- Paul Grewal obtained 'pause letters' sent by the FDIC to banks.

- Coinbase used a Freedom of Information Act request to obtain documents.

- Development is bound to intensify simmering debate over 'debanking' in crypto.

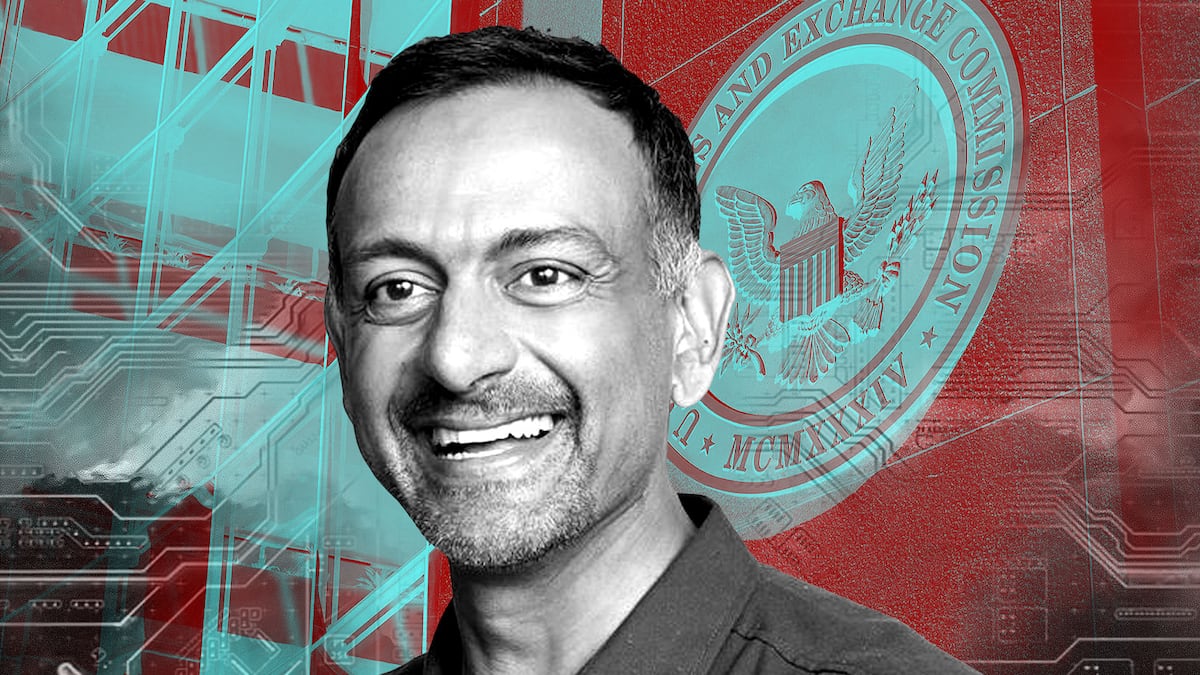

In the latest salvo fired in the debate over debanking, Paul Grewal, the chief legal officer of Coinbase, said Friday that a plot by the Biden Administration to press lenders to drop crypto clients was “no conspiracy theory” but a very real plan.

The lawyer said he now has the evidence to prove it — documents from the Federal Deposit Insurance Corporation.

“The letters show that this was… not just rank speculation or the musings of a paranoid industry,” Grewal said in an interview with CoinDesk, which first reported the news Friday.

“There was a concerted plan on the part of the FDIC that they carried out — without any reluctance — to deny banking services to a legal American industry.”

‘Pause letters’

Grewal said he was acting on information disclosed through Freedom of Information Act requests Coinbase submitted to the officials.

At the heart of the new data are the so-called “pause letters,” which appear to show the agency issuing guidance to lenders on crypto accountholders.

“We respectfully ask that you pause all crypto asset-related activity,” said one letter sent by the FDIC and obtained by Coinbase.

Grewal said this and other letters, most of which date to 2022, reveal that the government was intent on diminishing banking services for the crypto industry.

Dubbed Operation Chokepoint 2.0, the purported policy has inflamed the passions of crypto leaders who contend they are being singled out by Washington officials.

Two weeks ago, Marc Andreessen, the billionaire VC, triggered an outpouring of criticism from crypto heads when he went on Joe Rogan’s podcast and said he knew of 30 tech leaders who had been dropped by their banks.

“Tech and crypto founders: keep telling your stories of debanking,” said Nic Carter, a crypto VC and influencer who has been advocating against debanking for some time. “Don’t let the critics pretend it didn’t happen.”

Extra steps

It is normal practice for the FDIC and other banking watchdogs to send guidance on risks to lenders as part of their responsibility of protecting depositors.

Lenders, after all, are licensed institutions that have an obligation to err on the side of caution when it comes to providing banking services. And crypto, with its record of fraud and money laundering, has long been deemed a high-risk sector.

Sometimes bank supervisory agencies will ask lenders to take extra steps to safeguard the strength of their balance sheets.

The new information revealed on Friday showed that the FDIC requested banks not proceed with account approvals until applicants reported cost-benefit analyses for their products, and income projections to ascertain the financial feasibility of their business plans.

But Grewal vowed to take steps to reveal more of the content in the documents, which were heavily redacted.

“FDIC is still hiding behind way overbroad redactions,” Grewal tweeted. “And they still haven’t produced more than a fraction of them.”

Pedro Solimano is a markets correspondent for DL News based in Buenos Aires. Contact the author at psolimano@dlnews.com.