This may be just the beginning for Binance.

Less than a day after the US Commodity Futures Trading Commission accused the world’s top crypto exchange of running an illegal derivatives trading business, market analysts are girding for more action.

“It feels like regulators are under pressure to act against the crypto industry,” Gautam Chhugani, managing director and senior analyst of global digital assets at AB Bernstein, told DL News.

“It is possible that other regulators follow, given Binance is a giant,” he said.

The Binance case strikes as the crypto industry is reeling from an unprecedented crackdown by US authorities. For Binance, there have been signs of more scrutiny from regulators for months.

The Department of Justice said in December that it was investigating possible money laundering and criminal sanctions violations at Binance.

And Patrick Hillmann, Binance’s chief strategy officer, told The Wall Street Journal last month that he expects the firm will pay a fine to settle the DoJ’s and the CFTC’s investigations.

NOW READ: Do Kwon was nabbed in a private jet on tarmac in Montenegro with false Costa Rican passport

“Binance’s operations have been so void of transparency and sunlight that there’s a need for criminal prosecutorial and civil regulatory intervention,” John Reed Stark, former director of the SEC’s office of internet enforcement, told DL News last week.

In its civil action filed Monday in federal court in Illinois, the CFTC painted a picture of an organisation that routinely ignored best business practices and compliance with anti-money laundering rules.

It also said Binance unlawfully failed to register digital assets as commodities even though it was serving US customers.

“The defendants’ own emails and chats reflect that Binance’s compliance efforts have been a sham and Binance deliberately chose – over and over – to place profits over following the law,” Gretchen Lowe, CFTC’s Enforcement Division principal deputy director and chief counsel, said in a statement.

NOW READ: Stablecoins and Binance next in SEC crosshairs after Coinbase warning

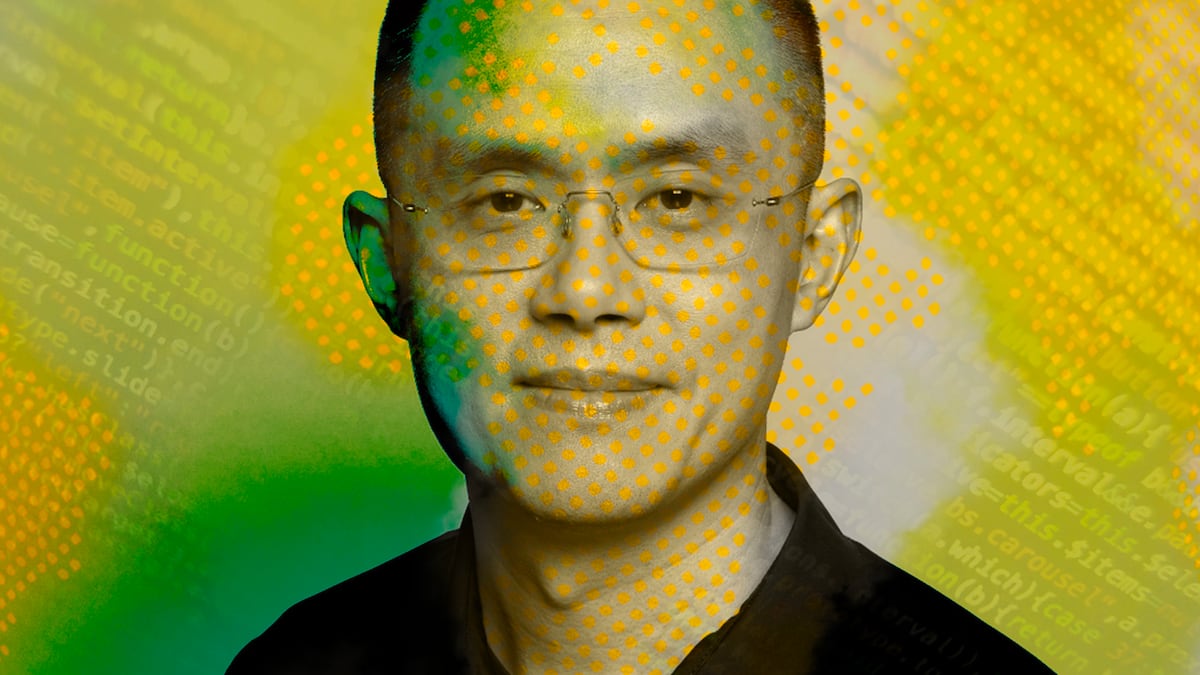

The agency accused Binance CEO Changpeng “CZ” Zhao, and Samuel Lim, the exchange’s chief compliance officer from 2018 to January 2022, with “numerous violations of the Commodity Exchange Act and CFTC regulations.”

The agency said Binance instructed employees and customers to circumvent compliance controls such as enforcing customer identity verification rules designed to prevent and detect terrorist financing and money laundering. The case also alleged Zhao is the direct or indirect owner of approximately 300 separate Binance accounts that have engaged in proprietary trading activity on the platform.

Hillmann took to Twitter to defend the company against the CFTC’s claims.

Unlike other exchanges, Binance does not, nor ever has, hunted user stops or liquidation prices. Any trades made are primarily algorithmic for market stability purposes or to reduce slippage. User protection has always and still remains our top priority and we will never…

— Patrick Hillmann (@PRHillmann) March 28, 2023

“Unlike other exchanges, Binance does not, nor ever has, hunted user stops or liquidation prices,” Hillmann tweeted. “Any trades made are primarily algorithmic for market stability purposes or to reduce slippage. User protection has always and still remains our top priority and we will never aggressively trade against users to their detriment.”

NOW READ: SEC vs crypto: A timeline of enforcement actions

The suit also alleged that Lim learned transactions on its exchange were linked to Hamas, a Palestinian militant group and political party that the US, the UK, and the EU designate a terrorist organisation. Lim also sent internal messages that certain Binance customers “are here for crime,” to which the money laundering reporting officer replied, “we see the bad, but we close 2 eyes,” according to the CFTC complaint.

In a blog post on Binance’s website, Zhao said the company had worked “cooperatively with the CFTC for over two years” and that “the complaint appears to contain an incomplete recitation of facts, and we do not agree with the characterisation of many of the issues alleged in the complaint.”

Zhao said he owned two accounts at Binance: one for Binance Card, a product that allows the user to convert and spend their crypto, and one for his crypto holdings.

“I eat our own dog food and store my crypto on Binance.com,” Zhao said. “I also need to convert crypto from time-to-time to pay for my personal expenses or for the card.”

NOW READ: Gensler’s history hints at what’s coming next in the crypto crackdown

Zhao said he and other Binance employees adhere to a rule stipulating that they are not allowed to sell a coin within 90 days of their most recent buy, or vice versa.

“While we are not perfect, we hold ourselves to a high standard, often higher than what existing regulations require,” Zhao said.

Binance TVL dropped from $76.4 billion to $73.7 billion in the 24 hours following the CFTC suit.

Major players such as Coinbase, Kraken, and Paxos have been hit with regulatory actions this year.