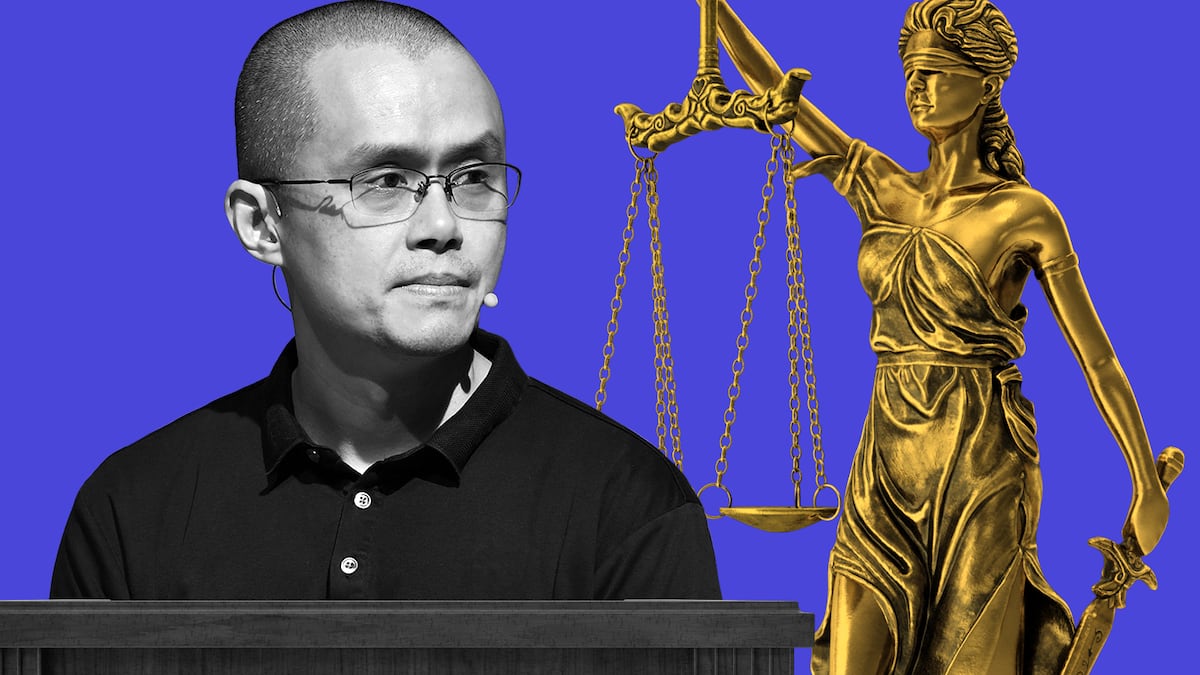

Changpeng Zhao finds out today how long he will spend behind bars.

A Seattle court will decide the Binance co-founder and ex-CEO’s fate after he pleaded guilty in November to failing to maintain an effective anti-money laundering programme.

The verdict will punctuate just one of the crypto exchange’s legal battles. And it’s a preamble to potentially fiercer challenges ahead.

This is how we got here.

2017

- July 14: CEO Changpeng Zhao and co-founder Ye Hi launch Binance with the aim to become a world-class crypto exchange.

2018

- January: Binance becomes the world’s top crypto exchange by volume, with Zhao telling Bloomberg that the exchange is adding a couple million registered users every week.

- September 28: The New York Attorney General refers Binance — as well as fellow exchanges Gate.io and Kraken — to the Department of Financial Services for possible violations of state crypto regulations.

2019

- June 13: Binance announces the launch of Binance.US.

- June 14: Binance’s global exchange bars deposits and trading from US customers on its global platform, and changes its terms of service to state “Binance is unable to provide services to any US person.”

- September 17: On the eve of the launch of Binance.US, the exchange says it will exclude customers in 13 US states — including New York and Alabama — from its services. As of April 2024, that number has dropped to nine US states and regions.

- September 18: Binance.US launches.

2020

- October 29: A Forbes report details the so-called Tai Chi document, which conceived of the creation of Binance.US as an “elaborate corporate structure designed to intentionally deceive regulators.” Zhao later claims he “flatly rejected” the proposal.

- November 18: Binance sues Forbes for defamation for its October story, stating it contained “numerous false, misleading, and defamatory statements.”

2021

- February 4: Binance drops its lawsuit against Forbes without saying why. A judge approves the dismissal the same day.

- March 12: The Commodity Futures Trading Commission investigates Binance for allegedly allowing the sale of derivatives to US investors, according to Bloomberg.

- May 13: Bloomberg reports that the Internal Revenue Service and the US Justice Department are investigating Binance for criminal violations. A Binance spokesperson said the exchange had built “a robust compliance programme that incorporates anti-money laundering principles and tools used by financial institutions to detect and address suspicious activity.”

- September 17: Bloomberg reports that US regulators’ inquiries into Binance will be expanded to include possible insider trading as well as market manipulation. The review involves CFTC investigators, sources told the publication.

2022

- February 10: Binance buys a $200 million dollar stake in Forbes through a publicly traded special-purpose acquisition company, or Spac, just a year after the exchange dropped its defamation lawsuit, Forbes reports.

- June 5: The Securities Exchange Commission opens a review into Binance’s BNB token, accusing it of having a “blatant disregard of the federal securities laws” that protect investors.

- June 13: Jeffrey Lockhart, an investor who lost money in the Terra collapse in May 2022, sues Binance.US for falsely marketing Terra USD as a safe asset ahead of the stablecoin’s collapse, Reuters reports. “These assertions are without merit and we will defend ourselves vigorously,” Binance tells Reuters.

- September 22: CoinDesk reports that Binance has hired several lawmakers including a former US Senate Finance Committee chairman to run a board of advisers to navigate regulatory hurdles worldwide.

- November 6: Zhao says in a post on X that Binance will liquidate its holdings in the FTX exchange’s FTT token. The token’s price drops sharply, and kicks off a crisis for FTX.

- November 8: Zhao announces plans to acquire FTX to help its “significant liquidity crunch.”

- November 9: Binance pulls out of the deal to buy FTX, and within days, the rival exchange enters bankruptcy.

- November 10: Bankman-Fried congratulates “a particular sparring partner,” adding “well played; you won” in a cryptic tweet likely addressed to long-running rival Zhao. In later court filings, Bankman-Fired blamed Zhao for leaking a damaging document, sparking FTX’s downfall.

- November 14: Zhao speaks at a conference in Bali, Indonesia, where the CEO calls for “not just regulators” to protect investors, but for crypto companies to carry their share of responsibilities.

2023

- February 8: Binance suspends US dollar deposits and withdrawals for international customers. Binance.US tweets that it is unaffected by the move.

- February 13: The New York Department of Financial Services orders stablecoin issuer Paxos to cease minting Binance-branded BUSD due to “unresolved issues related to Paxos’ oversight of its relationship with Binance.”

- March 1: US senators, including anti-crypto firebrand Elizabeth Warren, publish an open letter to Binance and Binance.US. They request information on its internal operations, suggesting Binance is “a hotbed of illegal activity.”

- March 10: The DoJ appeals the court order approving Binance’s deal to purchase Voyager Digital, on grounds that the appeal was too broad, and might impede later attempts at criminal charges or enforcement actions.

- March 17: Binance responds to Warren’s letter with then-Chief Strategy Officer Patrick Hillmann describing the company’s efforts to come into compliance with regulators. Between August 2021 and November 2022, Binance stopped over 54,000 transactions “as a result of transaction monitoring alerts,” Hillman writes.

- March 27: The CFTC sues Zhao, Binance, and its related entities for the alleged offer of unregistered crypto derivatives products, as well as for allegedly telling US customers how to evade compliance controls.

- March 27: A judge halts the deal for Binance.US to purchase Voyager Digital.

- April 25: Binance.US calls off the $1.3 billion deal to purchase Voyager Digital, citing a “hostile and uncertain regulatory climate.”

- June 5: The SEC sues Binance and Zhao for allegedly mishandling customer funds, lying to investors and regulators, and breaking securities rules.

- June 7: Binance.US removes several trading pairs — assets that can be traded for each other — and pauses its over-the-counter trading portal, citing “community feedback” to explain the move.

- July 6: The SEC asks the presiding court to grant a temporary restraining order to freeze assets linked to Binance.US’ operating and holding firms. The request alleges several compliance failures, including claims that external companies could secretly access US customers’ funds.

- July 6: Hillmann verifies reports he is leaving the company, but says he does so “on good terms.” Other executives reported to exit the company around this time include General Counsel Hon Ng and Binance.US’s chief business officer, Yibo Ling, neither of whom comment on their departures.

- August 28: The SEC files a sealed motion against Binance, which would allow the agency to file documents against it out of the view of the public.

- September 21: Binance, Binance.US, and Zhao file for a motion to dismiss the SEC’s charges against them.

- September 30: Yiannis Giokas, senior director of product innovation for Moody’s Analytics, tells DL News that if the DoJ files criminal charges against the Binance, it would have “a cascading effect.”

- October 2: A class action lawsuit against Binance and Zhao says that Zhao’s personal “vendetta” drove him to post misleading information that triggered FTX’s collapse. “The case is without merit and we will vigorously defend ourselves,” Binance told DL News.

- October 26: In an open letter, Republican Senator Cynthia Lummis urges the DoJ to wrap up its investigations of Binance press criminal charges against it.

- November 8: The SEC rejects Binance’s motion to dismiss the agency’s lawsuit, and says the motion leans on “distorted” and “tortured” readings of the law.

- November 8: As Binance’s head of regional markets, Richard Teng opens Binance Blockchain Week in Istanbul.

- November 14: A judge denies a protective order on the SEC vs Binance case, which allows the public access to the case. November 20: DL News reports that Marcus Bacchi-Howard, who worked as an institutional client account manager at Binance, has become the latest executive to leave the exchange.

- November 20: Bloomberg reports that the US Department of Justice is seeking more than $4 billion from Binance to resolve its multi-year investigation into the company.

- November 21: The DoJ announces that Binance agreed to pay a $4.3 billion fine to settle criminal charges against the exchange. As part of the settlement, Binance will pay the penalties, and report to a court-appointed compliance monitor for five years. Zhao also agrees to step down as CEO and plead guilty to violations of the Bank Secrecy Act, as well as pay a $50 million fine. Zhao names Teng as his successor. In an X post, Teng states his goals are to restore investor confidence and work with regulators.

- November 23: Binance’s share of Ethereum trading volume drops to 30% from 40% on November 20 before Zhao’s exit, according to Kaiko data.

- November 26: Teng posts selfies with soccer legend Ronaldo and MMA star Khabib Nurmagomedov at an F1 event in Abu Dhabi.

- November 29: In an interview with Bloomberg TV, Teng says he will not shuffle Binance’s top leadership.

- December 5: Teng debuts as CEO at a Financial Times conference in London, where he answers for Zhao and Binance’s recent legal woes in the US. “There were mistakes made,” Teng tells the audience, “and we acknowledge those mistakes.” When asked about Binance’s elusive headquarters, Teng says he will announce its location “in due course.”

- December 6: In an X post critical of bankers, Teng references an academic paper that says traditional fiat currencies are responsible for trillions of dollars worth of illegal activities annually, compared to roughly $20 billion in annual crypto crime. “Loved this analysis,” writes Teng.

- December 7: A federal judge rules Zhao may not leave the US until his sentencing. In the ruling, the judge cites the lack of an extradition treaty with the United Arab Emirates, where Zhao resides, and the vast overseas wealth that could render his bail package “inadequate to ensure his return” to the US. Zhao’s lawyers follow up with a second request to allow him to travel.

- December 8: Reuters reports that Binance subsidiary BV Investment Management withdraws an application for a licence in Abu Dhabi. The licence would have allowed the firm to operate a collective investment fund in the city. “We decided this application was not necessary,” Binance says.

- December 12: In a joint filing, Binance, Binance.US, and Zhao request a hearing to argue for a dismissal of charges before the SEC trial.

- December 18: The CFTC confirms court approval for fines levied against Binance and Zhao. The court orders Zhao to personally pay $150 million to the agency, while Binance must pay $2.7 billion.

- December 19: Teng appears at Taipei Blockchain Week, where he touts Binance’s growing user base of over 167 million users globally.

- December 28: India’s Financial Intelligence Unit announces the issuance of “Show Cause” notices to nine digital asset service providers, including Binance. The announcement petitions the Indian Ministry of Electronics and Information Technology to block the providers’ URL addresses.

- December 29: Judge Jones denies Zhao’s second request for travel permission.

2024

- January 2: Speaking to El País, Teng says the future is bright for Binance and cites “very robust” December inflows. From December 31 to January 2, Binance sees $130 million in investor funds enter the exchange.

- January 4: Binance announces the addition of its “Monitoring Tag” to several assets, including Monero and Zcash. The company tags tokens it deems higher risk and more volatile. The tokens see liquidity dry up following the announcement.

- January 7: A Kaiko report says Binance removed the TrueUSD stablecoin from its Launchpool staking programme. The removal comes after the company axes its zero-fee structure for the asset. According to Kaiko, the changes likely caused the stablecoin to experience a price depeg.

- January 21: Binance’s inflows have grown to $4.6 billion since Zhao’s exit. Company inflows continue to increase in February, according to DefiLlama data.

- January 22: In a public hearing, Binance asks Judge Amy Berman Jackson to toss out the SEC’s lawsuit against the firm. An April 5 status report says the SEC is reviewing documents provided by the exchange.

- January 31: Families of victims of the October 7 Gaza attack sue Binance over its alleged role in facilitating terrorist financing to Hamas.

- January 31: Binance confirms to DL News that the company will sell its majority stake in the South Korean crypto exchange Gopax. Binance purchased the stake in February 2023 — its first activity in South Korea since 2021.

- February 1: In an X post, Teng announces that Binance froze $4.2 million worth of hacked XRP tokens. Teng urges victims to reach out to Binance in the case of further hacks.

- February 2: Binance announces the re-hiring of Steve Christie as deputy chief compliance officer. Christie formerly served the company as senior vice president of compliance. He was among several executives who left the firm in mid-2023.

- February 5: Binance co-founder Yi He announces a $5 million bounty on any employees trading on insider information after Ronin’s RON token rose 17% and fell 25% shortly after listing on Binance.

- February 6: Binance announces it will delist the market’s largest privacy coin, Monero, and several other coins. Monero’s token plummets 32%.

- February 21: Binance defends itself in a blog post amid calls for a ban on the exchange in Nigeria by a presidential spokesman who says currency speculation and market manipulation on Binance are out of control. A source tells DL News of an ongoing investigation into an alleged “coordinated effort to manipulate the country’s forex market via crypto trading on Binance.”

- February 23: Judge Jones approves Binance’s $4.3 billion payment in its November plea deal, Reuters reports. Afterwards, Binance says the company accepts responsibility and is making “significant progress” towards reaching compliance.

- February 26: DL News reports that Nigerian authorities detain two Binance executives, American Tigran Gambaryan and Briton Nadeem Anjarwalla, as part of its probe into the exchange for alleged currency manipulation.

- February 29: In a report, Binance says it has recovered $4.4 billion of mishandled funds for customers, resolving hundreds of thousands of cases in which users deposited cryptocurrency but were not credited in 2022 and 2023.

- February 29: Teng’s 100th day as CEO passes. DL News reports how his tenure has been marred by the legacy of Zhao.

- March 5: Binance’s woes in Nigeria continue, as it delists the country’s currency under intense scrutiny from authorities.

- March 8: In the US, federal appeals court rules that Binance must face a class action lawsuit in which investors accuse the exchange of selling tokens whose value tanked, Reuters reports. Binance had argued that the US securities laws didn’t apply to it because it’s not located in the country. But the appeals court ruled that the case can go ahead, as Binance is hosted on California-located Amazon servers.

- March 15: Bloomberg reports that Binance has spun off its $10 billion venture capital business, Binance Labs.

- March 19: Zhao teases his new project, a children’s education platform called Giggle Academy, in a post on X. “We are HIRING. Small team, work directly with CZ,” the post says.

- March 25: In an audacious escape, Anjarwalla slips away from his guards and jets out of the African nation, apparently using a second passport he had hidden from authorities.

- March 25: Commex, the business to which Binance sold its entire Russia operation in 2023, announces it will shut down.

- March 26: Philippine regulators announce they will block access to Binance, leaving investors rushing to withdraw their funds. Binance drew the ire of officials by failing to get an operating licence.

- March 29: Nigeria charges Binance with money laundering to the tune of $35.4 million. The case filed by the country’s anti-corruption police includes a five-count charge against Binance, Anjarwalla and Gambaryan.

- April 9: Teng breaks with Binance’s long standing policy of being based nowhere, and hints that it is “speaking to a few jurisdictions” to set up a global headquarters, DL News reports.

- April 19: Reports say Binance may re-enter the Indian market after winning a licence from Dubai.

- April 23: A Canadian court gives the go-ahead on a class-action suit against Binance. The plaintiffs are retail investors in crypto derivatives who are seeking damages from the platform, saying it violated Canadian securities laws.

- April 23: Friends and family of Zhao — 161 in all, including investors, former colleagues, and his partner and Binance co-founder Ye Hi — submit letters to the Seattle court, asking for a light sentence.

- April 24: US prosecutors recommended a 36-month prison sentence for Zhao.

- April 24: Filipino regulators say they are working with tech giants Google and Apple to remove Binance’s applications from local app stores.

- April 29: DL News reports on how the sentencing of Zhao won’t be the end of Binance’s woes as it still has to tackle the SEC’s lawsuit.

- April 30: DL News reports that Zhao’s guilty verdict will make French regulators think twice about granting Binance the licence it needs to operate in Europe.

- April 30: Bettors put the odds of Zhao spending time in prison at 75%, DL News reports.

- April 30: Zhao is slotted for sentencing in Seattle.

Joanna Wright and Eric Johansson cover regulation for DL News. Got a tip? Email them at joanna@dlnew.com and eric@dlnews.com.

Related Topics