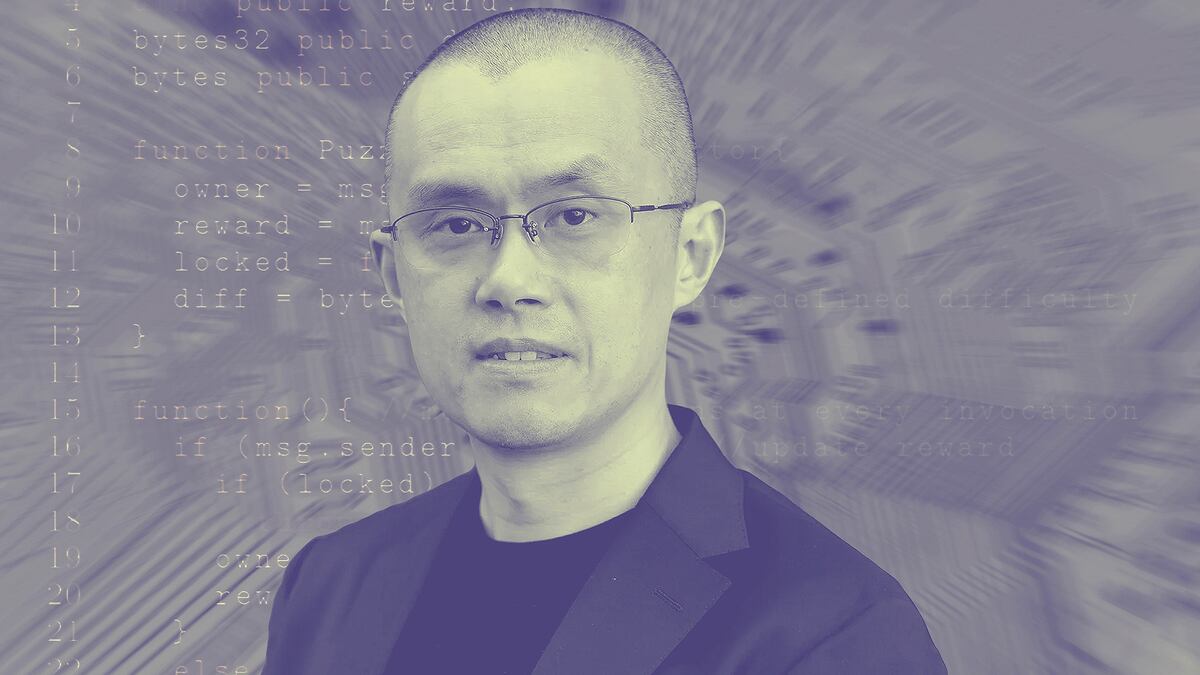

- A new class action lawsuit against Binance claims CEO Changpeng "CZ" Zhao “recklessly” shared information online that caused the collapse of FTX.

- Zhao’s motive was to take down a competitor and “monopolise the cryptocurrency platform market,” the lawsuit alleges.

- Binance says the case “is without merit” and that it will defend itself.

Binance CEO Changpeng “CZ” Zhao’s personal “vendetta” saw him post misleading information that caused FTX’s collapse, according to a new class action lawsuit against the world’s largest crypto exchange.

The lawsuit was filed as Sam Bankman-Fried, the former FTX CEO, faces his first day in court where he will fight criminal charges relating to the collapse of his crypto empire last November.

The class action lawsuit accuses Zhao of issuing false and misleading statements about FTX in a bid to take down a competitor and “monopolise the cryptocurrency platform market.”

“When an opportunity to hurt FTX Entities arose, Zhao did not hesitate to trigger the collapse of FTX Entities stock in the market,” the lawsuit claims.

Lawyers representing a California resident named Nir Lahav and other FTX retail investors filed the suit on Monday.

Zhao’s actions ultimately led “to a rushed and unprecedented collapse of FTX Entities” and ended up hurting Lahav and other retail investors when FTX became insolvent, the lawsuit alleges.

The filing indicated that aggregate claims of the putative class members exceeded $5 million.

“The case is without merit and we will vigorously defend ourselves,” a Binance spokesperson told DL News in an email.

Representatives from Devlin Law Firm LLC, which represents Lahav and other investors, did not return requests for comment.

CZ’s tweets

FTX’s woes began when details of a balance sheet from Alameda Research — a trading company founded by Bankman-Fried — were published by CoinDesk on November 2, 2022.

The document showed that a significant portion of Alameda’s portfolio was locked in illiquid tokens and FTX’s native token FTT.

On November 6, Zhao wrote on Twitter, now X, that Binance would liquidate its remaining FTT holdings.

The announcement caused the token’s price to drop sharply, and FTX depositors responded by pulling funds out of the exchange until FTX eventually froze all withdrawals.

Bankman-Fried and Zhao then announced on November 8 that Binance would acquire FTX to help the exchange’s “significant liquidity crunch.”

However, Zhao pulled out of the deal the next day, and FTX wound up filing for bankruptcy on November 11.

What’s in the lawsuit

While Zhao said on November 6 that Binance would liquidate its FTT assets, the exchange had already sold $530 million worth of FTT on November 5, the lawsuit claims.

“Defendants knew and recklessly disregarded the false and misleading nature of the information they caused to be disseminated to the investing public,” the filing says.

In regards to the botched deal to buy FTX, the suit claims “Zhao never had a good faith intention to actually acquire FTX Entities.”

Zhao announced that the deal would not go ahead on November 9 on X, tweeting, “Sad day. Tried but” followed by a crying emoji, which the lawsuit described as “crocodile tears.”

Yet another headache for Binance

The lawsuit piles on to Binance’s legal woes.

The exchange and Zhao already face civil lawsuits from the SEC for violating a variety of securities laws, and from the Commodity Futures Trading Commission for looking the other way on activity involving sanctioned entities.

But the industry is also bracing for the possibility of US prosecutors eventually levelling criminal charges against Binance and Zhao.

Crypto investors are keeping a close eye on what law enforcement has in store for Binance. For crypto markets, the effect of a criminal lawsuit and/or a shutdown of the exchange could be catastrophic.

“If anything was to happen to an entity of that size, most likely that would have a cascading effect on tokens or crypto and not necessarily on other products that are used for more straightforward use cases,” Yiannis Giokas, senior director of product innovation for Moody’s Analytics, recently told DL News.

Got a tip on Binance? Contact the authors at inbar@dlnews.com and tcarreras@dlnews.com.