- Fortress has been ordered to close.

- Court documents reveal a $11 million shortfall in its finances.

- Now people raise questions about how this could’ve happened.

A version of this story appeared in The Guidance newsletter on October 27. Sign up here.

Hey all, Liam here.

For a company named after keeping treasure safe, Fortress is doing a pretty poor job of it.

That’s according to Nevada regulators, who issued a cease-and-desist letter to the crypto trust company on October 22.

The state revealed that Fortress maintained roughly $12 million in customer deposits, both in crypto and cash. In reality, however, the company had only $1.2 million on hand.

In other words, the court filing reads, “the respondent’s liquidity position is wholly inadequate to meet customer obligations.”

As such, the company has been ordered to shutter its operations. The filing also indicates that Fortress was unable to provide financial statements from July to September.

“I learned after assuming the position of chief executive officer that the Trust was experiencing severe financial difficulties and challenges related to events that occurred prior to assuming my role as Chief Executive Officer,” Anthony Botticella, the company’s CEO, wrote in the filing.

“These pre-existing issues materially affected the Trust’s ability to continue as an ongoing viable entity.”

It’s an appalling state of affairs.

A charter trust effectively operates as a bank by holding and administering assets on behalf of its clients, which, in this case, primarily means various crypto companies.

But with a nearly $11 million shortfall, Fortress, which recently changed its name to Elemental Financial Technologies, has failed spectacularly.

It’s also raised serious questions about how this could happen.

“Where was the regulator? Why were there not controls?” Austin Campbell, the author of the Zero In newsletter, said on Friday. “Why were these things not reported?”

These are all relevant questions. Especially, when such malfeasance is afoot.

But given the Securities and Exchange Commission’s position on allowing state trust companies to hold cryptocurrencies, some suggest that Fortress’s failings may be just the first of many.

Typically, trust companies — crypto or otherwise — aren’t allowed to hold customer deposits. These companies also have far fewer reporting rules than federally chartered banks.

On September 30, however, the SEC announced it would make an exception to this rule only if the charter businesses are holding crypto.

But why exactly?

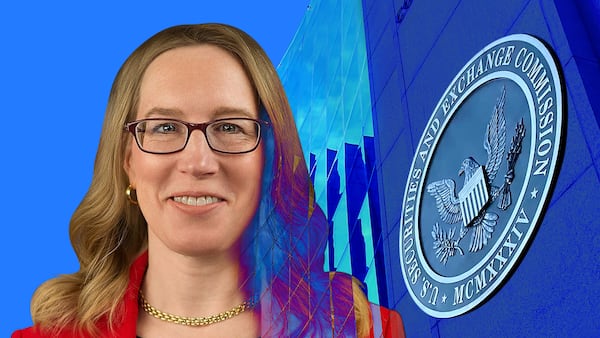

“No idea!” SEC Commissioner Caroline A. Crenshaw wrote in response to the Commission’s decision.

Crenshaw has emerged as one of the more alarmed members of the SEC’s Commissioners Board over the agency’s handling, or lack thereof, of regulating crypto during US President Donald Trump’s second term.

“And even though these assets have a notoriously high risk of loss, we offer no real explanation for why we are comfortable with crypto assets receiving less custodial protections than traditional assets.”

ICYMI

- New CFTC nominee joins Trump pledge to make US ‘Crypto Capital of the World’Mike Selig has served as chief counsel at the SEC’s Crypto Task Force since March. He is also an advisor to SEC Chair Paul Atkins, who has committed to a pro-crypto agenda in an effort to bring equities markets onchain.

- Maxine Waters blasts Trump over CZ pardon, says President is doing ‘massive favours for crypto criminals’Waters’ excoriating statement reignited allegations by Democrats in Washington that Trump’s crypto connections are more than ideological; they are transactional.

- Nigel Farage became the star of the crypto conference. Not everyone’s happyLike Trump, Farage is seemingly banking on the crypto industry’s support — and the young people who invest in it — to catapult him into power.

Story of the week

Biden’s ‘war on crypto is over’ as Trump pardons ex-Binance CEO Changpeng Zhao

Changpeng Zhao spent four months in prison in 2024.

White House Press Secretary Karoline Leavitt told DL News that Trump “exercised his constitutional authority by issuing a pardon for Mr. Zhao, who was prosecuted by the Biden Administration in their war on cryptocurrency.”

Now, with Zhao’s pardon, that war is “over,” Leavitt said.