- So-called real-world asset tokenisation has generated a lot of hype in recent years.

- Its backers say it automates inefficient processes in financial markets.

- But these benefits could be achieved with better tech than blockchain, Hilary Allen, a professor at American University's law school, said on Wednesday.

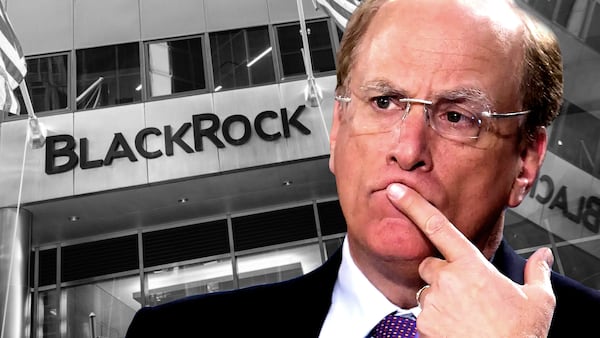

Wall Street giants — from investment banks like JPMorgan to the world’s largest asset manager BlackRock — are touting the benefits of issuing and processing securities onchain.

These firms say so-called tokenisation of assets, from stocks and bonds to art and real estate, will automate what are currently inefficient and error-prone operations in financial markets.

However, all these benefits could be achieved with other kinds of ledgers and databases than blockchain, a finance academic told Congress on Wednesday.

“Crypto runs on permissionless public blockchains, and tokenisation does not need to,” Hilary Allen, who is a law professor at the American University Washington College of Law, said.

Allen was testifying in a hearing convened by the House’s Subcommittee on Digital Assets, Financial Technology and Inclusion to debate whether tokenisation will facilitate efficient markets.

‘Blockchains suffer from inescapable inefficiencies and operational fragilities that make them unsuitable as supporting infrastructure for real-world assets.

— Prof Hilary Allen

Consensus concerns

Wall Street has dabbled in tokenisation for years, mostly — thanks to competitive and regulatory concerns — on closed, so-called “permissioned” blockchains.

More recently, however, banks have started testing the capabilities of public blockchains like Ethereum.

The problem is, these blockchains “suffer from inescapable inefficiencies and operational fragilities that make them unsuitable as supporting infrastructure for real-world assets,” Allen said.

For instance, consensus mechanisms — protocols for bringing the nodes of a blockchain into agreement to verify transactions — are ineffective and wasteful, she said.

That’s often by design — many blockchains have built-in delays, for instance — but this does mean they can’t process large volumes of transactions.

Additionally, governance is an issue.

The world’s financial markets run on centralised databases that are monitored for cybersecurity and operational risk, and that are subject to strict controls, rather than by unregulated and sometimes anonymous core developers.

When financial firms experiment with blockchain, they often address these scalability and governance issues by re-centralising control of certain processes, Allen said.

But that raises the question — “Why use the public, permissionless blockchain in the first place?” she asked.

Allen also took aim at the claim tokenisation projects make in their marketing — that they’re democratising finance by offering fractional ownership of assets usually inaccessible to ordinary Americans.

“I urge you not to pin your hopes on tokenisation as a means of improving financial inclusion,” she said.

“With so many Americans living paycheque to paycheque, the problem is not a lack of investment opportunities, but a lack of money to invest in the first place.”

Better rules

Allen sounded the lone sceptical note at the hearing.

Other witnesses represented firms exploring or actively involved in handling tokenised securities.

These witnesses called on Congress to ease legal and regulatory obstacles to tokenisation.

“Existing statutes and regulations were not designed with blockchain in mind,” Carlos Domingo, co-founder and CEO of Securitize, told lawmakers.

Securitize is the transfer agent for BlackRock’s tokenised fund BUIDL.

Among other measures, he called for improvements in the Securities and Exchange Commission’s licensing regime to allow brokers to safeguard digital assets.

The SEC introduced a special broker licence for this purpose in 2021.

However, Domingo said, it is “frustratingly difficult to achieve, limited in scope, and it isn’t clear which tokenised securities are eligible” for the licence.

Email the author at joanna@dlnews.com.