- The election of 720 new lawmakers could mean changes for the EU's carefully crafted crypto regime.

- Important crypto legislation awaits new members of the European Parliament.

- Focus may shift to blockchain technology as the industry implements new laws.

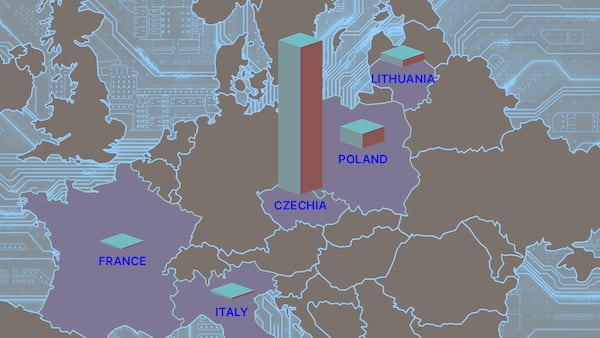

The European Union’s elections start on Thursday. For crypto, that means key lawmakers may lose their seats in the new 720-member parliament, and the policy agenda for the sector will go into a period of flux.

While crypto has emerged as an issue in the US presidential election, it’s remained a sleeper topic in the European campaign.

Still for the last five years, the EU has methodically addressed the challenges of crypto assets by adopting a comprehensive regime known as MiCA. At the same time, European leaders have also set up a small but symbolic body to oversee the rollout of blockchain infrastructure.

A delicate balance

But how a new Parliament picks up where the last one left off remains an unknowable question until the dust clears after this weekend. Crypto experts are watching closely to see how lawmakers approach the delicate balance between regulation and innovation.

“There seems to be a recognition that whilst regulation is important and can be enabling, it can also go too far and be seen as a blocker,” Mark Foster, EU policy lead at the Crypto Council for Innovation, told DL News.

The crypto industry will be looking out for who fills several key roles in the new Parliament.

For example, the Parliament’s Committee on Economic and Monetary Affairs has played a crucial role in amending and shaping crypto legislation over the last five years.

It’s shaped MiCA, which stands for the Markets in Crypto-Assets regulation, as well as rules to prevent money laundering.

Each parliamentary committee has a chair who coordinates the work within the groups of several dozen lawmakers focused on specific sectors.

The chairs also have a subtle influential role during the so-called trilogue negotiations, the final and most meticulous segment of law drafting shared between the EU institutions.

The Committees on Civil Liberties, Justice and Home Affairs, and on Internal Market and Consumer Protection have had impact on crypto legislation.

Parliament’s groupings

Other key jobs are the coordinators of the Parliament’s parties spanning across the political spectrum.

Coordinators allocate legislative reports within the group, deciding who gets to lead negotiations on a bill.

While experts expect to see a swing to the far right in the upcoming elections, the centrist-right European People’s Party remains taking up the biggest chunk in the polls.

The left-wing Socialist and Democrats group, whose MEPs have historically posed challenges to crypto industry advocates, come second in size.

Pending bills

There are a few pending draft laws that were not completed ahead of the elections. These bills will need a rapporteur, or an appointed lead negotiator in the Parliament.

The digital euro, a controversial bid to set up a European Central Bank-run digital currency, will also need a new parliamentary leader should German MEP Stefan Berger not return to complete the process.

Other legislation for payment services and financial data will also need a new MEP to take lead.

The Payment Services Regulation will be important in determining whether issuers of fiat-backed stablecoins, or e-money tokens, will need to comply with more onerous measures than the ones proposed within MiCA.

And, the new composition of lawmakers in the committees could redraft the work done by the last mandate to their own liking.

DeFi versus tokenisation

The European Commission is due to report on progress in decentralised finance and NFTs, and assess any risks the ecosystems may pose to consumers and markets.

The MiCA framework largely excludes these two features of the crypto industry, and focuses on service providers. Instead, the Commission will decide based on its findings whether extra legislation is needed.

The DeFi and NFT reports, which will include insights from European financial markets and banking regulators, are due in December.

But potential policy action on DeFi may be thwarted by another trend eating up the industry: tokenisation.

“If we’ve got huge banks and market infrastructures going into tokenising securities, debt instruments and deposits, that will need to have the right framework around it,” Foster said.

Europe’s crypto legislation

MiCA, which covers stablecoin issuers plus licensing requirements for crypto firms to safeguard markets and consumers, will go live in stages starting from the end of June.

Financial institutions, including crypto service providers, will also need to comply with beefed up IT security requirements from 2025 under the Digital Operational Resilience Act.

A DLT Pilot project was another pod in the European Commission’s Digital Finance Package. It was designed for market participants to experiment with tokenised financial instruments, but has not had much success.

In addition, Europe produced crypto-focused anti-money laundering rules to collect data on senders and receivers of transactions under the Transfer of Funds Regulation.

Plus, a separate Anti-Money Laundering Regulation also swept in crypto services as entities required to comply with the EU’s updated regime for the private sector.

Now, top officials are calling for a slow down in regulation and a chance for the tech and financial sector to implement the firehose of new laws spewed at them.

Blockchain, not crypto

“What we’ll see over the course of the next five years, the term of this legislative cycle, will be a focus more on DLT and the underlying technology,” Foster said.

That could cover decentralised, digital identity and wallets, or revamping financial market infrastructure with features like instant settlement to wipe out intermediaries.

And, these lawmakers will need to approve the next heads of the European Commission, Europe’s executive arm.

EU budget

The next European Commission leaders will be nominated by EU member states, and then elected by the European Parliament. This process will take place after the summer.

The new European Commission president, a job that could well remain with incumbent Ursula von der Leyen, and Commissioners leading the financial and technology sectors will be responsible for any new legislation that may impact crypto or blockchain.

The Commission also has an important role in allocating the EU’s budget towards its long-term goals on digitalisation or sustainability.

That includes projects like the blockchain infrastructure designed to underlie European administrations, dubbed Europeum.

It also includes other initiatives to update internet infrastructures and digitising services or businesses.

“This is an important ingredient to enable citizens to be able to use web 3 and crypto products and services,” Foster said.

Inbar Preiss is a Brussels-based regulation correspondent. Contact her at inbar@dlnews.com.