- The Bank for International Settlements' Innovation Hub is launching what it calls its most ambitious project yet for cross-border payments.

- A group of seven central banks hope to work with private financial firms to leverage smart contracts.

- The technology would help banks settle payments on blockchains.

- The news comes as Wall Street giants like BlackRock also eye the $14 trillion potential of tokenising assets.

Wall Street giants like BlackRock are excited about the potential of tokenisation to automate the plumbing of financial markets.

And central banks want a slice of that pie too.

The Bank for International Settlements is giving its cross-border payments systems an overhaul, in what it calls its most ambitious project yet.

The BIS, the Basel-based global forum of central banks, sees tokenising central bank money and deposits to leverage smart contracts as key to this transformation.

On Wednesday, it launched a blueprint for a project aiming to harness smart contracts to speed up the services central banks offer to global financial institutions.

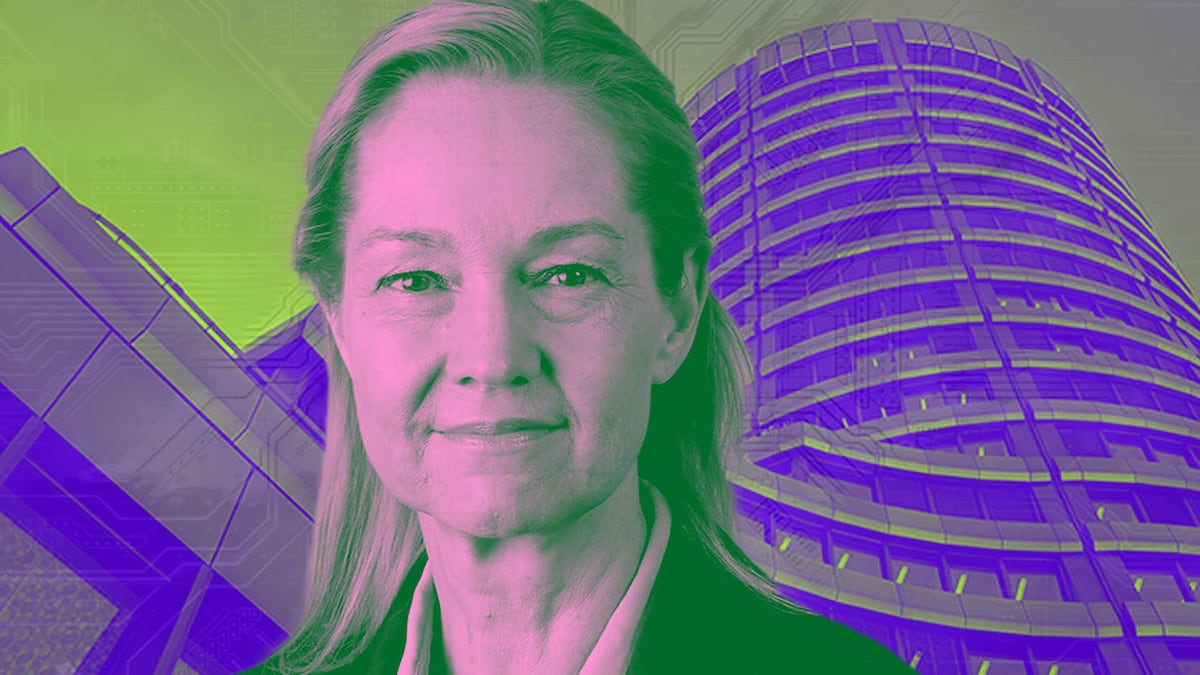

“Tokenisation is the next frontier in terms of the digitalisation of money and payments,” BIS Innovation Hub head Cecilia Skingsley said at a press briefing on Wednesday.

The BIS is hoping that smart contracts, which enable automated transactions when conditions are met on a blockchain, can speed up the heavy-footed process for banks to make cross-border payments.

Seven central banks are jumping on the new project dubbed “Agorá” by the BIS Innovation Hub.

These include the Bank of England, the Federal Reserve Bank of New York, and the French central bank representing the eurozone, as well as the central banks of Japan, Mexico, South Korea, and Switzerland.

Commercial financial firms may also join, but the BIS has no confirmation of participants yet. It will open a call for interest in the coming weeks, Skingsley said.

Tokenisation hype

Project Agorá comes as the tokenisation buzz is growing, with governments, regulators and financial institutions investigating how blockchain technology can make markets more efficient.

The US, UK and the European Union are among the jurisdictions offering experimental playgrounds for institutions to test out how tokenised financial instruments could work on blockchain under a regulatory microscope.

Larry Fink, CEO of Wall Street giant BlackRock — fresh off the wild success of Bitcoin spot exchange-traded funds — has said his true goal is “the tokenisation of every financial asset.”

And consulting firm Oliver Wyman estimates that tokenised assets could top at $14 trillion worth by 2030 in the private sector in a 2023 report.

While these efforts have had some initial success, they’re being done in isolation, the BIS says.

Tokenisation projects “have been hampered by the silos erected by each project and the resulting disconnect from other parts of the financial system,” the BIS said in a 2023 report.

How Project Agorá works

Project Agorá aims to bring more integration of the financial system by tokenising its own money so that it can settle payments on blockchains.

You may think of central banks as primarily the entities that lower or raise interest rates, as monetary policy is their most public function.

But central banks also facilitate the massive transactions that financial institutions engage in daily.

They provide so-called “final settlement” for these transactions, ensuring the buyer gets their asset and the seller gets their money.

Central banks do this in their own money, which ensures that everyone gets paid at par even if they’re using different currencies.

Achieving final settlement is easier said than done. Different systems have to talk to each other via messaging protocols.

With Agorá, the BIS hopes to unify all these systems — clearing, settlement, messaging — into unified ledgers, eliminating delays and uncertainty.

Under the project, central banks would tokenise their own money, creating central bank digital currencies, or CBDCs. That would ensure that settlement still occurred at par.

And on the financial institutions’ end, their deposits and assets would be tokenised, with properties and instructions encoded in underlying smart contracts.

Beating crypto

While blockchain promoters say the tech broadly promises to remove intermediaries, the BIS has contrasting goals.

“Our goal is to perfect the role of intermediaries in the international monetary system,” Hyun Song Shin, BIS head of research and economic adviser, said at the briefing Wednesday.

The project comes as the BIS worries that stablecoins and cryptocurrencies threaten to usurp some of the functions central banks perform in the global financial system.

While crypto shows the potential of tokenisation, the BIS said last year that crypto “is a flawed system that cannot take on the mantle of the future of money.”

It also “lacks the anchor of the trust in money provided by the central bank,” the BIS said.

Along with making payment processes more efficient, that’s why central banks are steadily moving towards claiming blockchain.

Inbar Preiss and Joanna Wright are regulation correspondents at DL News. Got a tip? Email them at inbar@dlnews.com and joanna@dlnews.com.