- Republican presidential hopeful Ron DeSantis has labelled central bank digital currencies as “government-sanctioned surveillance.”

- The CEO of R3 has rejected that notion, saying that “CBDCs are definitely not evil.”

- R3 has provided tech support for over a dozen central banks’ blockchain projects, and has links to big Wall Street banks.

- The comments come as a digital dollar and crypto have become divisive issues in Washington ahead of the 2024 election.

Like many in the Republican Party, Florida Governor Ron DeSantis is not a fan of central bank digital currencies. The presidential hopeful has vowed to prevent the Federal Reserve from ever circulating a digital version of the dollar.

And he says CBDCs are a threat to “personal economic freedom and security” that is tantamount to “government sanctioned surveillance.”

DeSantis is just fear-mongering, said David E. Rutter, the CEO of R3, a blockchain technology business that partners with top global financial institutions and central banks.

“CBDCs are definitely not evil,” Rutter told DL News in an exclusive interview. “DeSantis looking for votes is good for him, but money is already digital. Central bank digital currencies take it to the next level.”

Crypto and CBDCs did not come up in the GOP debate held Wednesday night in Milwaukee. But digital money has become a lightning rod issue in the 2024 presidential contest as DeSantis and other Republicans lambaste the potential introduction of a digital dollar.

NOW READ: Attacks on CBDCs highlight crypto’s new battleground

At the heart of their argument is the idea that a digital dollar will open the door to mass-surveillance by letting central bankers track how people spend their money.

Vivek Ramaswamy, a political neophyte and biotech entrepreneur who largely stole the show Wednesday, takes it even further. He has called CBDCs “the latest trojan horse of the Great Reset,” a reference to a conspiracy theory that claims a global elite is using the Covid-19 pandemic to dismantle capitalism.

R3′s clientele are certainly elite. The New York based company has provided distributed ledger technology for global commercial lenders such as HSBC and financial giants like Wells Fargo, and partners with about a dozen central banks on CBDC projects.

NOW READ: 24 central banks could have CBDC by 2030

But Rutter said the rollout of CBDC would hardly be the surveillance state DeSantis and his fellow sceptics fear.

Thanks to smart-phone payments and digital commerce, corporations and tax authorities already collect and analyse spending data on an industrial scale.

A CBDC would not be much different from the practices governments already use to track spending. Banks and credit unions, for instance, have long had to report transactions worth at least $10,000 to the federal government.

“There are all sorts of ways that governments monitor payments,” Rutter said. He added that anti-money laundering regulations, designed to prevent criminals from cleaning dirty money in the financial system, already put provisions on how banks track transactions.

NOW READ: CBDCs are ‘1984 on steroids’ critics warn as supporters say Britcoin will save the economy

Besides, a CBDC put out by the Fed would probably enable consumers to make anonymous transactions up to a certain amount without government oversight, Rutter said. He expects Western governments to introduce ways to protect people’s privacy.

“If the government wanted to monitor their citizens, it may be a more efficient way [than using CBDCs to do so],” Rutter said.

Across the pond, the Bank of England, the European Commission, and Sweden’s Riksbank have each rejected claims that CBDCs mean mass-surveillance.

While no CBDC project has been green-lit by the Biden Administration or the Fed, the US Department of the Treasury has said the technological development of a digital dollar is under way.

Attacks against CBDCs are growing as Republican presidential race takes off

With CBDC detractors such as DeSantis embracing Bitcoin, crypto is shaping up to be an issue in the 2024 race.

Since the failure of crypto exchange FTX last November, officials have redoubled their efforts to establish a regulatory framework for crypto, Olivia Buckley, a researcher at lobbying research firm OpenSecrets, recently told DL News.

The US Securities and Exchange Commission and other authorities have taken a hard line on crypto firms this year. The agency has sued Binance and Coinbase, among other ventures, for failing to register their businesses as exchanges or broker-dealers under longstanding securities laws. The companies countered that they are not required to submit to the SEC’s oversight.

NOW READ: Get ready. These seven bills may decide the future of crypto in the US

Meanwhile, crypto has become a divisive topic on Capitol Hill. There are seven crypto bills under consideration in Congress.

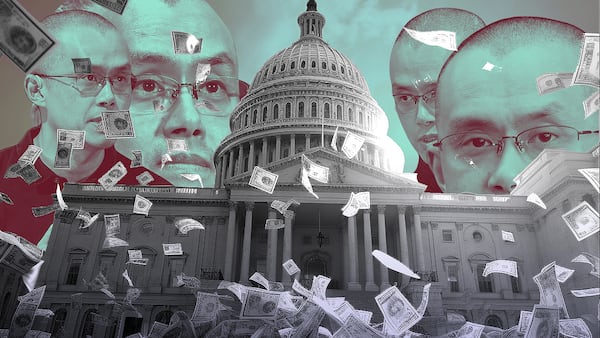

In a bid to mitigate the most onerous legislation, 60 crypto companies spent $22 million on lobbying in the US, almost triple the amount in 2021, according to OpenSecrets data crunched by DL News last week.

NOW READ: Coinbase and Binance crank up lobbying push as Congress prepares to debate crypto bills

Moreover, the number of lobbyists employed by crypto firms almost doubled in 2022 to 283 from 147.

Binance and Coinbase’s total lobbying bill was $2.4 million in the first six months of 2023.

Eric Johansson is DL News’ London-based News Editor. He covers all things crypto culture, cybersecurity, and regulation. Got a tip? Reach him via email eric@dlnews.com, or @ericjohanssonlj on both Twitter and Telegram.