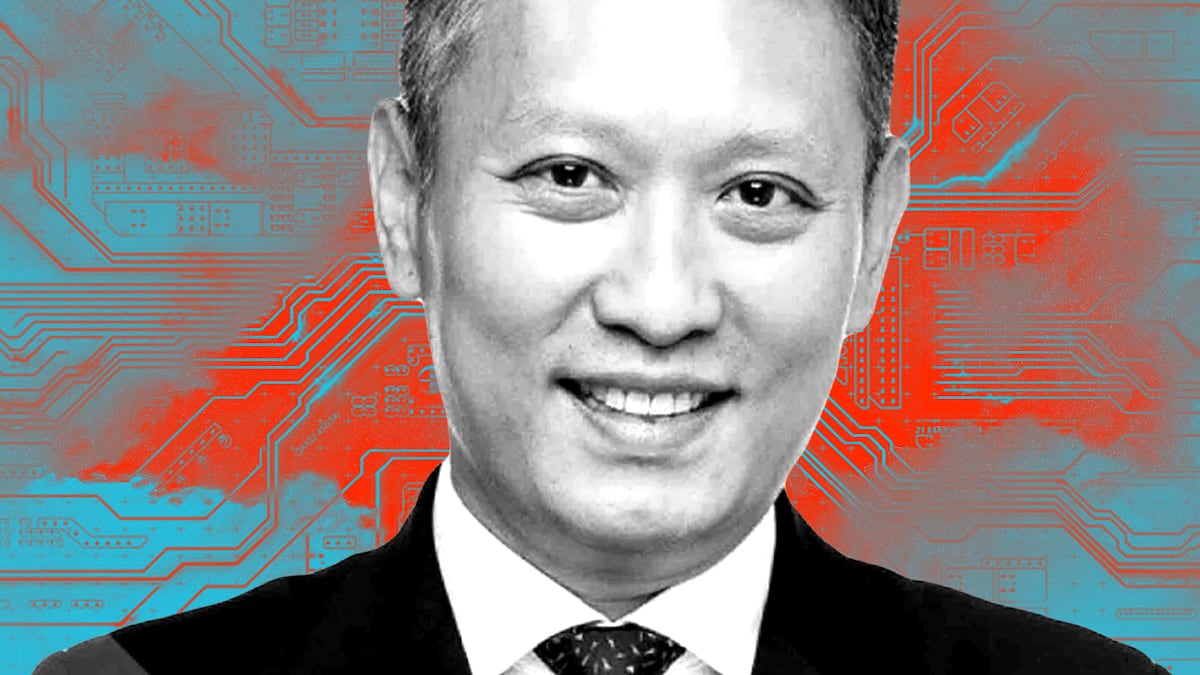

- Richard Teng just succeeded Changpeng Zhao at the helm of the world’s largest crypto exchange.

- He told a conference in London today that the company is working closely with regulators and beefing up compliance.

- He pushed back on questions about the company’s headquarters and UK licensing plans.

Binance’s new CEO Richard Teng debuted in London saying that, in the aftermath of its blockbuster deal with the US government, the exchange is moving past its issues.

Binance, which ballooned to the world’s largest crypto exchange just six months after it was founded in 2017, had outgrew its compliance measures, Teng said.

But that’s all behind it now.

“There were mistakes made, and we acknowledge those mistakes. We have now moved past them, we resolved those issues with US agencies,” Teng told the Financial Times Live conference in London on Tuesday.

“Going forward, we are focusing on being a user-led organisation, but also a compliance-led organisation.”

Teng has a regulatory background. But his job won’t be easy. He must now shepherd the exchange, which sees about 40% of all crypto market volume, to its future as a law-abiding player in the financial establishment.

The FT’s journalist Scott Chipolina grilled Teng, who called in from Singapore, in front of a room packed with those eager to hear from founder Changpeng Zhao’s successor only a few weeks into the job.

Teng, previously head of regional markets for the exchange who joined in 2021, took the helm after Zhao stepped down last month.

He will have the task of rebuilding credibility for an exchange that relies on institutional investors for big chunks of its business.

Among Teng’s tasks: appointing an independent monitor to scrutinise the company for the next five years, steering Binance through a Securities and Exchange Commission lawsuit, and managing Zhao, who retains his majority stake in the company.

Zhao’s departure was one of the terms of a plea deal with the US government that also saw Binance admit to money-laundering and sanctions violations, and stump up a $4.3 billion fine.

Safe and sound

Chipolina pressed Teng on how Binance plans to improve.

Binance under Zhao insisted it had no fixed address — a sticking point in 2021, when UK finance industry watchdog the Financial Conduct Authority said it could not supervise Binance as it would not answer basic questions about its location.

Teng said Binance will announce a global headquarters “in due course,” as well as appoint a board of directors.

He would not be drawn into whether Binance was reapplying for an FCA licence in order to trade the UK, saying the company keeps its discussions with regulators confidential.

“Why do you feel so entitled to these answers?” he asked Chipolina when the journalist pressed him to elaborate on these and other questions. Teng added that Binance is transparent with users and regulators in the 18 jurisdictions where it is licensed to operate.

“We are accountable to the regulators that regulate us. Is there a need to share all this information publicly?” he said. “Most private companies don’t publish that kind of information.”

Chipolina responded that Binance disclosing basic information like its headquarters and the names of its auditors would help customers trust the exchange again.

The journalist pointed out that Binance has experienced outflows, and lost market share in recent years.

Teng responded that Binance’s institutional clients are returning since it has resolved its federal charges.

“We are still by far the largest and most liquid exchange,” Teng said.

He’s not wrong. While the impact of the settlement on Binance’s flows are hard to measure, as much of the data comes from Binance itself, its dominance still has few peers.

Market depth — the market’s ability to handle large trades without impacting the price of the asset — on Binance increased the week after the settlement, analytics company Kaiko said in a recent report.

Kaiko said that Binance remains the leading crypto exchange when it comes to liquidity, ahead of rivals Coinbase and ByBit.

Executive outflows

Teng also said Binance is investing in hiring and has a strong team, despite bleeding top executives.

“We have very high standards for people, we hold them to high demands. Sometimes things don’t work out,” he said.

He said he’s operating in an evolving industry.

“Today’s landscape is very different. There are going to be many more regulations, we’re going to see many more institutions,” piling into crypto markets, he said.

“But our fundamental change will be our user focus — looking at products and services that users need and servicing their needs.”

,