- European Union member states are laying down new laws to facilitate the bloc’s crypto regulations.

- Lithuania plans to tighten crypto regulation while Poland is giving firms more time.

- The Czech Republic has the most crypto entities registered among EU countries.

The European Union’s crypto sector is getting revamped.

Countries across the 27-nation bloc are preparing for the new Markets in Crypto-Assets regulation, or MiCA, which will forever change the rules for the industry.

In February, Poland became the latest nation to introduce laws to kick-start a new regime for the 1,187 businesses registered there.

The transition begins

The overhaul marks the start of its transition to conform with the bloc’s new rules for virtual asset service providers, or VASPs, by the end of 2024.

“This law is filling in all those details needed in order for MiCA to function in Poland and for crypto asset service providers to be able to comply,” Jarosław Nowacki, partner and founder of law firm tau.legal, told DL News.

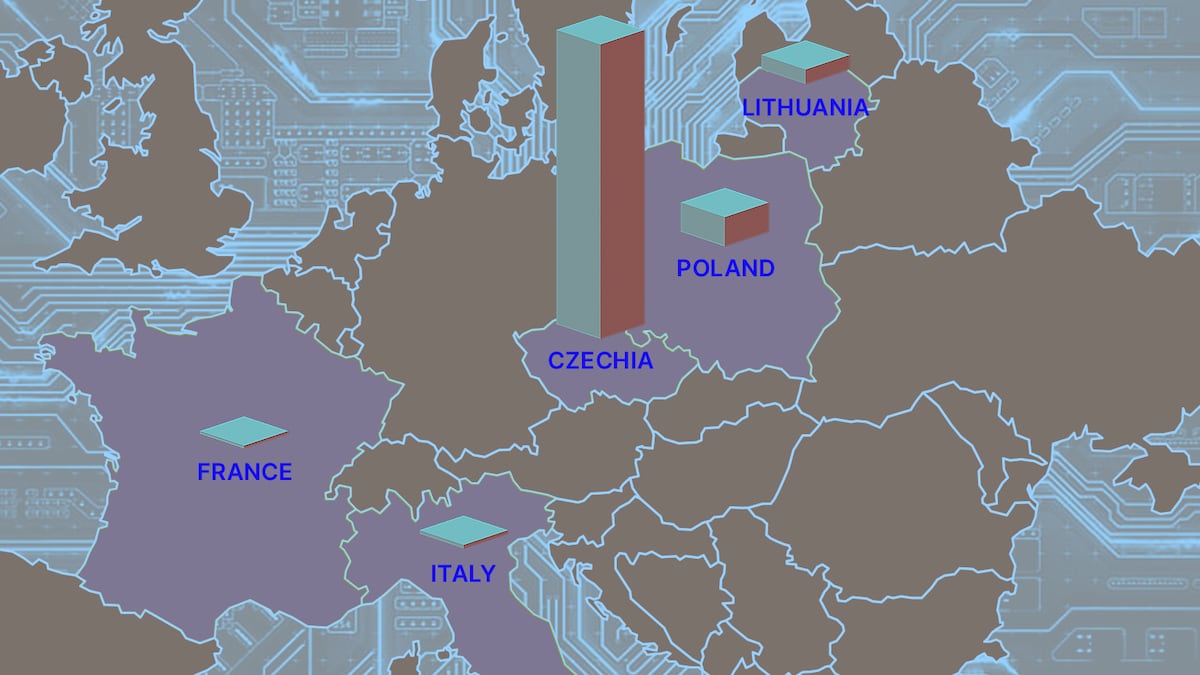

The Czech Republic, Poland, and Lithuania have the most crypto outfits registered with local financial authorities, according to data collected by DL News.

Cheap, fast and easy registrations have allowed scores of firms to open up shop, even if some are not physically present in these countries.

However, MiCA may put an end to the party as the landmark regulation sets tougher standards for firms offering crypto products.

On the plus-side, it will also allow firms to access the whole EU market with a licence from a single member state.

Czech VASPs

The Czech Republic leads the charts with 9,372 individuals and firms registered, according figures last updated in May 2023.

Czech authorities did not respond to DL News’ repeated requests for updated data. There is no online register.

Both the Czech Republic and Poland allow individuals to register as VASPs.

‘They have a fair amount of work to do given their existing anti-money laundering regime is rather light touch.’

— Neil Samtani, CEO VASPnet

While Poland is striding ahead toward MiCA implementation, the Czech Republic’s road map is less fleshed out.

“The Czech Republic has a lot of work ahead of them with a high number of existing registrants to process and little reported so far on progress made on MiCA,” Neil Samtani, CEO of VASPnet, a firm that analyses data on VASPs, told DL News.

Capital requirements

Lithuania comes third place with 569 entities registered.

“Unlike Poland or Czech Republic, registrants are mostly companies, not natural persons, and this is likely due to the €125,000 minimum share capital requirements,” Samtani said.

Lithuania announced it will tighten national laws on crypto in December, when authorities published draft laws that would overtake MiCA.

“They have a fair amount of work to do given their existing [anti-money laundering] regime is rather light touch and involves only a notification process,” Samtani said.

Price tag

One of the ways these countries have been able to attract more crypto entities to register is by offering cheap and efficient sign-up.

In the Czech Republic, it costs about €40 to notify the regulator, in contrast to Italy, where companies can expect to cough up €8,300 for a registration.

In Poland, the new draft law suggests that it will cost a crypto venture a minimum of €4,500 to get licensed under MiCA, Nowacki said.

At present, it takes only two weeks and less than €150 in fees to register as a VASP in Poland.

New regimes

France is among the top five countries in the European Union when it comes to development of the crypto market. There are 103 registered VASPs listed in France.

The country also leads the EU in MiCA implementation. In July, the country established a MiCA-like regime in place for new market entrants.

Still, there is a long way to go until the industry gets on board, and the clock is ticking.

Société Générale’s digital assets arm, SG Forge, is the only business in France that is authorised under the country’s tougher MiCA-like regime.

Meanwhile, in Italy, 129 entities are registered.

“Italy currently has open consultations on their implementation of MiCA, which signals they’ve done the lion’s share of the work, and it’s likely we will not see many changes to their proposed regime,” Samtani said.

Transitional phase

Under MiCA, countries in Europe can choose to extend the deadline in which companies already registered need to comply with the new laws by up to 18 months.

Yet the European Securities and Markets Authority, which oversees part of MiCA’s implementation, warned not to take more than12 months.

Lithuania has decided to scrap the transitional period and have MiCA laws take effect on December 30. And Italy recently announced a 10-month transition.

Poland will give registered companies an extra year, Nowacki said.

“After the end of 2025, this current registry will cease to exist,” he told DL News. “Before that, firms can operate on the basis of the currently obtained registration.”

But Poland’s registry may shrink before the 2025 deadline, Nowacki said.

If a VASP fails to file a quarterly data report to Poland’s financial intelligence unit, or if a business fails to respond to an audit request from regulators, it may be deleted from the CASP register.

Inbar Preiss is DL News’ Brussels correspondent. Contact the author at inbar@dlnews.com. Ana Ćurić is a data journalist. Contact her at ana@dlnews.com.