- Nishad Singh cooperated with prosecutors against Sam Bankman-Fried in 2023.

- He learned the exchange company had stolen billions two months before its collapse in 2022.

- He was given a lighter sentence than co-defendant Caroline Ellison.

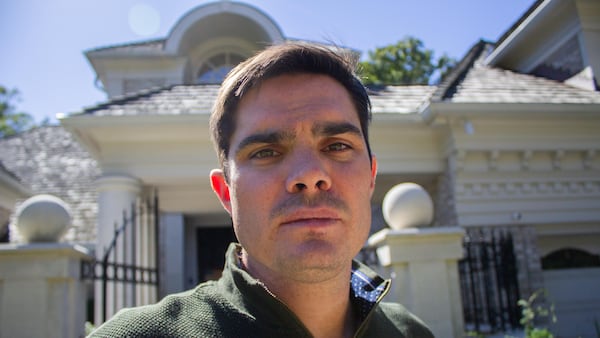

Nishad Singh, a soft-spoken former software engineer colleagues once called the “king of kindness,” was sentenced on Wednesday to time served for his role in the failure of FTX in November 2022.

This means he won’t serve any additional time behind bars in connection to the $8 billion fraud committed by Sam Bankman-Fried at FTX and its sister company, Alameda Research.

In 2023, Singh pleaded guilty to six counts of fraud, conspiracy, and related charges. Just like Caroline Ellison, the former head of Alameda Research, he cooperated with federal prosecutors and testified against Bankman-Fried at his trial in the autumn of 2023.

Unlike Ellison, who received a two-year prison sentence in September, Singh is to remain free.

“Your case is not the case that Ms. Ellison’s was,” US District Court Judge Lewis Kaplan told Singh in court on Wednesday. “She was involved from the beginning. She knew for years what was going on.”

A gaping hole

In 2022, Singh was FTX’s head of engineering. That September, Ellison and FTX Chief Technology Officer Gary Wang told Singh that Alameda had borrowed billions from FTX customers, he testified during Bankman-Fried’s trial.

He demanded a meeting with Bankman-Fried, he said.

Standing on the balcony of their $35 million penthouse in the Bahamas, the CEO confirmed to Singh that FTX couldn’t immediately repay all its customers if they decided to withdraw their cash and crypto en masse.

Two months later, FTX collapsed after depositors demanded their money back from the stricken exchange. Once valued at $32 billion, FTX’s failure sent shock waves through an industry struggling to go mainstream and assuage the concerns of regulators worldwide.

In a letter this month to Judge Kaplan, Singh’s lawyers highlighted their client’s “extraordinary” circumstances, which included his relatively limited role in the collapse of FTX and his “immediate and exemplary” cooperation with prosecutors. Earlier this year, Bankman-Fried was sentenced to 25 years in prison.

The lawyers asked the court to take this into consideration when handing down his sentence. And Kaplan did.

Reiterating his belief that the collapse of FTX was the greatest financial fraud in history, the judge told Singh he was “entirely persuaded ... that your involvement was much more limited than certainly Bankman-Fried and Ellison, that it came relatively late in the day.”

Taking the stand

When Singh took the stand at Bankman-Fried’s five-week trial, the software engineer said he had long found the CEO’s lavish spending “embarrassing” and reeking of “excess and flashiness.”

Companies within the FTX empire had spent hundreds of millions on venture investments, luxury real estate, celebrity endorsement deals, and political donations.

Singh also detailed at the trial the moment he learned the true cost of Bankman-Fried’s shopping spree.

‘I felt really betrayed that five years of blood, sweat, and tears ... turned out to be so evil.’

— Nishad Singh

“I felt really betrayed that five years of blood, sweat, and tears from me and so many employees, driving towards something that I thought was a beautiful force for good, had turned out to be so evil,” Singh testified.

During the following two months, Singh redoubled efforts to get Bankman-Fried to trim the company’s expenses, according to his lawyers. Still, he never blew the whistle on him.

Singh told the court he stayed at FTX because he was afraid his departure could precipitate the company’s demise.

“It was a panicked, self-delusional, and ultimately criminal error in judgement,” his attorneys wrote in their letter to Kaplan.

“Nishad knew that staying at FTX meant hiding the existence of the hole from customers, and that he would be taking otherwise routine steps that, in these circumstances, would perpetuate the fraud.”

Singh’s background

Raised in the San Francisco Bay Area, Singh was childhood friends with Bankman-Fried’s younger brother. He graduated from the University of California in Berkeley, majoring in electrical engineering and computer science.

In late 2017, Singh joined Alameda, impressed by its employees’ commitment to “effective altruism,” a philosophy that encourages adherents to seek high-paying careers and donate substantial sums to charity and good works.

Despite being an inexperienced programmer when he joined Alameda, he rose up the ranks. When FTX collapsed, Singh was the company’s head of engineering and its third largest shareholder.

During this time, he was suicidal, his parents wrote in letters to Kaplan.

Singh has since found full-time work as a software engineer outside the finance and crypto industries and become engaged to longtime girlfriend Claire Watanabe, according to letters from friends and family.

Singh is the fourth former FTX executive to be sentenced this year.

In March, Kaplan sentenced Bankman-Fried to 25 years in prison for stealing $8 billion from customers of the exchange. Ryan Salame, the former co-CEO of FTX’s subsidiary in the Bahamas, was sentenced to more than seven years in May.

Wang is scheduled to be sentenced on November 20.

Aleks Gilbert is DL News’ New York-based DeFi correspondent. You can reach him at aleks@dlnews.com.