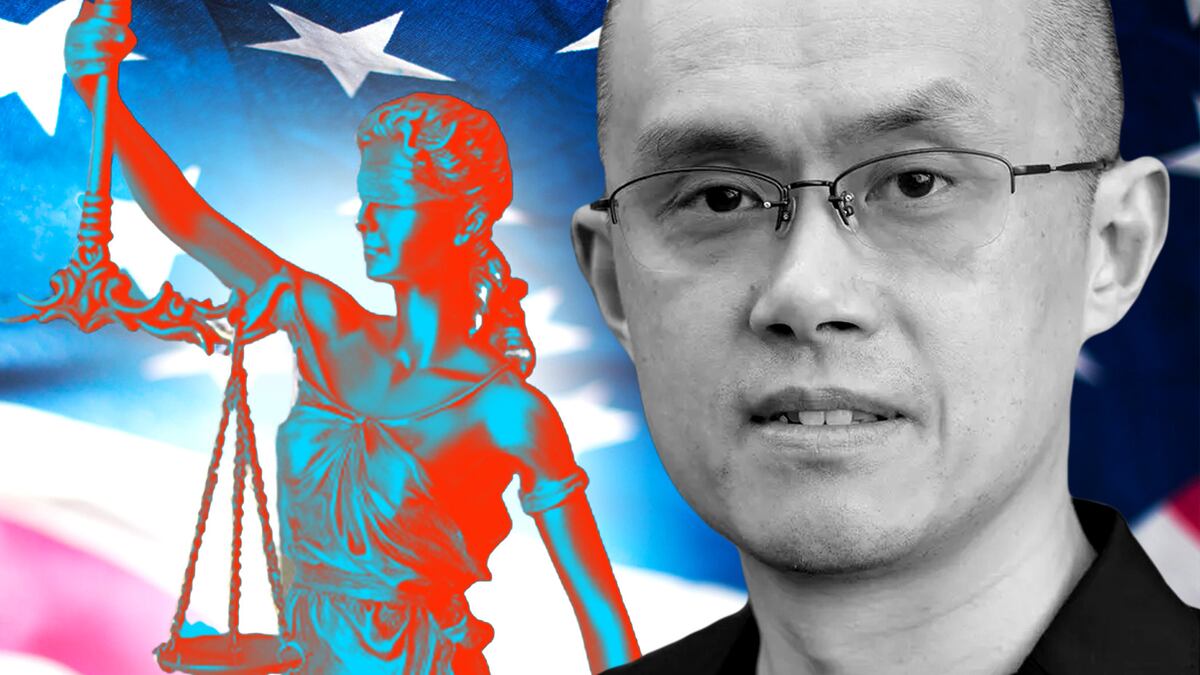

- Binance CEO Changpeng Zhao is in a dominant, but fragile, position in crypto.

- Will a bevy of civil lawsuits in the US be followed by criminal charges from the Department of Justice?

- See the ups and downs of crypto’s “Teflon Man.”

Binance CEO Changpeng Zhao should be celebrating.

One of his biggest rivals, FTX co-founder and former CEO Sam Bankman-Fried, was convicted of fraud and is going to jail.

The two had a well-documented rivalry.

Bankman-Fried blamed Zhao for leaking the Alameda balance sheet to CoinDesk that helped spark his empire’s downfall. FTX investors are suing Zhao, saying his personal “vendetta” led to FTX’s collapse.

And Zhao still bemoans FTX’s past attempts to get regulators to crack down on Binance to increase its own market share.

Still, with his nemesis out of the way, Zhao is now left with his own legal woes — including the looming prospect of criminal charges.

And as Bankman-Fried awaits sentencing, law enforcement and regulators can focus on Binance.

Those challenges raise the question of whether the co-founder of the world’s biggest crypto exchange, with an average monthly trading volume of more than $2 trillion, can ride out another storm.

If it can’t, that could mean carnage.

“If anything was to happen to an entity of that size, most likely that would have a cascading effect on tokens or crypto,” Yiannis Giokas, senior director of product innovation for Moody’s Analytics, told DL News in September.

Binance did not respond to a DL News request for comment for this article.

The obstacles Zhao faces are massive.

This year, Binance has been slammed with lawsuits and enforcement actions from US market watchdogs, and in the shadows looms a multi-year US Department of Justice investigation that has yet to produce any charges.

Binance’s elusive nature as an exchange with no official headquarters has been challenged as it’s been forced to withdraw from key European and Asian markets.

At the same time, Zhao has seen Binance market share decline as rivals seize on the legal uncertainty. Traditional exchanges say they’re luring crypto investors who opt for relative safety.

Zhao’s personal fortune is estimated to have dwindled from about $29 billion in 2022 to $17 billion this year.

Just who is this man who has been referred to as crypto’s “Teflon Man” and “The Most Powerful Man in Crypto”?

From McDonald’s to McGill

Born in China, Zhao and his family moved to Vancouver when he was 12. As a teenager he worked at a gas station and for two years as a cook at McDonald’s, where he said he made $4.5 Canadian dollars an hour.

In school, Zhao ranked 10th in Canada’s national maths competition, according to The Economist, and he later studied computer science at Montreal’s McGill University.

After graduation, Zhao worked first as an intern at the Tokyo Stock Exchange, and then spent four years at Bloomberg in New York where he developed software for futures traders.

In a Rolling Stone article years later, his former boss at Bloomberg described him as “not the classic Wall Street asshole” nor a “technology sociopath.”

By 2005, Zhao joined the budding high-frequency trading industry and started a software company, Fusion Systems.

Things changed for Zhao in 2013, after learning about Bitcoin at a poker game.

He quit his role at Fusion, bought a million dollars’ worth of Bitcoin, and became fully immersed in the world of crypto for the next four years.

The launch of Binance

In 2015, Zhao launched Bijie Tech, a company that built software for crypto exchanges in Shanghai.

The venture proved short-lived as China implemented a series of crypto bans in the country.

Then in 2017, seemingly out of nowhere, Zhao co-founded Binance with former Chinese television broadcaster Yi He.

Within five months of its launch, Binance became the top crypto exchange worldwide.

Its rocket ride to the top has been attributed to a tendency to list new coins faster than other exchanges, its support for non-English languages that allow it to cater to Chinese investors following the China bans, and rock-bottom fees that have given the exchange an edge on the competition.

The success cemented Zhao as a top figure and thought leader in the industry almost overnight.

But the growth did not come without snags.

Binance, founded in Shanghai, could not technically operate in China. So Zhao moved to Hong Kong, Singapore, Malta, and purchased a home in Dubai.

“I want to show that we are committed,” to the region, Zhao has said, likening the United Arab Emirate’s crypto-friendly stance to jurisdictions such as France and Singapore.

To date, Binance has no definitive global headquarters.

Last year, in response to accusations about his links to China, Zhao took to a company blog to assert his identity as “a Canadian citizen, period.”

The creation of Binance.US

Under Zhao, Binance has walked a tightrope between managing explosive growth and appeasing regulators.

Binance went largely unregulated in its early days. But regulators took notice as more hype and liquidity entered the market.

In 2019, Zhao approved the creation of Binance.US, an entity whose stated mission was “to serve US consumers and adhere to US regulations.”

The company designated “local partner” BAM Trading Services — an entity registered with the US financial tracking authority FinCEN — to handle the launch.

Reuters tells a different story. Citing 2018 internal messages, it reported that Zhao approved a plan to set up Binance.US to “insulate” the larger company from US regulators.

According to the publication, the plan was that the American version of the exchange would operate as a “regulatory inquiry clearing house,” and draw attention away from the main platform.

In response to the Reuters report, Zhao wrote in a company blog that the US plan was an external consultant’s “suggestion,” and that he “personally rejected it.” The company did not return a DL News request for additional comment.

Regulatory woes

In January, Zhao outlined plans “to keep 2023 simple.”

Will try to keep 2023 simple. Spend more time on less things. Do's and Don'ts.

— CZ 🔶 BNB (@cz_binance) January 2, 2023

1. Education

2. Compliance

3. Product & Service

4. Ignore FUD, fake news, attacks, etc.

In the future, would appreciate if you can link to this post when I tweet "4". 🙏

The year would prove to be anything but.

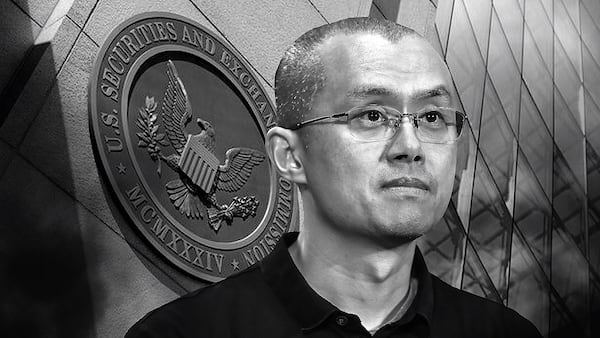

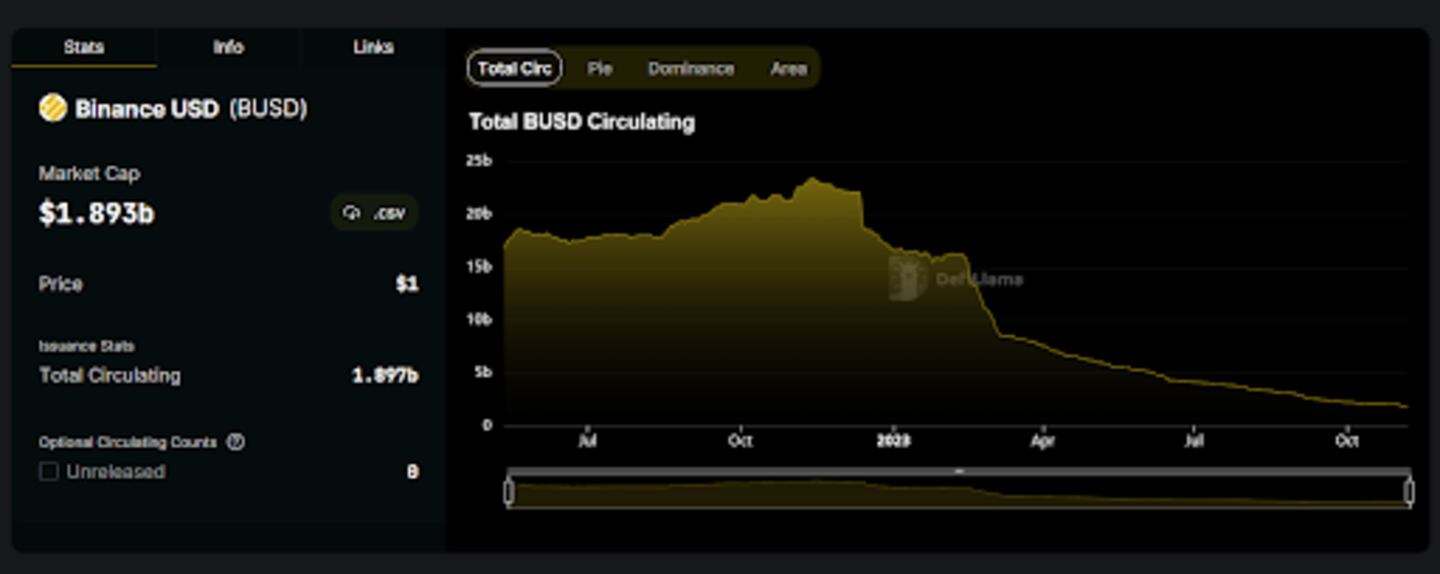

In February, the US Securities and Exchange Commission announced its intent to sue Paxos, the issuer of the Binance-branded stablecoin BUSD. New York regulators then ordered Paxos to stop minting BUSD entirely.

While Zhao distanced himself from the asset, the stablecoin was one of Binance’s primary holdings.

It tumbled. BUSD’s $16 billion market cap in February has since plummeted to around $2 billion.

In March, the Commodity Futures Trading Commission charged Zhao and Binance entities with operating an illegal exchange — painting a picture of an organisation that routinely ignored best practices and failed to comply with anti-money laundering rules.

It also said Binance unlawfully failed to register digital assets as commodities, even though it was serving US customers.

“Given Binance is a giant,” other regulators were likely to follow, Gautam Chhugani, senior analyst of global digital assets at AB Bernstein, told DL News at the time.

Zhao didn’t have to wait long.

In June, the SEC charged Zhao and Binance entities on 13 counts, including operating unregistered exchanges, misrepresenting trading controls and oversight on Binance.US, and the unregistered sale of securities.

It has hit additional snags in Canada, the Netherlands, Austria, Belgium, the UK, and France.

A flurry of departures rocked the company. Among them: Chief Strategy Officer Patrick Hillmann, compliance executive Steven Christie, General Counsel Hong Ng, and Chief Business Officer Yibo Ling.

Zhao dismissed the upheaval, saying “there is turnover at every company,” right before about 1,000 more employees were culled.

Zhao’s efforts to get his lawsuits tossed haven’t worked. And one expert said “the walls are closing in” on the company.

Shrinking market share

Bankman-Fried is gone and crypto prices are again soaring. As the long crypto winter seems to thaw, conditions appear ripe for a comeback.

But as regulators clamp down on crypto, Zhao’s kingdom is a troubled one.

The criticism Zhao has often dismissed as “FUD” is not his only worry.

Institutions are warming to crypto, and with more adoption comes the risk of Binance losing yet more market share to well-established players in traditional finance.

On Friday, Zhao pointed to a report that said regulators “promised” rival Bankman-Fried that scrutiny of Binance was coming.

Will crypto’s Teflon Man be able to keep his lead?

Tyler Pearson is a researcher at DL News. Got a tip on Binance? Reach out at ty@dlnews.com