- A new TRM Labs report says 80% of surveyed jurisdictions toughened crypto regulation in 2023.

- International trendsetters have been “critical” in defining global regulatory standards for crypto.

- The Financial Action Task Force is one of the more important bodies for crypto watchers to follow this year.

The Financial Action Task Force is poised to lead a worldwide regulatory crackdown as authorities increasingly live up to pledges to tame the “crypto Wild West,” according to a new report.

As many as 17 jurisdictions, which cover the majority of global crypto exposure, toughened up regulations in 2023, according to TRM Labs, the blockchain intelligence firm’s, new report.

“In the past year, we have seen every major standard-setter dedicate attention to standards for crypto,” Angela Ang, senior policy advisor at TRM Labs, told DL News. “We have also seen national regulators reference these standards.”

The report comes during a pivotal moment for the crypto ecosystem, which is anticipating a US regulatory greenlight for asset managers to offer Bitcoin Spot exchange traded funds.

Analysts say approval is key for the young industry to become accepted by mainstream financial institutions.

If crypto is to truly go mainstream, there must be a clear regulatory path, experts say.

Setting global standards

According to Ang, the FATF will be one of the most important international bodies shaping regulatory policy around crypto in 2024.

As part of its efforts, FATF designates nations with sketchy money laundering policies onto “grey lists” and urges policymakers and companies to be careful about doing business in those countries.

“This year we will see countries on the grey list work on virtual asset rules to get off the list,” she said.

In 2023, FATF found that only a quarter of its 39 members were fully compliant with its measures on anti-money laundering and counter-terrorist financing for virtual assets.

Other international organisations — like the G20, the world’s 20 biggest economies — have also helped drive the adoption of rules to govern crypto.

The G20′s watchdogs at the Financial Stability Board promised to review how well its policy recommendations have been implemented by the end of 2025.

The International Organization of Securities Commissions also came out with recommendations for DeFi which caused backlash from the industry.

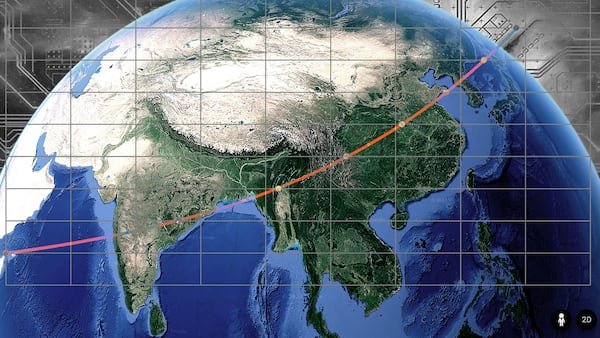

The idea is that these international bodies can help harmonise an otherwise fragmented policy landscape. Big differences across jurisdictions would make it difficult and costly for crypto firms to comply with all the different regimes.

“The reality is that national priorities are always going to differ somewhat,” Ang said. “I think we will end up in a similar place as traditional finance where approaches are aligned but implementation will vary.”

Countries push regulation

Jurisdictions have had a big year pushing forward their crypto regimes.

In the last year, the European Union approved the Markets in Crypto-Assets law. Before MiCA goes live by the end of the year, member states like France and Germany have updated their own rulebooks.

The UK introduced a firehose of new laws, and is preparing another comprehensive framework that optimists hope can be completed this year.

Its Financial Conduct Authority, and the Bank of England launched its new Digital Securities Sandbox to boost financial firms’ blockchain development on January 8.

In the US, regulators have cracked down with a barrage of lawsuits against crypto crypto firms handling alleged unregistered securities.

The government’s Treasury Department proposed new regulation to target crypto mixers and sanctioned illicit actors.

Hong Kong introduced a new regime for virtual asset service providers, and Singapore finalised its legal framework while implementing consumer protection rules.

As a result, which should not be surprising, “countries with full licensing and supervision regimes have lower rates of illicit activity than those in less regulated jurisdictions,” according to TRM Labs.

Inbar Preiss is a Brussels-based regulation correspondent. Contact her at inbar@dlnews.com.