- Binance will argue on Monday that a judge should throw out its SEC lawsuit.

- The exchange says it never offered unregistered securities to US investors.

- Regulatory experts say the case could be an easier win for the SEC, boosting its chances against Coinbase in a parallel suit.

Binance will ask a judge to throw out the US’s securities regulator’s lawsuit against it at a public hearing scheduled for Monday.

Lawyers for the exchange will tell the Washington court that the Securities and Exchange Commission has not plausibly argued that Binance violated securities law.

Those are arguments the agency in previous filings has labelled as “absurd” and based on a “tortured interpretation” of federal securities laws.

They will also field questions from Judge Amy Berman Jackson on whether litigation is the appropriate way for the SEC to oversee the crypto industry, according to court documents filed this week.

The pre-trial hearing is set to argue Binance’s “motion to dismiss” — a way for defendants to scuttle a trial before it begins by arguing that a lawsuit has no validity.

The judge could agree, and decide to throw out all or part of the case. Or she could allow the case to proceed to a jury trial.

The case is about more than Binance.

A win will arm the SEC with new ammunition in its cases against rival exchanges Kraken and Coinbase, strengthening its bid to be the top crypto industry regulator in the US.

Allegations against Binance

The legal battle began in June when the SEC charged Binance with setting up shop in the US without registering as an exchange, broker-dealer, or clearing agency, as required by federal law.

Binance also let users buy and sell unregistered securities, the SEC alleged.

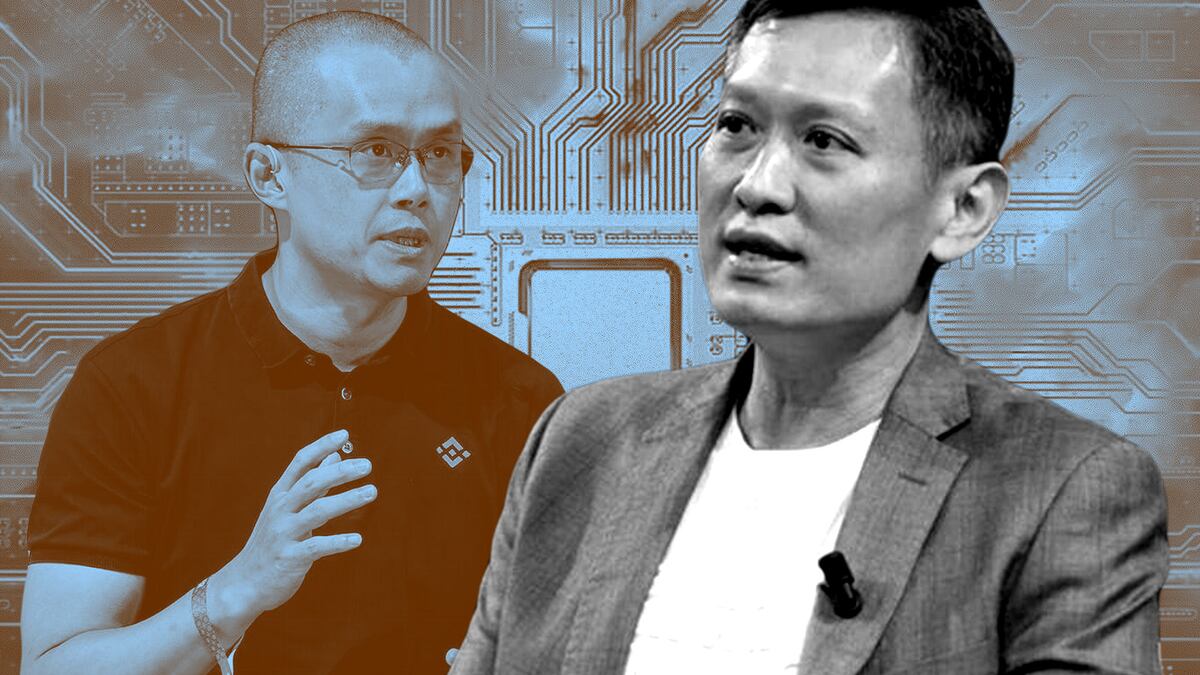

The regulator also alleged that Binance worked to evade legal scrutiny, and that executives, including founder and CEO Changpeng Zhao, committed fraud and lied to investors.

These charges are serious, and Binance could be seen as a relatively easy win for the regulator.

In September, Binance asked a federal court to dismiss the lawsuit, arguing the SEC was “seeking to achieve by litigation what it lacks by legislation” — a comprehensive regulatory regime for crypto.

It is this motion to dismiss the case that is scheduled to be heard on Monday, after severe weather conditions forced the court to postpone the hearing.

Bigger than Binance

For the SEC, the stakes are much higher than resolving a legal beef with one exchange, regulation experts say.

A win could set precedent, teeing up more court victories in parallel lawsuits with other exchanges like Coinbase and Kraken — ultimately bolstering the SEC’s claim to be crypto’s primary regulator.

The SEC has also charged these exchanges with violations of securities laws. But they are not charged with fraud or market manipulation or misrepresenting the facts to investors, as Binance is.

That’s why the SEC’s choice not to settle its case with Binance late last year hints at a canny long-term strategy, regulatory consultant Aaron Unterman told DL News at the time.

The regulator could have shared the limelight with the Treasury Department, and the Commodity Futures Trading Commission, which in November ended their own suits against Binance.

After all, that settlement was a big victory.

It ended the tenure of Zhao — who now faces a possible decade-long prison sentence — and netted a record penalty of $4 billion from the exchange.

But if the SEC had been part of that agreement, “it would have lost the opportunity to set a legal precedent with regard to the issue of whether crypto assets are in fact securities,” said Unterman, who is managing director at XReg Consulting.

The real issue for the SEC is settling the question of whether it has jurisdiction over crypto assets — whether they are investment contracts, and therefore fall into its domain, he said.

Settlements don’t set legal precedent, and courts don’t consider them in enforcement matters.

Coinbase went toe to toe with the SEC in its own motion to dismiss hearing earlier this week, parrying questions from a judge in a Manhattan court.

As each case plays out, the SEC’s claims to regulating crypto will be tested — and a Binance slam-dunk could give the regulator an edge.

Binance cleaning up its act

For Binance, the case is another hurdle on the way. Since the $4 billion fine, the exchange’s new CEO Richard Teng has publicly said that “mistakes” were made in the past, but that it has “now moved past them, we resolved those issues with US agencies.”

“Going forward, we are focusing on being a user-led organisation, but also a compliance-led organisation,” Teng said at a December event.

Teng has a regulatory background.

But his job won’t be easy. He must now shepherd the exchange, to its future as a law-abiding player in the financial establishment.

Despite the legal woes, crypto traders are flocking to Binance, with the exchange seeing inflows of about $3.6 billion in January alone, according to data from DefiLlama.

Binance declined to comment.

Reach out to the author at joanna@dlnews.com.