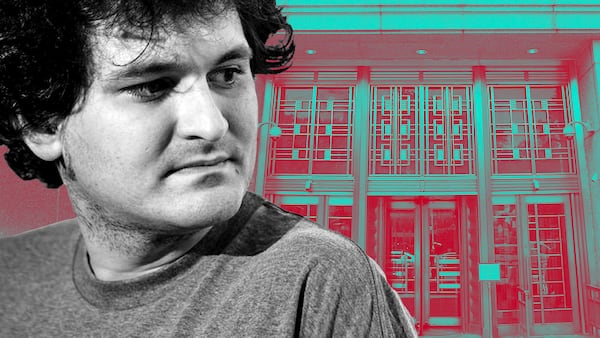

- US Judge Lewis Kaplan sentenced SBF to 25 years in prison for defrauding crypto investors.

- The onetime crypto wunderkind struck a defiant tone at the sentencing hearing.

- Bankman-Fried is expected to appeal his conviction.

A federal judge for the Southern District of New York sentenced Sam Bankman-Fried to 25 years in prison Thursday, citing the former FTX CEO’s “apparent lack of remorse,” “exceptional flexibility with the truth,” and the “brazenness” of his fraud.

The term was about half the 40 to 50 years prosecutors sought.

US District Court Judge Lewis Kaplan’s sentence came down five months after Bankman-Fried was convicted by a federal jury on seven counts of fraud and conspiracy in connection with the failure of FTX in November 2022.

Bankman-Fried’s attorney, Marc Mukasey, said he would appeal the jury’s verdict. He has 14 days to file an appeal.

‘Hugely influential’

Even though defendants usually express remorse to mitigate harsh sentences, Bankman-Fried, clad in beige prison garb and shackled at the ankles, occasionally struck a defiant tone as he stood and addressed the bench at Thursday’s hearing.

Echoing his failed defence last November, he blamed FTX’s collapse on his “mismanagement” and a “liquidity crisis” rather than on outright fraud.

“[FTX customers] could have been paid back” had he held onto the company, Bankman-Fried said during his meandering plea for leniency.

“There were enough assets. There are enough assets. ... It’s not because of a rise in the price of crypto.”

‘A thief who takes his loot to Las Vegas and successfully bets the stolen money is not entitled to a discount on on his sentence.’

— US District Court Judge Lewis Kaplan

Kaplan didn’t find the argument convincing.

“A thief who takes his loot to Las Vegas and successfully bets the stolen money is not entitled to a discount on his sentence,” Kaplan said at the beginning of the hearing.

Kaplan went on to deliver a blistering appraisal of Bankman-Fried’s character.

Citing testimony about Bankman-Fried’s propensity for risk taking, the judge decried the 32-year-old’s apparent lack of remorse for stealing $8 billion from FTX customers and $3 billion from the exchange’s lenders and investors.

“He knew it was wrong, he knew it was criminal, [but] he regrets that he made a very bad bet about the likelihood that he gets caught,” Kaplan said.

Describing Bankman-Fried as a “very high-achieving autistic person,” Kaplan said it was clear the former billionaire “wanted to be a hugely, hugely influential political person in this country.”

The judge also honed in on Bankman-Fried’s disastrous performance on the stand.

“When he wasn’t outright lying, he was often evasive, hairsplitting, dodging questions,” Kaplan said. “I’ve been doing this job for 30 years. I’ve never seen a performance quite like that.”

Prosecutor Nicolas Roos argued a lengthy sentence was necessary to prevent Bankman-Fried from committing more crimes. He cited an earlier comment from Mukasey, who said his client’s decisions weren’t motivated by malice, but by mathematics.

“It’s troubling,” Roos said, “because what it says is if Mr. Bankman-Fried thought the mathematics were justified, he’d do it again.”

Nevertheless, he found the government’s recommended sentence “substantially greater than necessary” to deter Bankman-Fried from committing similar crimes in the future and to dissuade others from doing the same.

In addition to the 25 year prison sentence, Kaplan levied an $11 billion fine on Bankman-Fried.

Kaplan recommended Bankman-Fried spend his sentence in a medium- or low-security prison as close as possible to his Northern California home. In a maximum security prison intended for violent criminals, Bankman-Fried, autistic and associated with great wealth, could become a target of other inmates, the judge said.

The sentence was more than four times longer than the term Bankman-Fried’s attorneys requested ahead of Thursday’s hearing.

In January, FTX’s new leadership said it expects to fully reimburse customers at the value of their holdings at the time FTX declared bankruptcy in November 2022.

“The most reasonable estimate of loss is zero,” Bankman-Fried’s attorneys wrote.

Moreover, FTX never lost customer money in the first place — it simply had a shortfall of “liquid assets.” Had Bankman-Fried had more time to sell the company’s assets, it would have been able to honor all customer withdrawals, his attorneys argued.

Critical argument

This was a critical argument for the defense, as the duration of Bankman-Fried’s sentence hinged, in large part, on federal guidelines that recommend certain prison sentences based on the amount of money stolen.

But it didn’t wash.

Since the collapse of FTX, the market capitalisation of all crypto tokens has increased almost threefold, from just over $1 trillion to $2.6 trillion, according to CoinMarketCap. Now, customers who had entrusted their crypto to FTX want to be repaid in crypto — not in dollars that represent the value of their crypto at the time of FTX’s bankruptcy filing.

One such customer, Sunil Kavuri, spoke at the sentencing. He said he had flown from London to speak on behalf of other jilted FTX customers, and called Bankman-Fried’s assertion they would be made whole a “continuous lie.”

Another speaker, Florida-based attorney Adam Moskowitz, asked the judge for leniency, citing Bankman-Fried’s helpfulness in a class-action lawsuit he had filed against superstar NFL quarterback Tom Brady and other celebrity endorsers of FTX.

At one time, FTX had been world’s biggest crypto exchange after Binance. Attracting top-shelf venture-capitalist backers such as Sequoia Capital, FTX sported a valuation of $32 billion in early 2022.

And Bankman-Fried courted celebrity supporters such as Brady and plastered the FTX brand on sports arenas and bought splashy Super Bowl TV commercials.

Crypto wunderkind

The crypto wunderkind also bridged the gap with Wall Street by establishing strong ties to luminaries such as hedge fund manager and conference impresario Anthony Scaramucci.

And he contributed millions to members of Congress and political action committees to curry influence on Capitol Hill. And it didn’t hurt that his parents were prestigious law professors at Stanford University.

In Bankman-Fried, finance and the political establishment finally found a face for the freewheeling crypto industry. With his slob-chic vibe of wrinkled T-shirts and cargo shorts, Bankman-Fried cast himself as the latest boy genius to spin billions of dollars in wealth from arcane techno-finance models.

SBF’s trial

Yet prosecutors, led by Assistant US Attorney Danielle Sassoon, produced a powerful and persuasive narrative that depicted Bankman-Fried as a fraudster who deployed some of the oldest tricks in the book to fleece investors.

He comingled deposits, moved funds around arbitrarily, and did not comply with many US regulations because his companies were domiciled in Hong Kong and then the Bahamas.

Several former colleagues, including Caroline Ellison, testified that Bankman-Fried funnelled billions of dollars in deposits at FTX into his crypto investment fund, Alameda Research, to cover losses in 2022.

They also told the jury that Bankman-Fried was not the head-in-the-clouds brainiac who knew little of the daily operations of his enterprises. In contrast, he was a hands on manager who designed and used backdoors to cook the books at both FTX and Alameda.

The onetime crypto chieftain flopped when he took the stand himself. He frequently couldn’t recall details of his tenure at FTX and Alameda. Among courtroom attendees, his “cannot recall’ riposte to prosecutors became a meme.

It took the jury just a few hours to convict Bankman-Fried of his crimes. Now he will pay back his debt to society for the next 25 years.

Updated on March 28 to report details of the sentencing hearing and Bankman-Fried’s plan for appeal.

Aleks Gilbert is New York-based correspondent for DL News. Contact the author at aleks@dlnews.com.