- Robinhood bought crypto platform with 50 licences and registrations.

- One potential approval is the European Union's MiCA licence.

- Deal highlights the importance of regulatory approvals.

Robinhood’s $200 million acquisition of Bitstamp last week won’t only deliver the US online brokerage crypto investors around the world. It also comes with a potential bonus prize — a MiCA licence.

The European Union is in the process of implementing a bloc-wide crypto regulatory regime called the Markets in Crypto-Assets regulation, or MiCA.

While numerous ventures are undertaking the painstaking effort to comply with the landmark law, Robinhood may leapfrogged them all by simply buying a company that is already qualified.

“It must be interesting to any US business to have part of your platform in Europe, just from a diversification of risk perspective,” James Sullivan, Bitstamp’s general counsel said at a Paris event on digital money the company co-organised on Tuesday.

Governance requirements

The deal comes as crypto firms operating in the EU will need to comply with tougher capital and governance requirements from the end of the year.

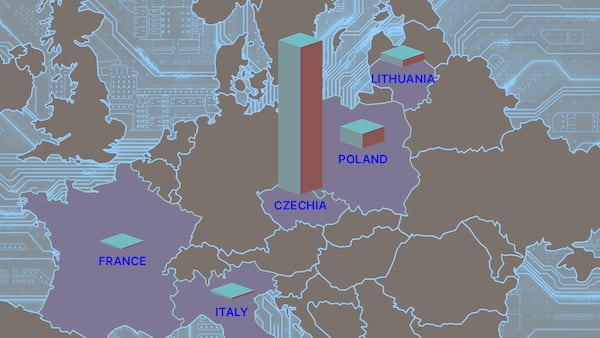

Once a firm earns its licence from a chosen EU country, it can passport its services across the 27-nation bloc.

“They [Robinhood] are hoping to acquire Bitstamp with a MiCA licence,” Sullivan said.

“That’s our strategy for 2024 and if all goes well, we will be their licenced MiCA entity.”

Indeed, in its deal announcement Robinhood highlighted the value of regulatory approvals.

“Bitstamp holds over 50 active licenses and registrations globally and will bring in customers across the EU, UK, US and Asia to Robinhood,” the brokerage said.

The deal is expected to close in 2025.

The European Union was the first major jurisdiction to pass comprehensive and tailor-made laws for crypto platforms.

“Europe as a market has been leading the charge in actually adopting a regulatory regime, which I think many other regulators are going to follow,” Sullivan said, five days after Robinhood broke the news on the acquisition plans.

Legal battles

The US government, on the other hand, has made little progress in agreeing on how to regulate the new digital asset class. As a result, some of the biggest firms are embroiled in legal battles on whether or not crypto classifies as a security.

Still, crypto has become a hot issue in the runup to the US presidential election in November. Former president Donald Trump, the presumptive Republican Party nominee, promised to prioritise crypto users.

But whether that would lead to changes in regulation is unknown.

“There is a scenario where nothing changes for some time,” Sullivan said.

“The US is obviously a very important market, but Europe is interesting because of it being more set,” Sullivan said, adding that market uncertainty stems from the lack of regulation.

Johann Kerbrat, general manager for Robinhood Crypto, previously told DL News that Robinhood is keen to continue expanding beyond the US, including European and Asian markets.

“The goal is to keep pushing on the international side,” Kerbrat said.

Inbar Preiss is DL News’ Brussels correspondent. Contact the author at inbar@dlnews.com.