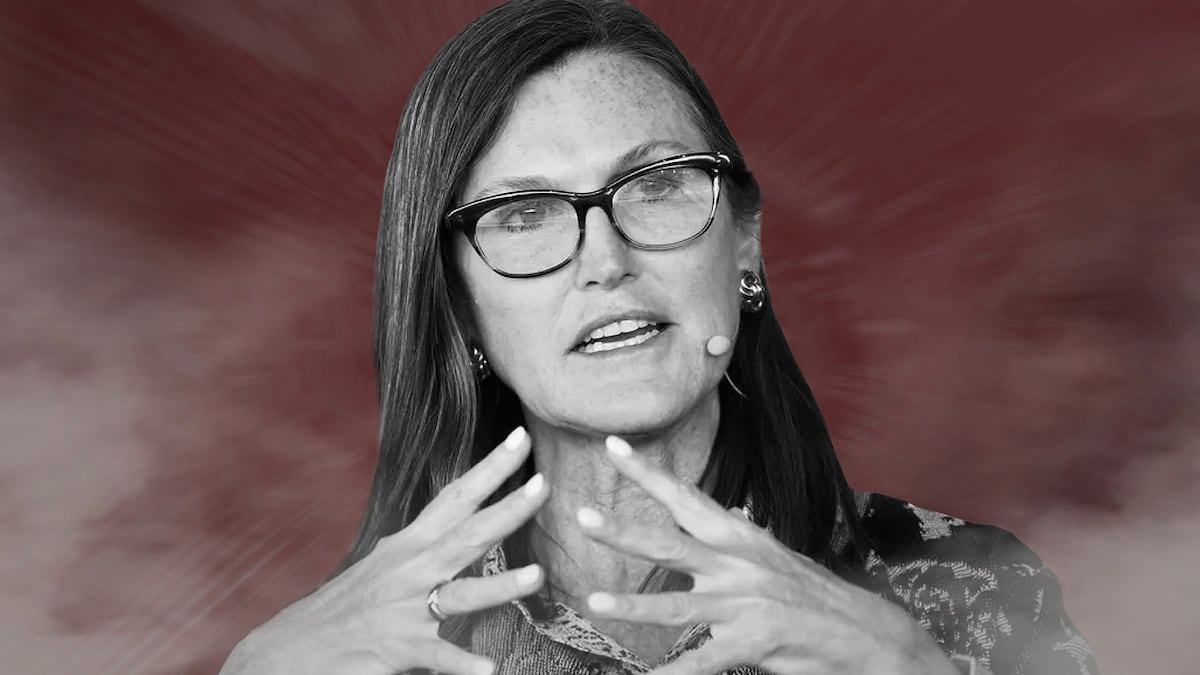

Now Cathie Wood’s firm is buying shares in the largest Bitcoin futures ETF. Here’s why this is important.

Liqudity tool

Ark Invest has been busy selling a lot of winners this month, including Coinbase and GBTC. The former is likely part of the fund’s typical rebalancing practice. GBTC is a little different.

Last month Ark’s Next Generation Internet ETF’s biggest holding was GBTC. Now, that position is completely closed.

The Florida-based fund manager used part of the proceeds from its GBTC sales, about $100 million, to buy shares in ETF issuer ProShares’ Bitcoin futures ETF.

Cathie Wood’s firm is now the second largest holder of the ProShares ETF, behind Goldman Sachs, according to Bloomberg data.

Ark is likely using the Bitcoin futures ETF as a “temporary parking spot,” ahead of launching its own spot Bitcoin ETF next year — pending US Securities and Exchange Commission approval — according to Bloomberg Intelligence ETF analyst Eric Balchunas.

Basically, the fund manager will hold shares in the futures ETF as its price will closely track Bitcoin.

It’s also highly liquid, which means holders can buy or sell at close to the prevailing market price. Less liquid ETFs could result in losses as it’s harder to exit the position.

Crypto market movers

- Bitcoin traded about $43,000, up 0.2% since Wednesday.

- Ethereum gained 5.6% to trade above $2,400.

- Solana and Avalanche shed 7.5% and 5.7%, respectively.

What we’re reading

- How Larry Fink, Cathie Wood and the rest of Wall Street are cornering Bitcoin — DL News

- Airdrop hunters plough $345m into fledgling blockchain to get new token — DL News

- MicroStrategy Buys 14,620 Bitcoin (BTC) For $615,700,000 — Milk Road

- Worldcoin Expands To Singapore Following Halt In India — Milk Road

Adam Morgan McCarthy is DL News’ London-based Markets Correspondent. Got a tip? Reach out at adam@dlnews.com.