- Lawmakers have vowed to probe whether crypto firms and founders are being 'debanked.'

- Regulators may simply be issuing guidance to lenders, experts say.

- The issue has become a lightning rod for crypto leaders.

A version of this story appeared in our The Guidance newsletter on December 16. Sign up here.

Debanking or derisking? Which is it when a crypto venture or founder is dropped by a bank?

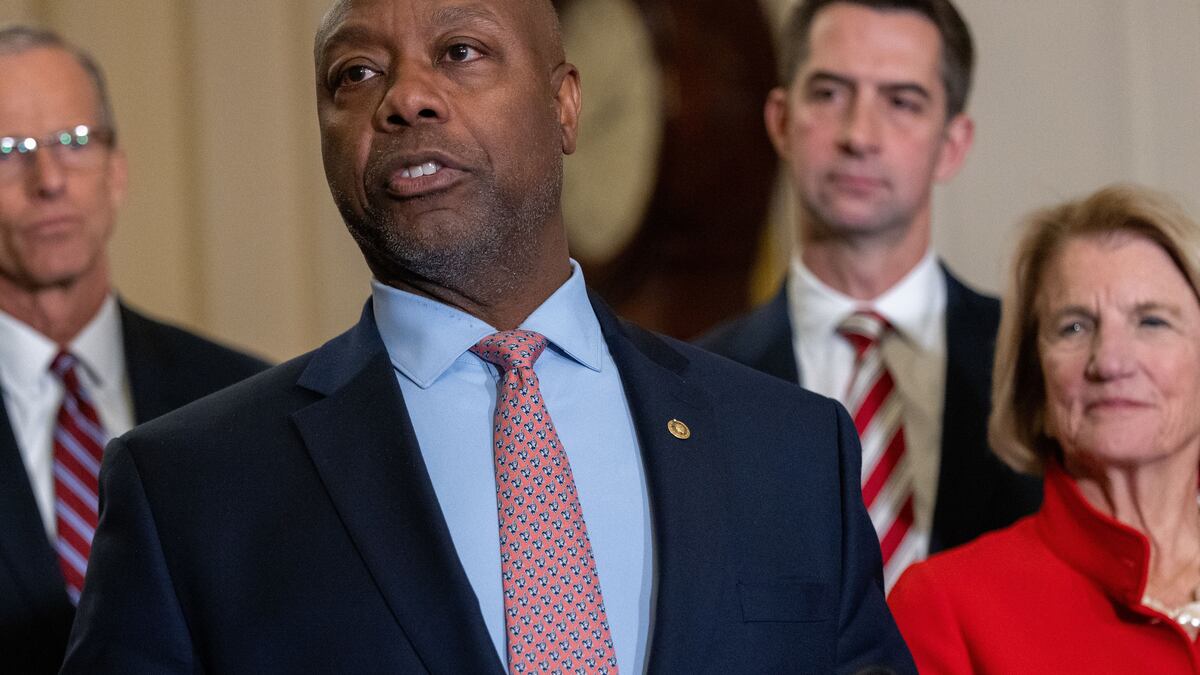

That’s the big question for the new Congress after being sworn in on January 3. Statements made this month by influential lawmakers Senator Tim Scott and Representative French Hill signal the debate is just getting started.

This long simmering issue came to a boil as Marc Andreessen and Brian Armstrong added their voices, to industry accusations that the Biden administration has been goading banks into dropping accounts for crypto firms and founders.

Questions will be asked

Hill, the next chair of the powerful House Financial Services Committee, has promised to investigate the matter. Scott has also suggested questions will be asked.

Yet coming up with a definitive answer to whether a spate of dropped accounts amounts to “Operation Chokepoint 2.0” isn’t going to be simple, Aleks Gilbert reports.

For starters, bank regulators such as the Federal Reserve and the Federal Deposit Insurance Corporation are obliged to supervise lenders and make sure they’re not jeopardising their businesses with high-risk clients.

Ordinary depositors, after all, trust banks to safeguard their savings.

As Patrick McKenzie, an adviser to payments giant Stripe, pointed out in an essay banks often “derisk” their balance sheet by dumping clients that are too risque.

Sometimes they do it on their own, and sometimes they receive guidance from bank supervisors.

In the wake of the 2008 global financial crash, for instance, bank regulators urged lenders to use caution when dealing with companies that offered subprime mortgages and auto loans.

Bad actors

Officials also cracked down on banks’ tolerance for bad actors that used accounts to launder criminal proceeds.

In some cases, well established banks failed stress tests because they were inadequately managing risk.

In that same period, the Obama Administration promulgated a plan called Operation Chokepoint urging banks to reduce their exposure to payday lenders, gun manufacturers, tobacco retailers, and pornographers.

‘No legal business should ever be debanked.’

— Senator Tim Scott

Now, crypto leaders are contending they’ve been unjustly swept up in a sequel to that crackdown. And they’re finding a receptive audience on Capitol Hill.

“No legal business should ever be debanked,” Scott, the Republican who is poised to become the new chair of the Senate Banking Committee, said in a hearing last week.

Itemising risk

Yet should Hill or Scott call hearings on the issue, the crypto industry may find the results a bit uncomfortable.

Regulators called to testify could be asked to itemise the risks lenders must manage when they bank crypto firms.

Given the alleged roles crypto played in Russian money laundering operations, $460 million in ransomware attacks, and funding North Korea’s nuclear weapons programme, among other illicit activities, the list might be a long one.

Edward Robinson is the story editor for DL News. Contact the author at ed@dlnews.com.