- The race is on to be the European Union's crypto hub.

- DL News is following the rate of crypto firm registrations across the bloc.

- Member states must change their practices ahead of the landmark MiCA law in 2024.

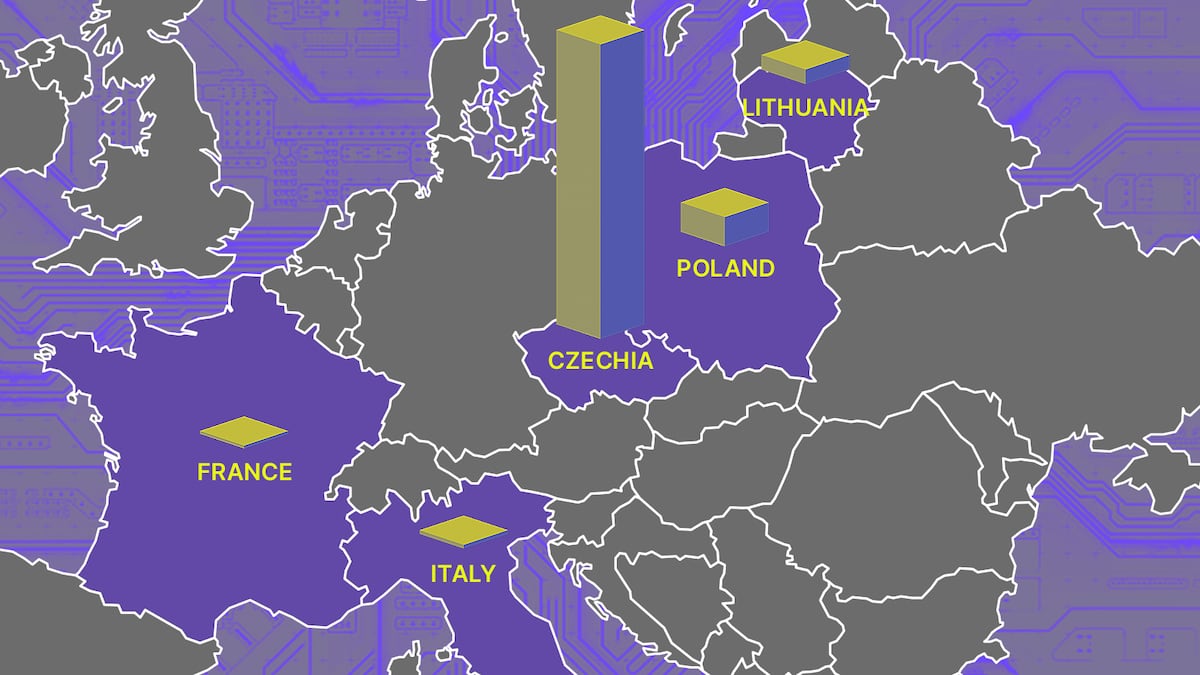

Czechia is miles ahead, Italy and France are gaining, and Belgium is missing in action.

Those are a few of the surprising results in the latest showing of the DL News Europe Crypto Tracker.

With the Markets in Crypto-Assets law, or MiCA, set to come into effect by the end of 2024, we wanted to see which locale will be the next crypto hub in the European Union.

So DL News compiled data from every crypto registry we could across the 27-member bloc.

Last month we reported that Poland led the pack thanks to its simple and affordable process for registering crypto firms.

This week, officials in Czechia responded to our longstanding request for crypto registration data and the result was a true eye-opener: the Ministry of Finance said there were 9,372 virtual asset service providers, or VASPs, registered in the Central European nation as of May 2022.

That’s about 10 times more than second-place Poland.

Here’s the catch: About 83% of those entities are people.

Poland also permits Individual applicants to qualify as crypto legal entities; and about a third of its roster of 971 entities are people.

In a letter to DL News, Jiri Beran, the director of of the Financial Markets Department in the Czech Ministry of Finance, said it wasn’t possible to provide a complete list of VASPs at this time.

It’s likely more crypto firms have registered in the last 14 months.

Running down the entire list, several takeaways jump out:

- The Czechs flex: Today, crypto firms in Czechia only need a special trade license, which can be obtained in a few days, Dalibor Cerny, an attorney from the Sparring.io law firm, told DL News. The country also hosts a lively crypto scene, with firms like the popular hardware wallet Trezor, and the first Bitcoin mining pool Braiins, formerly Slushpool.

- Italian speed: Italy’s third place showing was an eye-opener but the Mediterranean nation has become a top destination for crypto firms thanks to a super-fast registration process that doesn’t check the anti-money laundering requirements before approval.

- French clarity: The government of President Emmanuel Macron has executed a number of policies to attract cryptocurrency firms, including tax breaks on digital asset profits and MiCA-ready licences.

- Concentration at the top: About 96% of the 11,474 total crypto entities are registered in five nations: Czechia, Poland, Lithuania, Italy, and France. At the other end, six countries have less than 10 registrants: Hungary, Ireland, Cyprus, Germany, Finland and Latvia.

- Underachievers: We were surprised to see Cyprus, a longtime crypto-friendly nation and tax haven, with so few firms — just seven, all registered in 2022 and this year. Belgium, home to the EU’s capital, has zero. (We’ll report why in a story to come soon.)

MiCA changes everything

The rules around establishing crypto firms in the EU are poised to shift profoundly in 2024. Unlike the muddled regulatory picture in the US, the MiCA law will provide much desired clarity for crypto ventures.

MiCA will knock out the different systems in EU countries and replace them with a uniform set of rules to license crypto firms.

Looking ahead, France and Malta are already tailoring their domestic crypto regimes to MiCA.

And that’s a big plus for heavy hitters such as Binance and eToro, the Israeli-British discount brokerage, both of which have registered in France under its new MiCA-compliant licence.

By installing rules now for a post-MiCA world, regulators may provide businesses with something they crave: predictability.

Our data indicate this trend will accelerate in the months to come and shake up the race to be Europe’s top crypto hub.

Have a tip about crypto in Europe? Contact the authors at inbar@dlnews.com and ana@dlnews.com.