- The legal problems Binance faces in France may block its access to the EU as new crypto laws kick in.

- If French regulators reject Binance, other EU states may do the same.

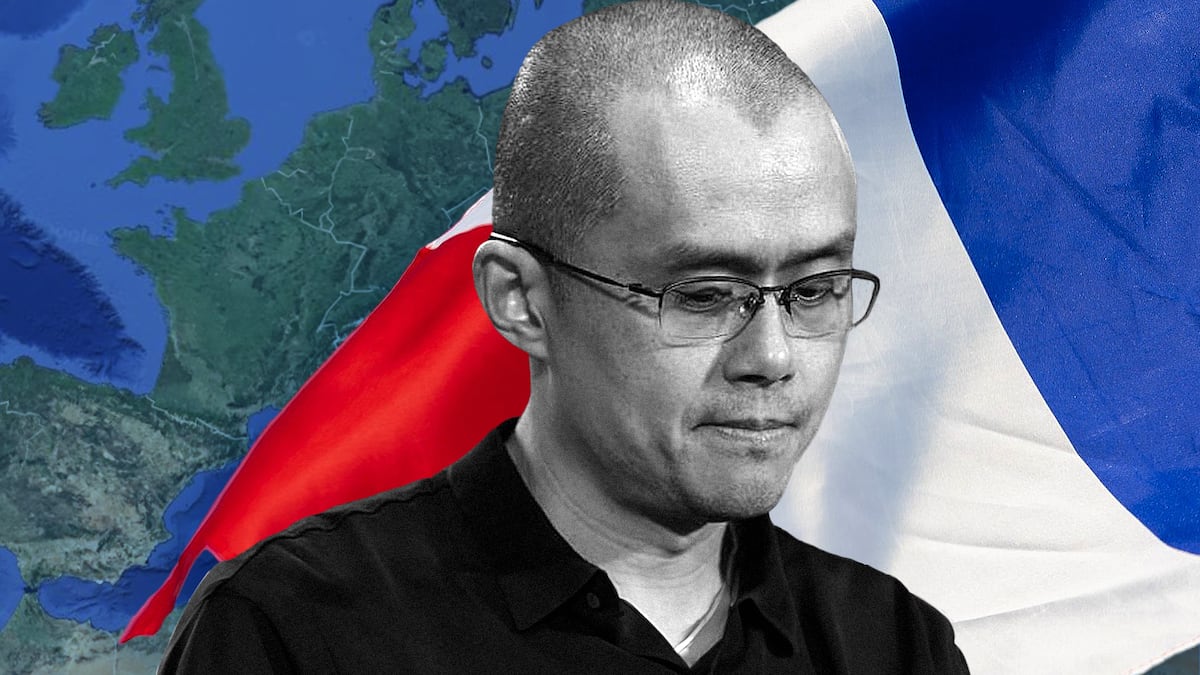

- Regulators may withdraw Binance’s registration as convicted former CEO Changpeng Zhao is the sole shareholder of French unit.

Binance faces legal hurdles in Europe that threaten the exchange giant’s access to the EU market.

Europe’s crypto rulebook known as the Markets in Crypto-Assets regulation, or MiCA, will force regulators to make a call on whether the legally entangled Binance has a place in the bloc.

Binance has soared to a market-dominating position in the crypto industry, helped by its significant hub in France. Its subsidiary, Binance France, is registered with the Financial Markets Authority, or AMF.

But a convicted criminal as the sole shareholder will make regulators in France think twice about the MiCA licence Binance needs to operate in Europe.

“This is a matter of life or death for Binance,” said William O’Rorke, lawyer and partner at crypto-focused law firm ORWL, told DL News. “MiCA should apply everywhere equally. If a company is rejected in France, it should not be authorised elsewhere in Europe.”

If French regulators don’t see Binance as fit for MiCA, the rest of the European countries would also be poised to turn it down.

Changpeng Zhao — Binance founder, former CEO and convicted criminal in the US — will face his verdict in a Seattle court on Tuesday. Zhao pleaded guilty to money laundering charges in November.

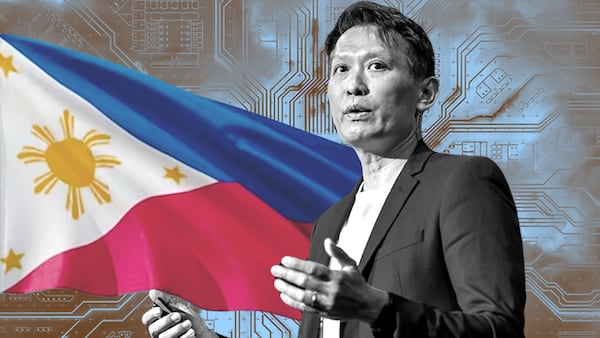

New CEO Richard Teng is tasked with cleaning up — and has tried to polish its tarnished reputation as a law-evader over its seven-year existence.

Sole shareholder

Zhao remains a 100% shareholder of Binance France.

“If you have a criminal conviction, there is a high risk of having your approval withdrawn,” O’Rorke said. “This is basic French regulation.”

The AMF did not immediately respond to a request for comment.

Zhao may not be able to remain a significant shareholder if Binance is to survive in France as a regulated body.

“Sooner or later the AMF will need to propose a solution, perhaps change the percentage Zhao owns,” he said. “As a regulatory lawyer, I’m asking myself how they will deal with it.”

Binance has been registered with the AMF as a digital asset service provider since 2022.

This registration, based on compliance to anti money-laundering rules, will allow Binance to serve users in France until the end of the transitional period that French regulators extended to December 2025.

After that, Binance will need to earn a MiCA licence in one EU member state, which it can then use to access all 27 countries.

MiCA lays down additional rules for crypto exchanges to prevent market abuse, bolstering security policy, rules for marketing and publishing disclosures on listed assets.

Binance in France

France is an “important jurisdiction” for Binance in Europe, O’Rorke said.

Zhao fostered close relationships with officials, and praised French President Emmanuel Macron for his innovation-forward policies.

Binace also spent €100 million on blockchain research and development in France in 2021.

But in June, following allegations from US authorities, the Paris public prosecutor opened an investigation into Binance for suspicions of money laundering.

In December 2022, a group of investors sued Binance for €2.4 million marketing to French consumers illegally.

These two investigations are another potential block between Binance and its MiCA licence.

If one of them succeeds, it will threaten Binance’s ability to operate in Europe, O’Rorke said.

Raising standards

The Department of Justice charges against Binance combined with Teng’s commitment to structural changes, “can also be seen as good news,” O’Rorke said.

It means that the more powerful and resourced US regulators are doing the heavy lifting in forcing the company to change.

“US regulators can now make sure that Binance is compliant with high, global standards of anti-money laundering supervision in a way that French regulators would not have been able to.”

For example, part of the Binance deal with the DOJ is a monitorship with an independent auditing firm that will oversee the exchange’s operations and records for five years.

The stern cleanup of Binance stateside may trickle down to its subsidiaries in Europe.

Registrations

Binance in Europe has had a tough time.

It withdrew its licence application from Germany, deregistered from Cyprus and the Netherlands. Belgian authorities ordered a halt to its operations, but then offered services through its Polish entity.

But Binance has registered subsidiaries in Italy, Sweden, Lithuania, Spain and Poland.

“They have a lot of internal work to do,” O’Rorke said.

“The DOJ prosecution could either be the beginning of the end for Binance, or the opposite — it could be the start of a new regulated Binance.”

Inbar Preiss is a Brussels-based regulation correspondent. Contact her at inbar@dlnews.com.