- Binance faces money laundering charges.

- Nigeri blames crypto exchange for collapse of its currency.

- Crypto is shrinking in Africa's most populous nation.

The allegations just keep coming.

Over the last 12 months, the Nigerian government has accused Binance of undermining its fiat currency, permitting criminals to launder dirty money on its site, and operating in the African nation without a licence.

Now, with the crypto exchange preparing to stand trial beginning Monday, officials have thrown another charge on the pile.

On Friday, Nigeria’s Information Ministry accused the world’s biggest crypto exchange of trying to pay officials to release Tigran Gambaryan, a senior executive detained in the nation last year.

“The government rejected Binance’s offer of a $5 million down payment in exchange for Mr. Gambaryan’s freedom,” said Mohammed Idris, the minister of Information and National Orientation, in a statement posted on X.

Latest salvo

He said the government opted for a “more beneficial settlement” with Washington before releasing the ailing Gambaryan, a US citizen, on humanitarian grounds and dropping charges last October.

Binance has not been charged in connection with the alleged payoff. Yet the latest salvo from the government intensifies the spotlight on Binance’s penchant for doing business in nations without proper regulation.

Starting next week, prosecutors plan to produce evidence in court proving that Binance facilitated $35 million in money laundering by allowing bad actors to use its crypto exchange.

Prosecutors also indicted Binance on currency manipulation charges and operating without a license in the country.

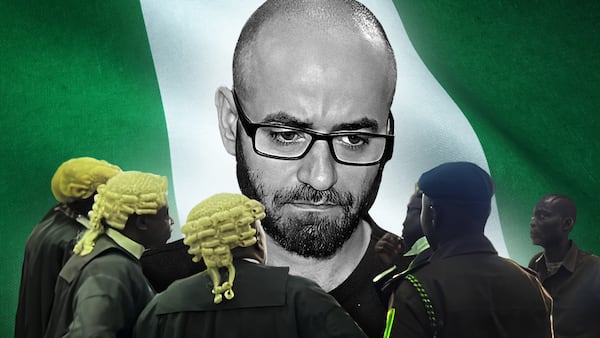

No Binance officials will physically be in the dock next week. Nadeem Anjarwalla, a British lawyer who was a Binance regional manager in Nairobi, will be tried in absentia, legal officials said.

Anjarwalla had been detained with Gambaryan last February but managed to elude his guards several weeks later and escape the country.

Currency collapse

If Binance is convicted, it will probably be hit with a fine for the full amount quoted in the indictment, according to Nigerian law. And Anjarwalla may be sentenced to a prison term.

Binance has denied the charges and pleaded not guilty, as has Anjarwalla. The company declined to comment for this story.

Last year, the company said that the government is unfairly holding it responsible for the collapse in the value of the naira, Nigeria’s currency.

Binance rejected the blame for Nigeria’s worst currency crisis and said that the foreign exchange market was driven by economic conditions and not by traders on its peer-to-peer platform.

Still, amid the escalating tensions with Nigerian officials, Binance blocked its P2P market in Nigeria.

“To remove any doubt about suggestions that we had played a role in the country’s currency crisis and as a good faith gesture, I made the difficult decision earlier this month to turn off our P2P product on the Binance platform for Nigeria,” Binance CEO Richard Teng said in a statement last year.

Pleading guilty

Still, the trial demonstrates that Binance is wrestling with serious legal challenges more than a year after it pleaded guilty to violating US banking law by accommodating criminals and paid $4.3 billion in penalties.

Last month, French prosecutors opened a probe into whether Binance was facilitating tax fraud and laundering money linked to drug trafficking.

A company representative told DL News in January that it would fight any charges that may arise from the French inquiry.

Even as Nigerian prosecutors prepare to meet Binance in court, finance officials are trying to turn the page on the crypto crackdown that roiled the country’s cryptocurrency market.

Apart from Binance, several other foreign crypto exchanges quit the country including OKX and KuCoin.

The government also prosecuted individuals and businesses accused of illegal crypto trading and froze their bank accounts.

Last year, stablecoin usage among Nigerians shrank 38%, to $23.6 billion, according to Chainalysis.

The Nigerian Securities and Exchange Commission recently licenced two exchanges under its new regime: Quidax and Busha.

Approved stablecoin

Earlier this month, both platforms rolled out cNGN, Nigeria’s first approved stablecoin.

The token is pegged to the notoriously volatile naira, the third worst-performing national currency in Africa in 2024. The naira has fluctuated more than 10% against the dollar this year alone.

Investors are wary of Nigeria’s new stablecoin, which has recorded a paltry $88,000 in trading volume in the last 24 hours, according to data from the project’s website.

Meanwhile, the Nigerian government’s allegation of an unproven $5 million payoff brings the case back to Gambaryan, the head of Binance’s financial crimes unit in the US and former federal agent.

Charged with money laundering last March, he spent eight months incarcerated in a prison in the Nigerian capital of Abuja and suffered the effects of malaria. Gambaryan often attended hearings on crutches as he dealt with a herniated disc in his back.

$150 million

This month, he said it was Nigerian officials who were seeking a bribe to settle his detention.

In an interview published in Wired, Gambaryan said Nigerian legislators demanded $150 million to prevent his arrest and settle Binance’s legal troubles last February shortly after he arrived in Abuja for talks with officials.

This alleged bribe was to be paid in cryptocurrency to the wallets provided by the legislators, Gambaryan said.

In May, Teng posted a blog providing a detailed account of the same alleged demands from Nigerian officials.

Nigeria’s government dismissed the allegations.

“We categorically deny the retaliatory claims made by Mr. Gambaryan against Nigerian officials involved in his case,” the government said in a statement.

“And we urge the public to disregard these false accusations in their entirety,”

Osato Avan-Nomayo is our Nigeria-based DeFi correspondent. He covers DeFi and tech. To share tips or information about stories, please contact him at osato@dlnews.com.