- Gemini and Genesis lost a legal skirmish to have their case thrown out of court.

- A judge said the SEC’s allegations against the pair were “plausible.”

- Lawyer John Reed Stark called the decision a win for the regulator.

The US Securities and Exchange Commission’s lawsuit against crypto exchange Gemini and crypto lender Genesis Global Capital will now proceed to trial, in what lawyer John Reed Stark hailed as a “decisive victory” for the regulator.

The case will now go to trial in the Southern District Court of New York after Judge Edgardo Ramos ruled the SEC had “plausibly” alleged the two firms violated federal securities laws, according to a court document filed Wednesday.

Ramos’'s decision is a “decisive victory for the SEC against Big Crypto’s so-called ‘lack of regulatory clarity’ and rogue SEC ‘regulation by enforcement’ defences,’” Stark, who spent 18 years as an attorney in the SEC’s enforcement division and now runs his own consultancy, wrote in an X post. He has no connection to the SEC’s lawsuit.

The judge’s decision backs up the SEC’s assertions that crypto falls under the nation’s securities laws, Stark said.

“What this decision states above all else is that regulatory clarity is anathema to securities regulation,” he wrote.

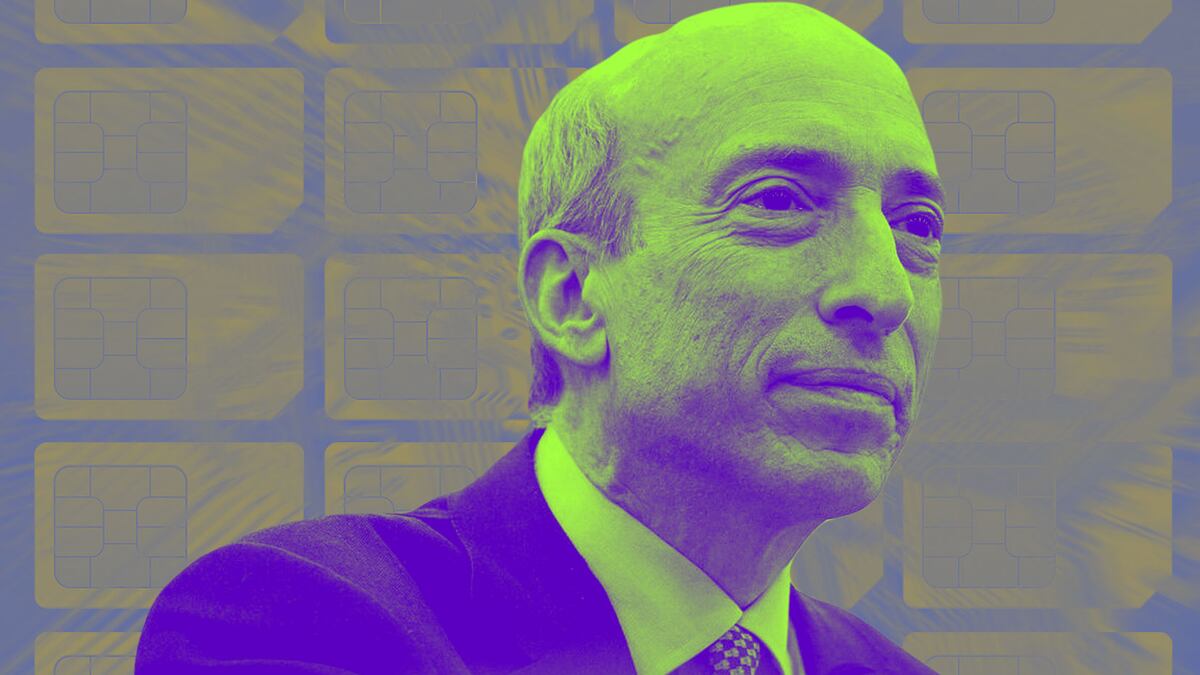

The SEC under current chair Gary Gensler has argued that the vast majority of crypto tokens are securities, which means federal securities laws apply to the industry.

‘What this decision states above all else is that regulatory clarity is anathema to securities regulation.’

The SEC has launched a series of lawsuits against crypto’s biggest companies — including exchanges Binance, Coinbase, and Kraken — alleging violations of securities laws.

The crypto industry has howled, protesting that the lawsuits amount to “regulation by enforcement” and calling on Congress to provide “clarity” by writing tailored rules for crypto.

‘Plausible’ allegations

The SEC sued Genesis and Gemini in January 2023, alleging they facilitated the unregistered offering of and sale of securities to retail investors through Gemini’s Earn programme.

Earn users could deposit their crypto, including Bitcoin, for lending to borrowers. In return, lenders could receive interest rates up to 8% on their assets.

Genesis, operating under Barry Silbert’s Digital Currency Group, was one of Gemini’s partners in the programme.

The firms sought to have the case thrown out, arguing that the assets involved weren’t securities.

But Ramos said in his ruling on Wednesday that the SEC’s allegations are “plausible,” while saying the defendants’ arguments are “in tension with the broad scope of the securities laws.”

His ruling was the latest in a string of legal showdowns both Gemini and Genesis have had to contend with regarding Earn.

On February 28, Gemini announced plans to fully return $1.8 billion in customer funds to Earn users who were affected by Genesis’ collapse on January 20, 2023.

Gemini, Genesis, and the SEC all didn’t immediately respond to requests for comment.

Reach out to the authors at sebastian@dlnews.com or joanna@dlnews.com.