- Solana led the recovery in crypto markets on Thursday as it gained over 5%.

- FTX gained approval to begin selling some of its crypto holdings on Wednesday.

- Liquidity in crypto markets continues to be low, according to Kaiko data.

Happy Thursday!

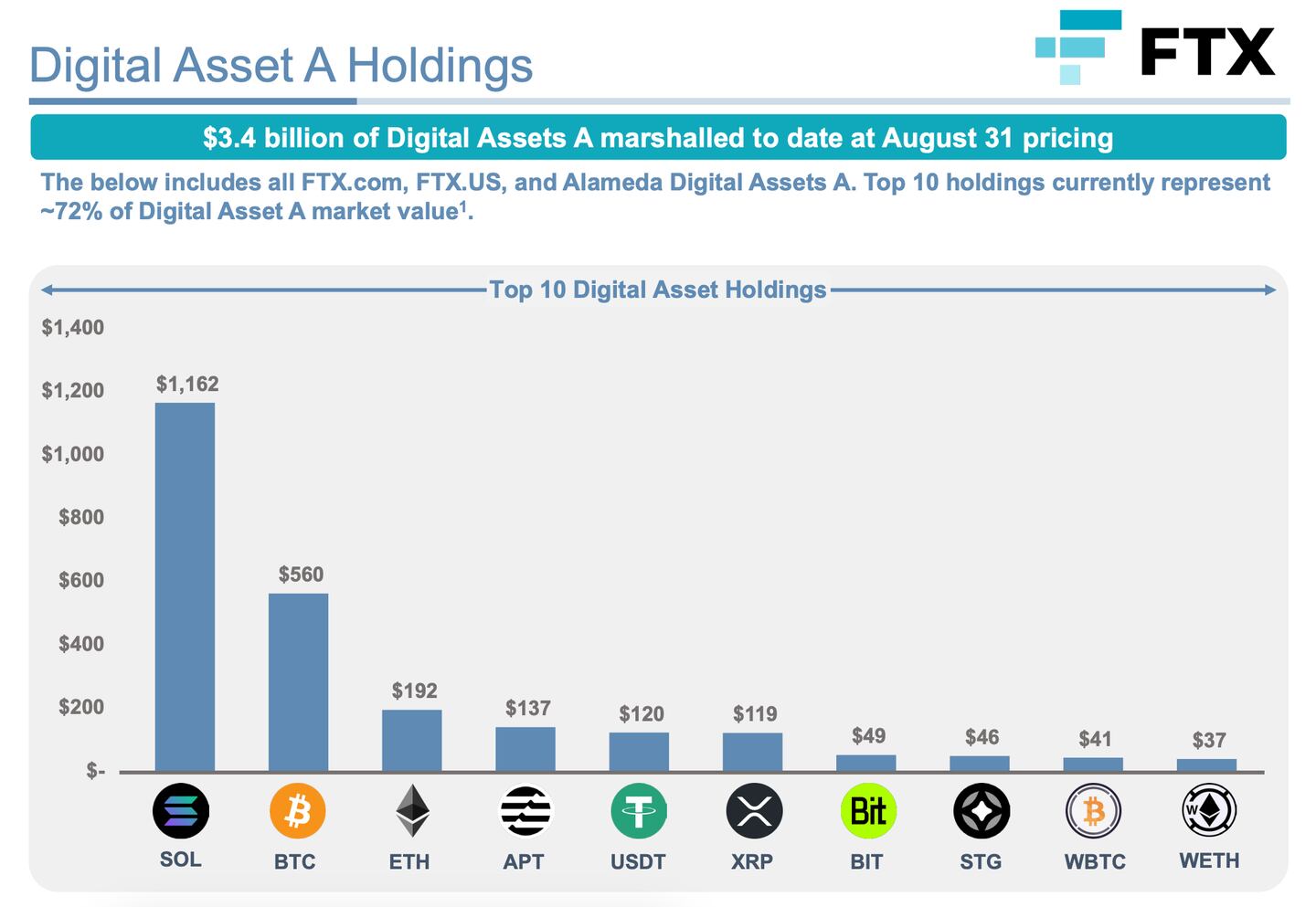

Bankrupt crypto exchange FTX gained approval to begin selling some of its crypto holdings over the next few weeks. The failed exchange holds around $3.4 billion in assets. Liquidity has been hard to come by in crypto markets in 2023, and altcoins have been particularly hard hit since FTX’s collapse.

Let’s get into it.

Headwinds and headaches

Nearly a year on from the collapse of Sam Bankman-Fried’s crypto empire FTX is still taking centre stage.

The exchange’s new leadership had its application to begin selling part of its crypto holdings approved on Wednesday. Crypto prices traded lower ahead of yesterday’s news as the potential selling pressure appeared to weigh on investors.

FTX holds over $3.4 billion in cryptocurrencies, which includes around $1.16 billion of Solana’s SOL token. The majority of its Solana holdings are locked and will unlock in tranches between 2025 and 2028.

The bankruptcy court in Delaware also approved FTX to enter into hedging arrangements using Bitcoin and Ethereum to offset any price movements from the asset sales. All sales will be handled by Galaxy Digital and are capped weekly at $100 million. The limit could potentially increase to $200 million.

Altcoins make up the bulk of the bankrupt exchange’s holdings. These cryptocurrencies with lower market capitalisation have been trading down over the past few weeks.

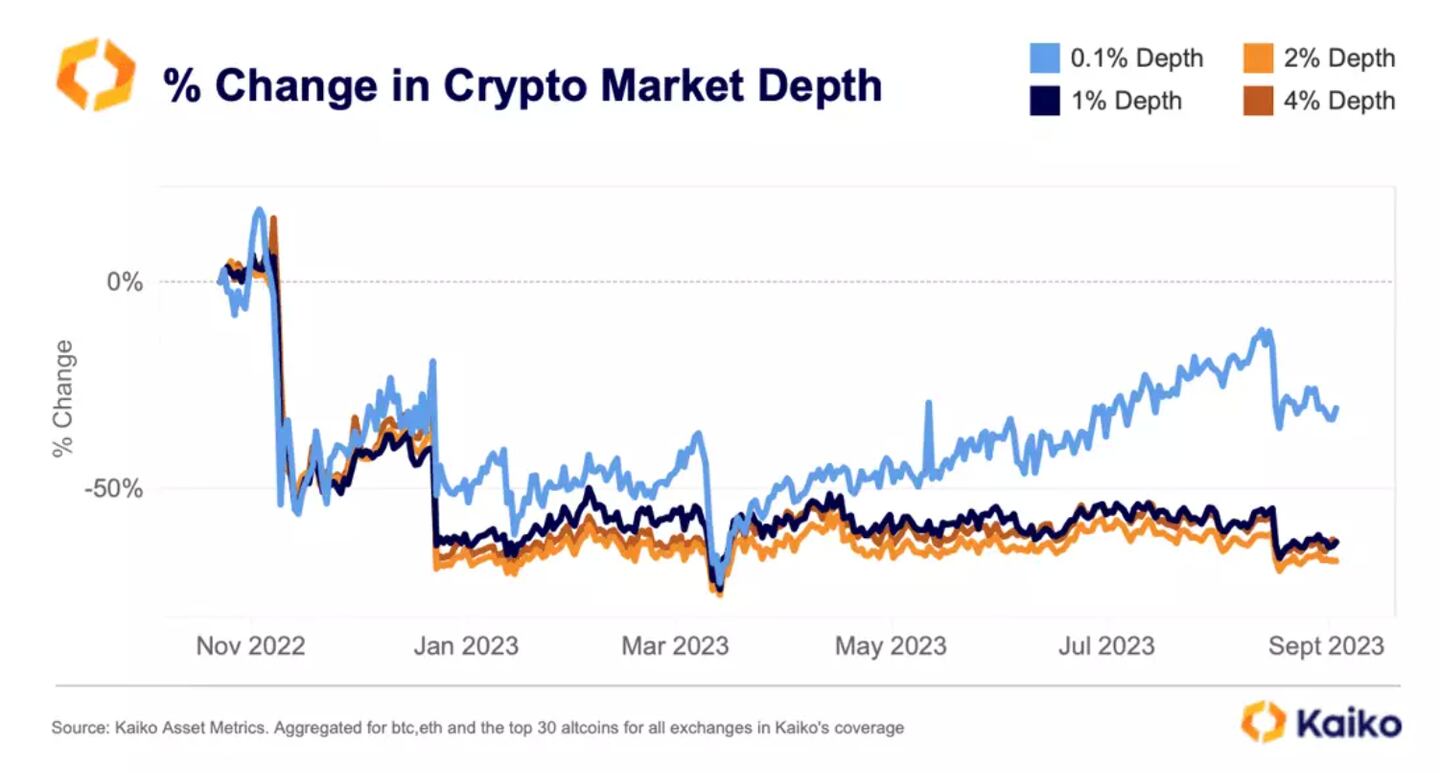

Liquidity is at a premium in crypto markets right now and particularly when it comes to these altcoins, research firm Kaiko said in a report last week. Liquidity cratered after the collapse of FTX and has failed to recover since.

Using market depth as a metric helps understand this liquidity issue. Kaiko defines market depth as the market’s ability to sustain relatively large market orders without impacting the price of the asset. Its determined by measuring the number of orders within a price range waiting to be filled.

Kaiko views market depth as one of the most important gauges of liquidity. The research firm sums bids and asks within 0.1%, 1%, 2%, and 4% of the mid-price to assess the depth of the market.

Since the FTX collapse the 0.1% market depth has recovered more than liquidity placed in wider ranges, Kaiko said.

However, what liquidity is there is heavily concentrated on just a handful of platforms — mostly outside the US.

Price moves can be exacerbate during periods of market turmoil when liquidity is low and overly concentrated.

Beyond liquidity, there also appears to be a lack of interest in altcoins from institutions — taking crypto trading platform FalconX’s recent flows a gauge.

Interest from institutional trading desks remains “somewhat subdued,” David Lawant, head of research at FalconX, said on Wednesday. Bitcoin and Ethereum are trading nearly two times the volume of all altcoins combined, he added.

“Unlike our flow in majors, alts flow mostly came from the sell side,” Lawant concluded.

Crypto market movers

- Bitcoin increased by 1.4% to around $26,500 over the past day. Crypto markets were undeterred by rising inflation in the US. Prices increased by 0.6% in August, driven mainly by increases in energy prices.

- Ethereum jumped back above $1,600 as it gained 1.9%.

- Solana led the gains in altcoins, it’s up over 5% over the past day. Tron’s TRX was the other big gainer, it was up 2.5% over the last 24 hours.

What we’re reading

- The Merge one year on: Ethereum no longer a ‘wanton environmental polluter’ but centralisation issues remain — DL News

- Circle’s Jeremy Allaire on deals and Asia growth amid Grab tie-up: ‘You’re going to see partnerships with a lot of different firms’ — DL News

- What is ‘rage quitting’? The growing DeFi trend that’s upending DAOs — DL News

Adam Morgan McCarthy is DL News’ London-based Markets Correspondent. Got a tip? Reach out at adam@dlnews.com.