- The US derivatives watchdog wants to ban predictions on the outcomes of elections.

- Economists say prediction markets are an important source of data.

A version of this story appeared in our The Guidance newsletter on August 19. Sign up here.

Ben Weiss writes in DL News that economists are leaping to the defence of prediction markets like Polymarket.

That’s after the Commodity Futures Trading Commission proposed a ban in May on certain “events contracts” — derivatives that allow an investor to bet on events like elections, sports games, or awards shows.

The US derivatives watchdog’s argument? That unrestricted prediction markets jeopardise democracy and national security.

The CFTC worries that these markets could create financial incentives for people to, say, assassinate a president, or commit an act of terrorism to win a bet.

It also warns that these markets are ripe for manipulation.

Insiders involved in an event could bet using an unfair information advantage — think a sports coach making a bet on the outcome of his team’s game.

Or voters may pick candidates based on the betting odds, rather than whether they’re the right person to hold high office.

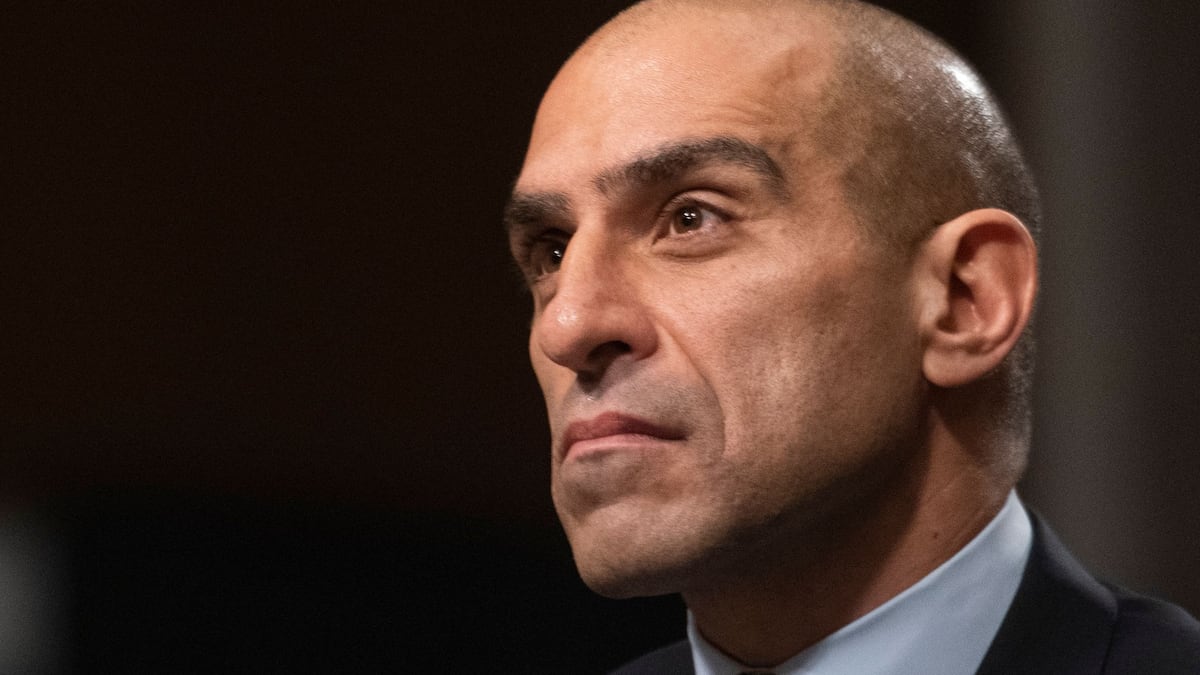

More events contracts “were listed for trading in 2021 than had been listed in the prior 15 years combined,” CFTC Chair Rostin Behnam said.

In response, the commission proposed to effectively strengthen the regulator’s ban on events contracts that encourage “gaming” or gambling.

Polymarket has officially not allowed US residents to use its platform since it settled a CFTC lawsuit in 2022 and paid a $1.4 million fine.

Still, guides on sidestepping the ban abound online, and the market’s most prolific better is based in Las Vegas.

Supercharged

The US presidential election has supercharged Polymarket.

Its most liquid bet is a $640 million market on whether Republican Donald Trump or Democrat Kamala Harris will win.

Polymarket’s monthly trading volume quadrupled to $387 million in July, according to Dune Analytics.

So any curtailment on election-related bets is bad news for the platform.

Still, prediction markets have powerful defenders in the crypto industry.

Heavyweight exchanges like Coinbase, Gemini, and Crypto.com have written to the commission.

Their letters say prediction markets provide predictive data that’s more accurate and cheaper than other kinds of forecasting.

Ben interviewed economists, who agreed that prediction markets are surprisingly accurate, and factor in the chances of market manipulation.

One of Ben’s sources, however, echoed the CFTC’s fear that these markets need regulation, as they might provide incentive to, say, throw an election.

Regulatory proposals often get watered down or rewritten as they churn through the rulemaking mill, so the CFTC proposal is not necessarily an indication of how that legislation might look in future.

But with Polymarket getting so big, regulators aren’t going to ignore it.

Reach out to me at joanna@dlnews.com.