- A dual definition of e-money tokens in MiCA has experts ringing alarm bells.

- Stablecoin laws come into effect on June 30.

- A new regulation may fix the problem.

There’s only two months to go before Europe’s hotly anticipated Markets in Crypto-Assets rules, or MiCA, go into effect.

And Europe’s crypto industry and legal experts are ringing alarm bells.

Experts worry that the regulations are so onerous and confusing that they will drive out some stablecoins starting on June 30 when the laws kick in.

It will be a “complete mess,” said Victor Charpiat, a lawyer at Kramer Levin Naftalis & Frankel, a global law firm.

Crypto confusion

The problem lies in a double definition of so-called e-money tokens, or EMTs. Those are stablecoins that are pegged to a currency, like the euro or the dollar.

Two popular stablecoins in this category dominate crypto markets. Tether’s USDT has a market value of $110 billion, and Circle’s USDC has $33 billion, according to CoinGecko.

That confusion stems from “crypto platforms not understanding how they should handle EMTs, and opposing interpretations coming from different national regulators,” Charpiat told DL News.

The worst case scenario would be to resolve the issue at the European Court of Justice, he said.

The term e-money tokens is defined twice in the MiCA text, which became law almost a year ago. The first defines EMTs as a type of crypto asset.

The second definition implies that e-money tokens are equivalent to electronic money — a term used since 2000 as digital cash.

Delistings may happen if the rules aren’t cleared up.

“Like many other cryptocurrency exchanges, we have mitigating plans in place to delist coins if issuers are not regulated by June 30,” a spokesperson for crypto exchange Bitstamp told DL News.

An industry letter sent to EU regulators and lawmakers seen by DL News warned that the current text could “lead to a significant drop in economic activity around EMTs in the EU.”

Chilling effect

Financial institutions handling e-money fall under more burdensome regulations for payment services — more so than crypto asset service providers.

The dual definition in MiCA could create “a chilling effect on the development of e-money tokens in Europe,” said Mark Foster, EU policy lead at the Crypto Council for Innovation.

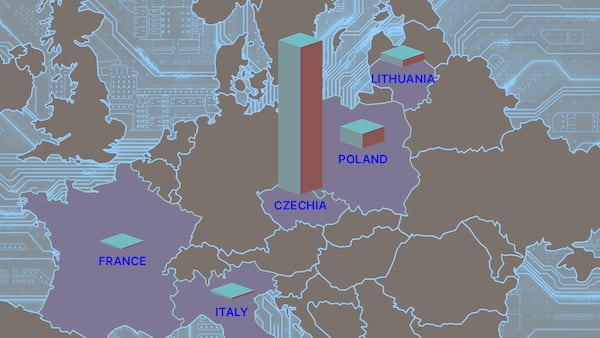

“If EU rules are so onerous that a viable, commercial business case cannot be made, firms will naturally seek out other jurisdictions, which undermines the value of the EU regime,” he told DL News.

Europe’s crypto advocates are rallying to obtain short-term clarity from regulators, and a longer-term fix within the EU’s bill revising rules for payment services, which lawmakers in the European Parliament moved ahead in a vote on Tuesday.

Payment Services Regulation

The Payment Services Regulation, or PSR, bill passed a plenary vote to move on to the next phase of negotiations.

In the text, lawmakers wrote: “To avoid duplicative requirements, it is important [to] clearly set out the instances where electronic money tokens should instead be subject to this Regulation.”

Another amendment to the bill said that “payment transactions used for the execution of trading and settlement services using electronic money tokens” — the ones defined as crypto assets — are excluded from the PSR.

That would potentially be a relief for the industry.

Negotiations will continue with finance ministers after the European elections in June. And the text signals that the EMT issue will be addressed.

Three-year gap

“Industry is encouraged that parliament has understood the importance of clarity for EMTs,” Foster said.

But this regulation, if it passes the rest of negotiations between Parliament and finance ministers in the Council of the EU, won’t go live until at least 2027.

That leaves around a three-year gap between the PSR and MiCA.

“We hope to have clarity before MiCA applies,” Foster said.

Otherwise, once the laws come into effect, crypto platforms may not know whether they need to comply with payment services laws or crypto asset laws to custody and transfer EMTs.

Investors would have different tax implications on their EMT holdings, and it would determine how they can use their EMT funds.

As crypto firms and investors engage with lawyers and regulators, they will reach opposing conclusions, Charpiat said.

That could lead to litigation. National regulators may give different interpretations to the financial firms handling EMTs that they are supervising.

The European Banking Authority, responsible for implementing and supervising stablecoin laws, told DL News it is “taking steps to promote convergence in the application of MiCA” together with the European Commission.

The European Commission, which first drafted MiCA, said that “EMT issuers can only be e-money institutions and credit institutions.”

They would need to be “licensed either under the E-Money Directive, or have a banking licence,” a spokesperson said.

E-money token issuers

“There is a dual regime that applies because an e-money token is at the same time a crypto asset and also e-money,” Patrick Hansen, Circle’s senior director for EU strategy and policy, said at a Frankfurt conference in February.

For global stablecoin players like Circle, which issue e-money tokens in other jurisdictions, including the US, issuing such a stablecoin in the EU means navigating “complex and challenging double issuer constructs,” he said.

It isn’t clear for which activities — from trading to payments — which definition would apply.

Circle has applied for an e-money institution licence in France.

Tether, which has been in regulatory crosshairs, is also busy unpacking MiCA’s “complexities,” on e-money definitions and EU requirements, a spokesperson said.

Tether is “working to consider the impact of these provisions.”

Jon Egilsson, chair and co-founder of euro-backed stablecoin issuer Monerium, is more optimistic.

“We are MiCA compliant today, that’s not an issue,” Egilsson said. That’s because Monerium is a licensed e-money institution from 2019. But that has come with a high regulatory cost that other firms will need to start facing once MiCA comes into force.

“We have to be audited, we have to submit reports on a regular basis — it is a lot of cost in order to operate,” he told DL News.

Up until now, “other players that we compete with, they are allowed to operate without any licence.”

Egilsson and others argue that the rules for payment services were not designed with blockchain technology in mind.

Those laws are designed to protect the customer if an institution transfers funds on behalf of a customer, using a third party for settlement.

“In web 3, the transaction is the settlement,” he said. “This means that the blockchain network is the payment rail.”

Inbar Preiss is a Brussels-based regulation correspondent. Contact her at inbar@dlnews.com.