- Binance is getting its first official headquarters.

- New CEO Richard Teng hinted about that fact last week.

- So we asked ourselves, where would we put the exchange’s official home?

A version of this story appeared in our The Guidance newsletter on April 15. Sign up here.

Binance CEO Richard Teng says the company has finally whittled down its search for a headquarters to ‘a few jurisdictions.’

During the reign of alleged micromanager, founder and disgraced former CEO Changpeng Zhao, the company was infamously based nowhere.

But now Binance must pick a permanent base — even if Teng’s giving no hints about where.

DL News asked: Where would we set up shop if we were Binance?

London

Sure, Binance suspended services in the UK last year, citing promotions rules. And crypto firms struggle to meet regulators’ high bar for registration.

But if a firm can afford an army of lawyers to help it meet that bar, London has a lot going for it.

The City is a global financial hub, it’s home to top-class talent, and it throws great parties.

The UK has high levels of crypto adoption, and the government is finalising regulation this year.

Prime Minister Rishi Sunak’s Tory government has pledged to transform London into a hub for digital assets.

Similarly, the Labour Party has said it wants the UK to be a tokenisation hub if they win the next election.

Singapore

Binance has a fraught relationship with Singapore.

The city-state threw open its doors to crypto businesses, and Binance got an exemption to operate there.

But in 2021, Binance left the country after attempts to gain a permanent licence failed, Bloomberg reported because it couldn’t meet anti-money laundering standards.

Nevertheless, Singapore is a great base from which to access Asia, with favourable taxation and established regulation.

Plus, Teng is Singaporean, and presumably understands the business environment. And compliance there would reboot Binance’s reputation.

The Cayman Islands

Stunning beaches, year-round sunshine, corporate tax breaks.

Why wouldn’t crypto companies want to set up here?

“The government is supportive of the crypto industry and values innovation and economic diversity,” said XReg Consulting managing director — and Cayman resident — Aaron Unterman.

The self-governing British territory offers a “special economic zone,” providing a streamlined way for foreign businesses to set up operations.

Cayman is also phasing in crypto regulation, and it’s been removed from the EU’s list of countries at high risk for money laundering.

Paris

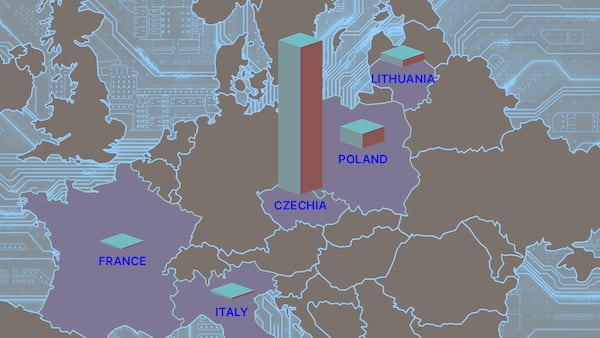

France under President Emmanuel Macron has said “Oui” to web3, attracting giants like Binance, Circle, and Crypto.com.

The country was early in preparing for the EU-wide Markets in Crypto-Assets regulation.

Under MiCA’s passporting regime, a Paris base would give Binance access to the EU’s €19 trillion crypto market. Zhao previously touted Paris as a “strategic” hub.

It’s already registered a French subsidiary with regulators, and could apply for higher-tier registration, giving it a smooth entry into MiCA compliance.

One downside: in June, the Paris public prosecutor launched an investigation into the company for money laundering.

Dubai

The United Arab Emirates have diversified their economies, embracing tech.

Dubai especially has made itself attractive to crypto with tax breaks and favourable regulation.

Binance was licensed to operate there in July 2023, and Teng has said it serves as the company’s Middle East and North Africa headquarters.

As Liam Kelly puts it, Dubai has a “convenient regulatory structure, lots of crypto folks are already there and Teng has already made inroads with the regulator there. He was, after all, the CEO of a financial free zone in Abu Dhabi.”

But Teng must also consider the optics.

Dubai is a hub for financial criminals.

And with Zhao having lived there, Teng might want to downplay associations with the city.

Email Jo at joanna@dlnews.com or Inbar at inbar@dlnews.com.