- The SEC slapped speed trading market maker Virtu Financial with a lawsuit this week.

- CEO Doug Cifu reacted by retweeting criticism of the chair, Gary Gensler.

- Cifu hit Gensler with critiques often levelled by the crypto industry.

- Cifu’s tactics mirror those of Coinbase CEO Brian Armstrong.

- Gensler is under pressure from crypto, the securities industry and Republican lawmakers.

Lawyers usually have a key piece of advice for clients: Keep your mouth shut.

Brian Armstrong, CEO of crypto exchange Coinbase, has flipped that script. Instead of avoiding the appearance of trying to influence the court or jeopardise an ongoing lawsuit from the Securities and Exchange Commission, he’s outspoken about what he calls unfair treatment.

NOW READ: Coinbase walks back Brian Armstrong’s assertion SEC asked exchange to delist every token but Bitcoin

Virtu Financial CEO Doug Cifu, who, like Armstrong, was slapped with an SEC lawsuit, is borrowing a page from the Coinbase playbook. Also like Armstrong, Cifu took to X, formerly Twitter, reposting tweets critical of SEC chair Gary Gensler’s record in regulating crypto markets.

The suit accuses the US speed trader and market-maker of failing to protect sensitive customer data and misleading the regulator about it.

Virtu, like rivals Jane Street and Jump Trading, is known for lightning-fast algorithmic trading strategies that seize on price gaps to make big returns. Such strategies were critiqued in Michael Lewis’ 2014 novel “Flash Boys.”

Cifu posted: “Politics. Not regulation and a proper application of law. Don’t believe in coincidence either … "

The phrasing seemed to suggest that the allegations against Virtu are politically motivated. It’s a charge increasingly levelled against the chair, especially by Republicans, who criticise the SEC’s enforcement actions and regulatory agenda.

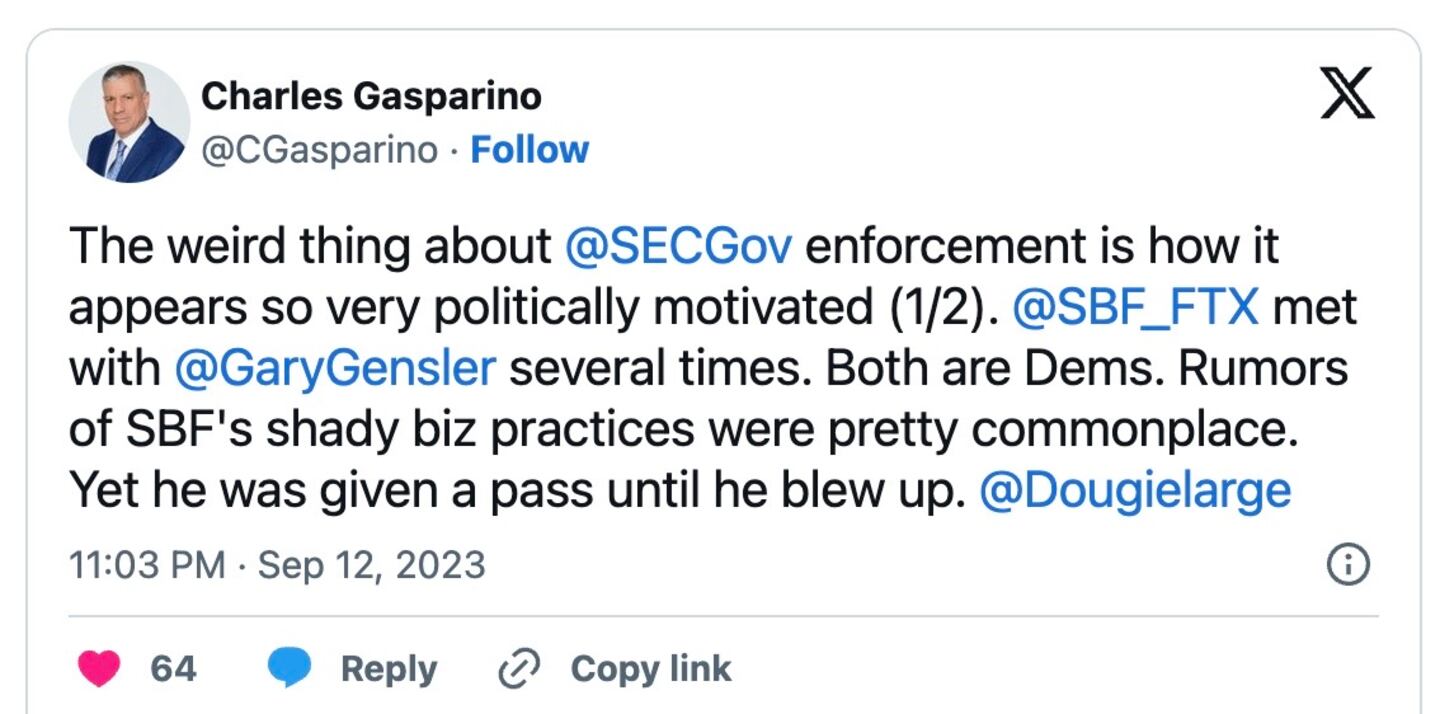

Cifu also reposted other tweets critical of Gensler.

These included one that echoed a common crypto industry charge: that Gensler ignored signs that exchange FTX was engaging in shady business practices as its founder, Sam Bankman-Fried, donated at least $40 million to Democrat politicians.

Bankman-Fried has said, however, that he gave just as much to Republican lawmakers, but kept those donations dark.

Crypto critics of Gensler’s SEC say that his agency should have rooted out the malfeasance at FTX before it collapsed.

Others say the blame lies in Congress — which has failed to produce any substantive crypto legislation — or with the banking regulators.

Energetic reg agenda

Cifu’s X posts tapped into sentiment widespread among industry and lawmakers, particularly Republicans — that Gensler is overstepping his authority and choking innovation in US capital markets.

Among the crypto community, Gensler is widely despised.

Gensler has stood his ground. On Tuesday, he told the Senate Banking committee during a hearing on SEC oversight that the industry was “rife with misconduct.”

Under his rule, the SEC has levied a slew of enforcement actions against some of the largest and most important crypto exchanges, including Binance.

NOW READ: Coinbase and Binance crank up lobbying push as Congress prepares to debate crypto bills

But Gensler has drawn the wrath of arguably far more powerful foes. His regulatory agenda has angered Wall Street and heavy hitters like Virtu. Virtu, which handles 25% of US retail order flow, is itself suing the SEC over proposals that would overhaul equity trading.

Under Gensler, the SEC has put out a slew of rule proposals affecting a wide swathe of securities markets, from stocks and bonds to private equity and fund management.

Industry participants say many of these proposals are long, complex, and interrelated, and they aren’t given sufficient time to digest their potential impact and prepare adequate responses.

Gensler has said that even markets as safe and liquid as the US’s need updating for efficiency and investor protection.

READ NOW: Crypto exchange guardrails are coming whether Gary Gensler wins his crusade or not

He said the SEC offers an average of 70 days to comment on proposals, and often engages with industry after those deadlines.

When it comes to crypto specifically, he said, there is nothing about these markets that “suggests that investors and issuers are less deserving of the protections of our securities laws.”

Gensler also tends to counter criticism by noting that he’s not acting alone, but makes decisions in concert with four commissioners, two Republican, two Democratic.

Charges against Virtu

The SEC’s complaint said that Virtu ran two businesses that were supposed to be walled off from one another.

From about January 2018 to April 2019, staff of one of these businesses could have hypothetically accessed a post-trade database held by the other.

The risk was that Virtu’s own traders could see customer information, and use that to trade to their own advantage.

Virtu hit back at the charges in a statement, saying it rejects the SEC’s allegations that the hypothetical possibility of access to the data by Virtu employees rendered its policies and procedures unreasonable.

READ NOW: Secretive trading firms that pile into crypto are ‘first sign’ of mainstream adoption

“The SEC does not allege, and there is no evidence to indicate, that any data was ever accessed or used in an inappropriate manner,” it said.

“Virtu has continuously maintained reasonable policies, procedures, and controls to protect data.”

Virtu declined to comment to DL News.

Do you have a tip about crypto regulation or markets? Contact the authors at joanna@dlnews.com or adam@dlnews.com