- Latest action draws fire across the cryptoverse.

- Venture capitalist Katie Hahn said artwork shouldn't be designated a security.

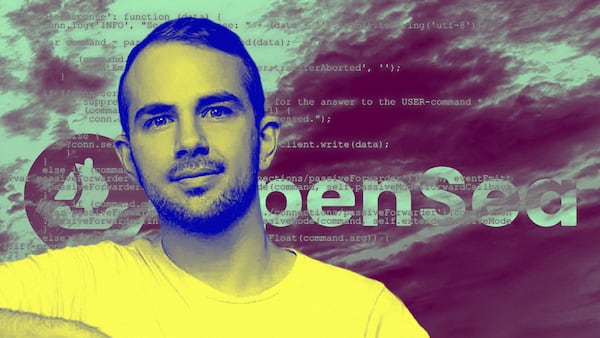

- The SEC move is the latest headache for OpenSea.

Gary Gensler sure knows how to rile people up.

Crypto luminaries reacted to the news OpenSea had become the latest target of the US Securities and Exchange Commission and its hard-charging chair with a mixture of outrage and befuddlement.

“This is obviously absurd on its face,” tweeted Kraken co-founder Jesse Powell.

“Gensler screws up again,” billionaire investor Mark Cuban posted on X.

“Congrats and welcome to the club,” quipped Coinbase CEO Brian Armstrong. “I’m long Wells notice companies.”

NFTs are securities?

After a quiet summer in the SEC’s three-year crackdown on crypto, OpenSea, the second biggest NFT marketplace, said Wednesday that it had received a notification — known as a Wells notice — it was the target of an investigation.

The issue, OpenSea CEO Devin Finzer said on X, is that the agency is probing whether NFTs sold on the site should be registered as securities.

The move would be consistent with Gensler’s longstanding contention that most cryptocurrencies are regulated under the same 90-year-old laws that govern stocks, bonds, and other securities.

While the SEC has accused Coinbase, Kraken, and Binance, among other ventures, of offering unregistered securities it now appears poised to designate NFTs the same way.

Congrats and welcome to the club!

— Brian Armstrong (@brian_armstrong) August 28, 2024

I’m long wells notice companies. https://t.co/cye8T5AlyS

The disclosure by OpenSea is just the latest dose of bad news as NFTs struggle to shake off a bear market. Volume on OpenSea has plunged 82% this year, to 240.6 ETH, according to DefiLlama data.

OpenSea, which was valued at $13 billion following a fundraising round in 2022, has lost its top position in the marketplace to archrival Blur, according to DefiLlama data.

‘Artworks and collectibles aren’t securities, whether painted on canvas or coded on a blockchain.’

— Katie Haun, Haun Ventures

No surprise, crypto supporters were agog at the notion nonfungible tokens, which tend to be digital images, should be regulated the same way as securities.

Katie Haun, the founder and CEO of Haun Ventures, also picked up in that thread.

“Artworks and collectibles aren’t securities, whether painted on canvas or coded on a blockchain,” said Haun on X. Her firm is an investor in OpenSea.

As it happens, museums and fine art auction houses such as Sotheby’s and Christie’s have continued to utilise NFTs even as their popularity has cratered.

Anthony Scaramucci, the hedge fund manager and crypto investor, expressed astonishment at the development.

“Gary Gensler, are digital US Open tickets now a security?” he tweeted referring to the pro tennis tournament underway in New York.

The @SECGov is now trying to claim that NFTs are securities. What's next? Baseball cards? Comic books? @GaryGensler's bad faith and un-American war on crypto is expanding. Digital web3 creators and artists are now in the crosshairs. https://t.co/boCbFI0O3p

— Tyler Winklevoss (@tyler) August 28, 2024

Tyler Winklevoss, the co-founder and CEO of Gemini, said the news was the latest sign the SEC’s “war on crypto is expanding.”

“Digital web3 creators and artists are now in the crosshairs,” he said.

‘They’re not dumb.’

For his part, Kraken’s Powell speculated the SEC was just trying to monkeywrench the industry and cared little for the merits of its actions.

“They aren’t that dumb. The point isn’t to win,” Powell complained. “The Point is to distract, waste resources, spread fear, uncertainty and doubt and slow us down.”

A spokesperson for the SEC said the agency would not comment on the “existence or nonexistence of a possible investigation.”

Osato Avan-Nomayo is our Nigeria-based DeFi correspondent. He covers DeFi and tech. To share tips or information about stories, please contact him at osato@dlnews.com.